March 2013 Client Letter

The anxiety-ridden days of the financial crisis get pushed further back in the minds of investors as the Dow and S&P 500 hover around all-time highs. Fear is no longer the dominant theme on Wall Street. Greed is back in favor. Investors appear convinced the next major move in the stock market will be up rather than down.

The strong performance from stocks over the recent years can seem puzzling. Economic growth is weak, unemployment is still nearly 8%, and private-sector real incomes remain below pre-crisis levels. How have stocks managed such an impressive recovery in the face of a slow economy?

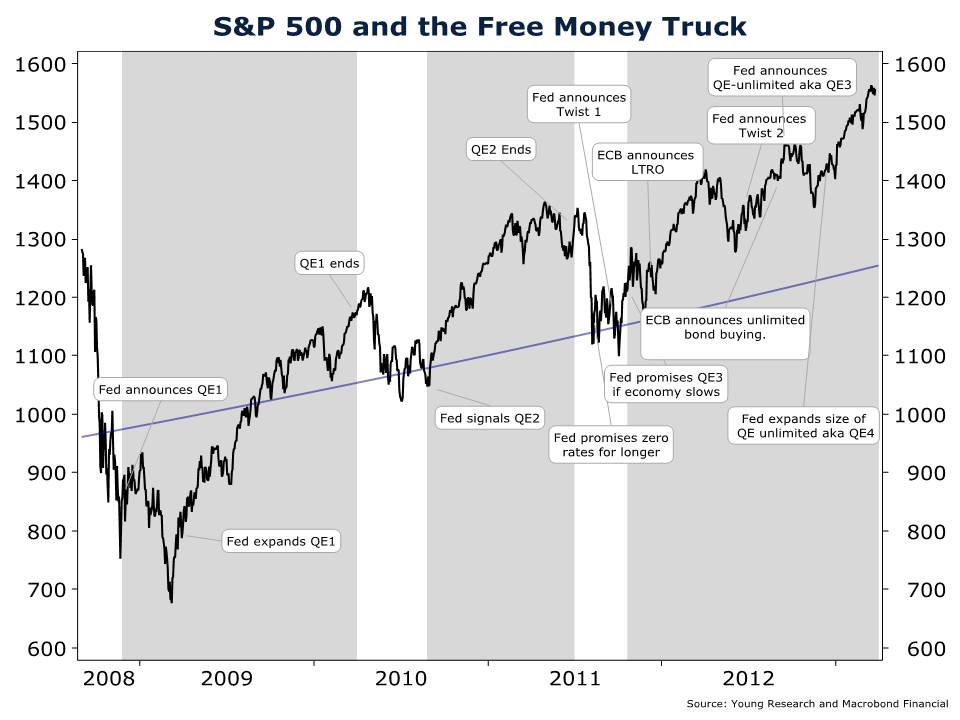

Our S&P chart goes a long way to explaining the last four-year bull market run. The black-line on the chart is the S&P 500. The blue line on the chart is an approximation of the fair market value of the S&P 500. Our measure of fair value is simply the level of normalized earnings (we use trend earnings) multiplied by the historical median price-to-earnings ratio.

As you can see in the following chart, the blue line trends upward from the lower left-hand to the upper right-hand side of the chart as trend earnings increase. In contrast, the S&P 500 fluctuates far above and below our fair-value line.

If you study the chart carefully, the drivers of stock market performance become apparent. During the height of the crisis, the S&P 500 plunged far below fair value as investors anticipated the coming of the second Great Depression. As the financial system stabilized and the Fed flooded the system with liquidity, stocks quickly rose back to fair value.

But since mid-2009 when stocks passed through fair value, the story of the stock market has been one of monetary profligacy. From mid-2009 until mid-2010, stocks rode the Fed’s free money truck (QE1) to a level far detached from underlying fundamentals. The market cratered back to fair value as soon as Dr. Bernanke decided it was time to pull the free-money truck back into the garage.

But a plummeting stock market didn’t sit well with Dr. Bernanke, so he released the free money truck for another spin around Wall Street. On this second joy ride (aka QE2) Dr. Bernanke drove stocks even further away from fair value. And once again when the ride was over, the market sank back toward fair value.

A sinking market upset the apple cart at the Fed. After all, the stated purpose of the first two trips in the free money truck (QE1 & QE2) was to inflate stock prices. So what did the Fed do? First they tried to prop up the market by promising to keep rates at zero for two years. Then they announced “operation twist,” which called for extending the maturity of the Fed’s Treasury portfolio. Apparently those policy actions didn’t have the immediate impact on stock prices that the Fed was hoping for. So, in the fall of 2011, the Fed signaled that a third round of money printing would be initiated as soon as U.S. economic growth slowed.

In December 2011, the European Central Bank (ECB) made its own contribution to raising stock prices with two massive money-printing campaigns of its own. Once investors were convinced that the Fed and the ECB would initiate more money printing should economic growth slow, it was off to the races for stock prices. Since the Fed promised QE3 in late 2011, stock market corrections have been shallower and the deviations from fair value have grown larger. Central bank intervention has also become more frequent. In mid-2012, after only a mini stock market correction, the Fed announced Twist 2. Then the ECB announced unlimited bond buying. Not to be outdone by the ECB, the Fed followed up with its own unlimited money-printing announcement only weeks later. And just to be sure it wasn’t outdone by the ECB, the Fed expanded the size of its unlimited money-printing campaign at its December 2012 meeting.

Perpetual money-printing campaigns by the Fed and its foreign counterparts have resulted in a widening disconnect between stock prices and fundamental values. At current levels, the S&P 500 is trading almost 20% above our fair-value estimate. Additionally, the Fed’s actions could significantly devalue the U.S. dollar, which is why we favor adopting a hedge against the risk of currency debasement.

Since 2006, we have been buying gold as our first line of defense against currency debasement. Gold is the world’s only true hard currency. Gold is not only a currency hedge, it is also an inflation hedge and a hedge against geo-political risk. Over long periods of time, gold retains its purchasing power.

Our philosophy towards gold is different than most other investments. In general, we view gold as a permanent holding in an investment portfolio. (At times, however, there may be a need to rebalance.) We are not looking to buy gold to sell it to a higher bidder in the next month or year or two years. If everything goes according to plan, the gold we buy will fall in price because, as should be evident from the last few months, when gold prices fall other positions in your portfolio will likely rise.

In addition to gold, we have begun to take a position in platinum. Gold is mainly used as an investment, and it has little industrial demand. Platinum has a very important role in industry, and it can be argued that its investment case is even stronger than gold’s. Platinum is rare. The Earth contains 265 times more gold reserves than platinum reserves.

Not only is there less platinum than gold, but mining for the platinum that does exist is not always an easy exercise. Most platinum is found in geopolitically risky countries. South Africa supplies 70% of the world’s platinum and Russia supplies another 11%. Earth’s largest-known deposits of platinum were found in South Africa in 1924 by Hans Merensky. The find is now part of what is known as the Bushveld Complex. The mines along the Bushveld have become a center for deadly riots and strikes that have crippled production of the scarce metal from time to time. Russia, which holds the second largest reserves of platinum, is no stranger to political unrest.

Other favorable attributes of platinum are global demand and less attention from central banks. Emerging market demand for platinum increased 30% over the last four years. Chinese demand rose 63% from 2008 to 2012. As the standard of living rises in developing countries, their populations are demanding more transportation. More cars on the roads lead to smog and new laws requiring catalytic converters to clean it up. Platinum is the premier metal for use in automotive catalytic converters.

Central banks around the world tend to own gold as a part of their reserves. Gold investors face the risk that the banks will sell their stockpiles if prices climb too high. Platinum isn’t owned in large quantities by any central bank or government, so the risk of government interference in the market that drives down the price is considerably lower.

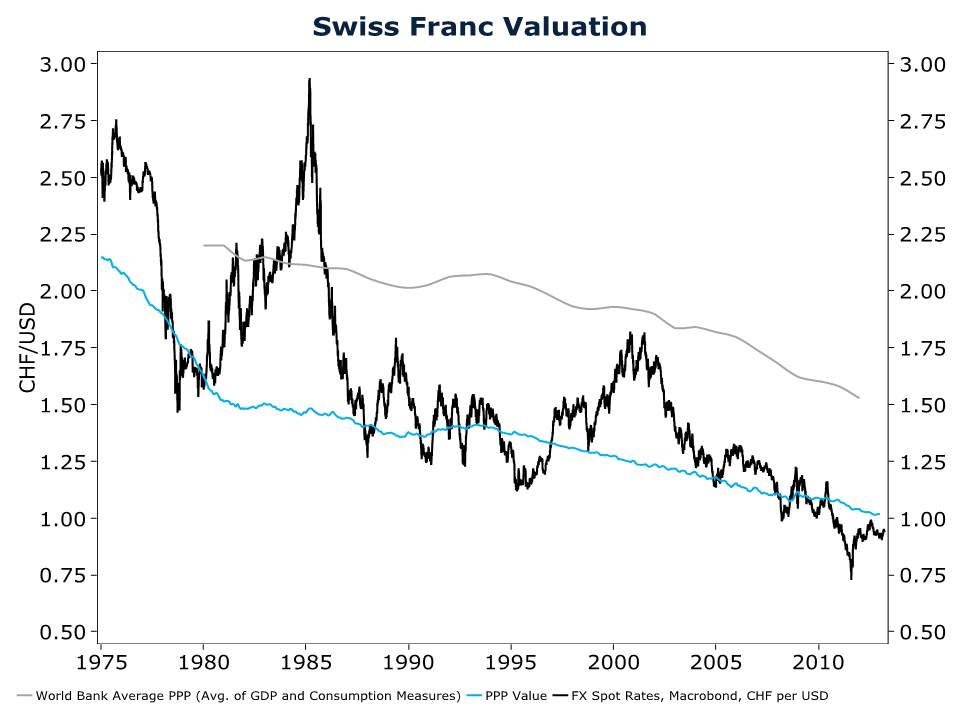

A complement to our metals holdings (gold, silver, and platinum) includes hard paper currencies. Hard is a relative term when talking about paper money; nonetheless a hard currency component complements a portfolio of assets denominated by inflationary currencies such as the U.S. dollar. Tops on our list here is usually the Swiss franc. The Swiss are known for running a tight monetary ship. The franc is one of a few developed market currencies with a decided long-term uptrend versus the U.S. dollar.

Unfortunately, with a dwindling number of truly prudent central banks, the Swiss franc is an overcrowded port in the storm. Our currency valuation work shows that safe-haven seekers have pushed the franc into considerable overvaluation territory. For new money, the franc offers limited medium-term upside. Swiss stocks are a different story, and we continue to gain exposure to Switzerland through the country’s individual, dividend-paying equities.

As an alternative to the Swiss franc, Nordic currencies have appeal. Our favored Nordic currency today is the Swedish krona. Sweden has been down the road of big government and soaring debt and is now well on its way back from that journey. Today, Sweden’s economic blueprint isn’t the socialist model that many associate with the country.

Over the last 20 years, Sweden has reduced public spending as a percentage of GDP by more than 25%. The U.S. has done the opposite. Since year-end 1999, U.S. federal spending as a percentage of GDP has risen by 28%. Sweden has also cut its marginal tax rate by 27 percentage points and eliminated a whole host of other taxes on property, gifts, wealth, and inheritance. The U.S. just raised rates on personal income and junked up the tax code with more Obamacare taxes and complicated exemption phase-outs. This year Sweden plans to reduce its corporate-tax rate to 22%. In the U.S., we can’t even manage to put together a corporate tax-reform bill to reduce the world’s highest corporate-tax rate.

Structurally, Sweden’s economy is much sounder than many of the world’s other major economic powers including the U.S., China, Japan, the United Kingdom, and the euro zone. Sweden runs a budget surplus and, according to the IMF, Sweden has a gross public debt to GDP ratio of only 37% compared to over 100% in the U.S. Looking at net debt to GDP figures, Sweden is one of the only countries in the world with a net asset position, compared to a net debt-to-GDP ratio of over 70% in the U.S. There aren’t many real AAA-rated countries in the world, but Sweden truly deserves its AAA rating.

According to INSEAD, Sweden is the world’s second-most innovative country. Sweden is also a leader in education, which bodes well for the country’s long-run structural growth. Sweden has introduced a universal system of school vouchers and the country has allowed private schools to compete with public schools. How long has the U.S. been talking about education reform and school choice?

Most important of all, the Riksbank, Sweden’s central bank, is not engaged in profligate monetary policy. Despite recent strength in the krona, the Riksbank still expects to begin raising interest rates in early 2014. On a purchasing power parity basis (a valuation measure for currencies), our work shows that the krona is one of the few rich-world country currencies still undervalued vis a vis the U.S. dollar. With the krona, investors get the one-two punch of a widening interest-rate differential and an undervalued currency. Today we gain exposure to kronor by investing in Swedish government bonds or the CurrencyShares Swedish Krona Trust.

To help hedge against currency debasement and long-term inflation, we have taken positions in various metals including gold, silver, and platinum. When we believe valuation measures are in our favor, we will also take positions in foreign currencies. Today we favor the Swedish krona. To help reduce portfolio volatility, we favor short-term corporate bonds. Short-term bonds will be less susceptible to price swings once interest rates begin to rise. As I outlined in detail last month, our equity focus remains on big companies with a high barrier to entry. Industries we currently favor include consumer staples, energy, industrials, materials, and utilities and telecommunications services. From our stocks, we seek a solid record of paying a dividend and, preferably, annual dividend increases.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Sincerely,

Matthew A. Young

President and Chief Executive Officer

P.S. In April you will receive your quarterly Portfolio Holdings report from our office. We have made a slight enhancement to the common stock portion; rather than list the equities in a single group, we now group the equities by industry sector and the percentage weighting the sector represents within the entire portfolio. The new format makes it easier to identify how your equities are diversified across our favored industries.

P.P.S. Sweden’s Svenska Cellulosa (SCA) is a powerhouse in Europe for developing, producing, and marketing personal care products, tissue, packaging, and forest products. SCA, the Kimberly-Clark of Europe, is the continent’s second-largest producer of corrugated board and containerboard and one of the largest producers of corrugated board in China. Additionally, SCA is Europe’s largest private forest landowner, with 6.4 million acres of forest. The rally in SCA shares has made the stock somewhat expensive in our view. For some portfolios, SCA has been reduced and replaced with two other Swedish stocks, Swedish Match and Atlas Copco.

P.P.P.S. We sold all shares in Market Vectors Brazil Small-Cap and First Trust ISE-Revere Natural Gas. With government activism on the rise in Brazil, we now believe the best way to gain exposure to the Brazilian economy is through the fixed income markets or select individual companies. With respect to the natural gas ETF, we think the prospect of abundant natural gas for years to come is likely to keep a lid on natural gas prices. As a result, a good number of players in the natural gas industry are likely to struggle with profitability. We no longer believe that an equally weighted portfolio of natural gas producers is the ideal strategy for investing in the industry.

Client Portal

Client Portal Secure Upload

Secure Upload Client Letter Sign Up

Client Letter Sign Up