March 2016 Client Letter

Investing in stocks for the long run has become the accepted wisdom of many investors over recent decades. The media, pundits, and promoters, as well as many brokers and advisors, recommend stocks as the most suitable asset class for investing over the long run. Stocks win over the long run, cash is trash, and bonds are boring, investors are told. The bull markets of the 80s and 90s surely greased the wheels of the “stocks for the long run” band wagon. Jeremy Siegel, professor of finance at Wharton School of Business, even wrote a book on the subject.

Professor Siegel’s data showed that a $1 investment in U.S. stocks at year-end 1801 grew to almost $600,000 by 2001. That same $1 invested in bonds grew to only $952. Stocks not only won, they annihilated bonds.

Doesn’t this prove that an all-stock portfolio is the best long-term investment? Prove is strong language when talking about matters of the future. However, historical evidence supports the case for stocks as the winning strategy, especially when considering a long time horizon.

For those with a 200-year time horizon, I say, by all means load up on stocks. But others, including those in or near retirement, may find an all-stocks strategy less appealing.

What is Your Long-run Investment Horizon?

Historical records show stocks can remain depressed for agonizingly long periods of time. The Dow required nearly 25 years to recover from its 1929 pre-crash high. From 1965 through 1981, the Dow didn’t gain a single point while inflation raged.

Investing in equities over the last 16 years has also produced disappointing results. So far this century, stocks have posted only modest single-digit annual returns.

Sixteen years, a significant amount of time, could account for most of one’s retirement. And given today’s bull-market run, beginning in 2009, equity returns may be modest at best in the years ahead. Additionally, a bear market can’t be ruled out, which would make a substantial dent in gains made during this stretch.

For most retired investors and those nearing retirement, we continue to favor a balanced portfolio featuring cash-producing stocks and bonds. Stocks do win over the long run, but bonds may help round off the peaks and valleys, providing the comfort of stability during retirement years.

Investing in Dividend Growth Stocks

In years past, our stock purchases have focused on dividend payers. Today, we have fine-tuned the strategy to place further emphasis on companies with a history of making annual dividend increases. Not only will dividend increases help combat the nasty effects of inflation, but dividend increases can also act as a magnet in lifting a stock’s price higher.

Kimberly-Clark

By example, take our favored Kimberly-Clark. At year-end 1999, Kimberly-Clark shares closed at $61.66 and paid a dividend of $1.04 per share for a yield of 1.7%. Sixteen years later, with the help of numerous annual dividend increases, Kimberly-Clark pays a dividend of $3.68 per share. If Kimberly-Clark shares were still trading at their year-end 1999 price, the stock would yield 6%. Investors would be falling over themselves to buy one of America’s great consumer products franchises at a 6% yield. But instead of trading at $61 per share, Kimberly-Clark today trades at $133. A more than tripling of the company’s dividend acted like a magnet, helping to lift the share price higher.

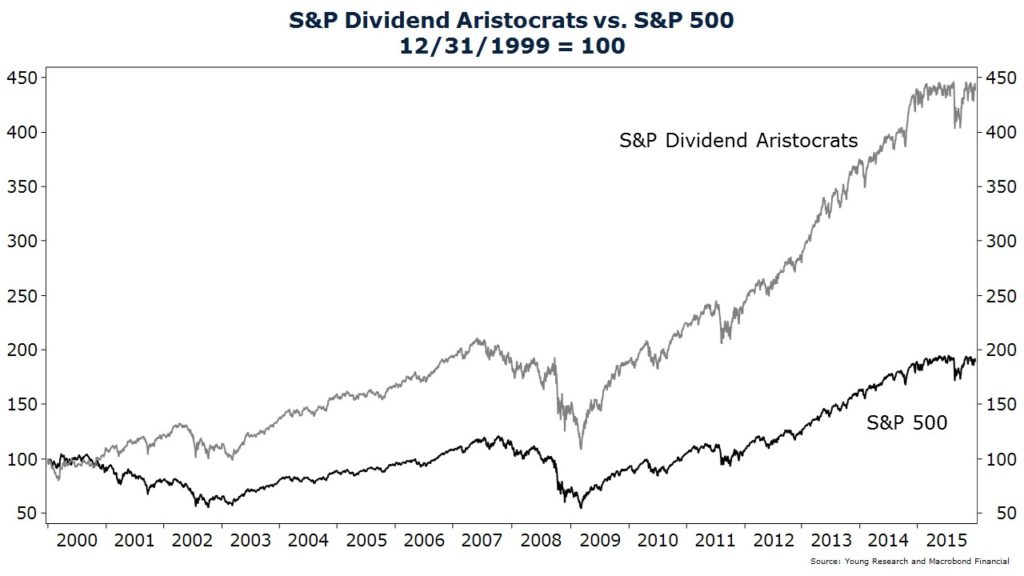

As much as we admire Kimberly-Clark, we do not want to rely too heavily on a small group of stocks. With individual companies, dividends can get cut and business prospects can change. But with a diversified portfolio of dividend-payers, these risks are reduced. One example of an index investing in dividend-paying stocks with a history of regular increases is the S&P Dividend Aristocrats Index. This index tracks a portfolio of companies that have increased their dividends each year for at least 25 consecutive years. How did the Aristocrats perform relative to the broader market over the last 16 years? Past performance is no guarantee of future results, but from year-end 1999 through 2015, the S&P Dividend Aristocrats Index increased at a compounded annual rate of 9.7% compared to 4.05% for the S&P 500.

Dividends and Dividend Growth: A Foundational Stock Investing Strategy

Investing in companies with a history of making regular annual dividend increases is the foundation of our equity strategy. We manage global equity portfolios focused primarily on individual dividend-paying companies. Our dividend mandate is a policy we believe distinguishes our approach from the approach of other advisors. The trend in the industry has been toward index-based exchange-traded funds (ETFs). While index ETFs may have cost benefits compared to the more expensive actively managed mutual funds, they are by no means perfect.

We see flaws in the ways many ETFs are constructed, the expenses and transaction costs of some, and the liquidity of others. And we would find it difficult to replicate our strategy solely with ETFs. We don’t weight positions by market capitalization, as so many ETFs do; we are selective in where we invest abroad, in the industries we favor or eschew, in the currency risks we take, and in the businesses in which we want to invest.

The same is true of our fixed-income holdings. Bond ETFs—or at least the most liquid bond ETFs—tend to benchmark their portfolios to the entire bond market or an entire segment of that market. Trying to tailor a portfolio for a specific type of maturity risk or credit profile is difficult with bond ETFs. Bond ETFs also have the disadvantage of trading at what we consider to be wide premiums and discounts to the underlying value of their holdings.

Investing in Individual Bonds

Our approach to managing fixed-income portfolios has been to include individual bonds and traditional, lower-cost mutual funds. The combination allows us to tailor portfolios for maturity and credit risk. With interest rates still at levels historically associated with recessionary conditions, we continue to favor a short-maturity portfolio. During the last 12 months, we have also scaled back on credit risk. While we aren’t attempting to forecast a recession, we believe the economy is in the later stages of the cycle. During recessions, lower-quality bonds tend to perform poorly.

Understanding GNMA Securities and Funds

Our higher-quality bonds include Treasuries, investment-grade corporates, and one of our long-time favorites, GNMA securities. GNMA securities are not like conventional bonds. Conventional bonds pay interest during the life of the bond and pay back all principal at maturity. GNMA securities are mortgage-backed securities, or bonds backed by payments on mortgage loans. The loans are pooled and then, out of those pools, securities are issued that entitle holders to a share of interest and principal. GNMAs are the only mortgage-backed securities explicitly backed by the full-faith-and-credit pledge of the U.S. government.

Since GNMA securities are backed by the U.S. government they are free of credit risk; but they do carry prepayment risk and extension risk. Prepayment risk is the risk that principal will be repaid before maturity. Why is getting paid early a risk?

Let’s say you invest in a GNMA security, and every mortgage backing that security has a 6% rate. Fast-forward one year and assume mortgage rates have fallen to 4%. Further assume every mortgage backing the GNMA security is refinanced to lock in that lower 4% rate. As the investor in this GNMA security, the entire balance of your principal is returned to you. You can reinvest in another GNMA security, but the prevailing rate on GNMA securities is now only 4%. Instead of earning 6% on your money, you now earn 4%.

Extension risk is the opposite of prepayment risk. When interest rates rise, the rate of prepayments on GNMA securities slows, which effectively extends the maturity of a GNMA security. This can result in a longer maturity bond than originally invested, just as interest rates are rising. The combination of higher rates and a longer maturity results in a lower price.

While interest rates are the big factor determining the percentage of a pool of mortgage-backed securities paid back ahead of maturity, it is not the only factor. The rate of prepayments on a pool of mortgages also depends on the historical path of interest rates, housing turnover, the aging of loans, seasonality, and credit conditions, among other factors.

With interest rates still near historic lows, the risk that investors should worry about today is extension risk. How much are investors in GNMA securities being compensated for taking extension risk? According to the Merrill Lynch GNMA Index, GNMA securities yield about 2.4% today. That compares to 1.55% for Treasuries with similar maturity risk. A 2.4% yield is not going to spin your straw into gold; but compared to Treasury securities, GNMA investors appear to be getting a fair shake. In today’s yield-starved environment, we believe GNMA securities can play an important role in fixed-income portfolios.

Investing is often looked at as an offensive process where the goal is to earn the highest return possible. For investors with long time-horizons and the ability to shrug off chaotic markets, then the highest return goal may make sense. Investors in this group may favor a reduced fixed-income allocation. But those with shorter time-horizons, income needs, or who find financial crisis difficult to endure will find greater comfort with a more defensive portfolio.

Defensive investors can still have the goal of making money and keeping pace with inflation. But they also have the goal of avoiding periods of serious loss. We believe defensive investing should include a diversified portfolio of bonds, precious metals, and dividend-paying stocks. The exact mix will vary among individuals based on numerous factors, including past experiences, risk tolerances, income sources, and total portfolio of assets.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. As of early February 2016, global central banks have cut rates 637 times and spent $12.3 trillion on assets since the financial crisis, according to Bank of America. In addition, the bank estimates 489 million people live in countries with negative interest rates. Despite all this central bank intervention, inflation remains soft in many advanced economies. Now there is speculation that governments may look to sell short-term debt straight to their central banks for newly printed cash, which could be directed straight into the economy through tax cuts or spending programs. The strategy has been referred to as “helicopter money.” The helicopter strategy has many sceptics who say it will not work over the long term, just as the rate cuts and rounds of quantitative easing did not work. One doubter is HSBC Senior Economic Advisor Stephen King: “The helicopter option is simple, easily implemented and, for some, offers the closest thing to a free lunch. If this sounds too good to be true, that’s because it is.”

P.P.S. Signs that the current economic cycle could be on its last legs may be showing up in the U.S. commercial real estate market. February sales of $25 billion worth of office buildings and apartment complexes was a significant decline compared to $47 billion in February of 2015.

P.P.P.S. GE decided to leave Fairfield for Boston most likely due to Connecticut’s high-tax and high-regulation policies. Hartford politicians, like many, refuse to understand that there can be no high paying jobs without successful businesses. And, you cannot start a business without investment. Punitive taxation and burdensome regulation will stop investment in its tracks and limit the number of new successful businesses. If Connecticut stays the policy course, the state will reduce the number of entities to tax. Not a good thing when you face a $266-million budget shortfall, as they do for fiscal year 2016. To help make ends meet, Connecticut is now setting its sights on Yale University’s endowment. A proposed bill in the state is looking to tax a share of the endowment’s currently tax-exempt annual investment gain. This, despite the fact that Yale makes an $8.2-million voluntary payment to New Haven and employs about 13,000 people.

P.P.P.P.S. We recently updated both Part 2A and Part 2B of our Form ADV as part of our annual filing with the SEC. This document provides information about the qualifications and business practices of Richard C. Young & Co., Ltd. If you would like a free copy of the updated document, please contact us at (401) 849-2137 or cstack@younginvestments.com. There have been no material changes since the document was last updated on March 26, 2015.

Client Portal

Client Portal Secure Upload

Secure Upload Client Letter Sign Up

Client Letter Sign Up