A Surprise Victory

November 2016 Client Letter

A Surprise Victory

Even well into election day, few predicted a Trump victory. Much of the mainstream legacy media predicted Clinton would win. The final national polls had Trump down a few points, and down a meaningful amount in many of the swing states he ended up winning.

Many financial pundits predicted that a Trump win would spell disaster for the markets. On November 1, in an article in The New York Times titled, “What happens to the markets if Donald Trump wins?” Andrew Ross Sorkin wrote:

The conventional wisdom is that, right off the bat, the stock market would fall precipitously. Simon Johnson, the Massachusetts Institute of Technology economist, posited that Mr. Trump’s presidency would “likely cause the stock market to crash and plunge the world into recession.” He predicted that Mr. Trump’s “anti-trade policies would cause a sharp slowdown, much like the British are experiencing” after their vote to exit the European Union.

The venerable hedge fund manager Bridgewater Associates told clients on Election Day that if Trump won, the Dow would plunge 10%. Citigroup predicted a 3–5% drop on a Trump victory, and Goldman Sachs called for a big drop in the stock market.

There was an initial panic in futures markets on election night, but by the close of trading on Wednesday, the Dow finished up, and as of this writing it is trading at an all-time high.

Why were the forecasts of immediate gloom and doom so wrongheaded?

Clearly, Trump was not the favored candidate of Wall Street. Financial markets are first and foremost averse to uncertainty and, rightly or wrongly, uncertainty is what many saw in a Trump presidency. As it sunk in that not only had Trump won the White House, but that Republicans maintained their majorities in the House and the Senate, the picture among investors brightened.

Why? With Republican majorities in the House and Senate and a Republican in the White House, the prospect of policy action is much greater than it would have been under the divided government scenario that many were anticipating.

With respect to the economy and financial markets, Trump was undoubtedly dealt a difficult hand to play. The economy is in the winter stage of the cycle, by our estimation, and financial markets have grown accustomed to eight years of 0% interest rates, trillions in quantitative easing, and the expectation of more of the same.

What will Trump’s presidency mean for markets and the economy, given the challenging starting point? In terms of investment strategy, we see some potential positives as well as some potential negatives from the election outcome.

Potential Positives:

Rolling back regulation:

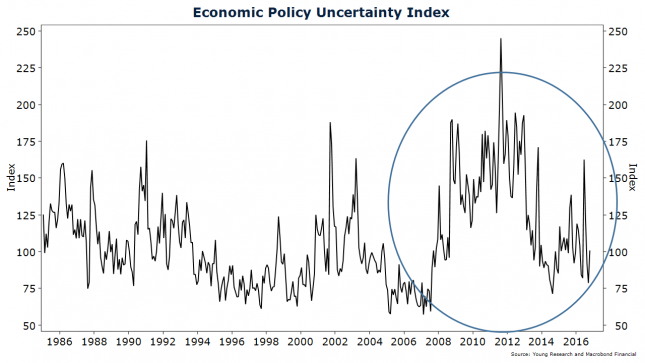

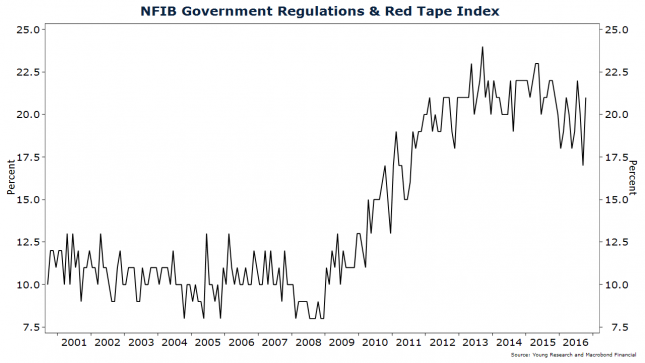

On the positive side, the regulatory environment is likely to be much more favorable toward business. One of the biggest complaints by businesses both big and small over recent years is that aggressive regulatory policies have created uncertainty and red tape that have held back investment. Our charts on the Policy Uncertainty Index and the National Federation of Independent Business’s Regulation and Red Tape Index signal an unusually long period of heightened concern about regulation.

Dodd-Frank:

Also on the regulatory front, Trump has promised to revise the Dodd-Frank financial reform bill. Dodd-Frank was designed to make the financial system safer, but one unintended consequence has been to create a regulatory and compliance nightmare for banks, which has stifled loan growth and heightened risk aversion in the banking sector.

Obamacare:

Obamacare is also on the chopping block in a Trump administration. Obamacare has been a major sore spot for business in recent years. The employer mandate is viewed as a job destroyer by many, and the rise in premiums has cut into the discretionary income of many Americans.

Infrastructure spending:

Trump has called for major infrastructure spending. An increase in infrastructure spending could help growth in the short run, and in the long run it potentially increases productivity. The details of Trump’s infrastructure plan have not yet been made public, so it is premature to estimate how powerful such a program may be.

Personal and corporate tax reform:

The biggest potential positive from a Trump presidency may be his promise of personal and corporate income tax reform. The personal and corporate tax codes are each a mess. They are terribly inefficient and about as far from pro-growth policies as one might get. Most economists agree that the most pro-growth tax systems have a broad base, few deductions, and low marginal rates.

On the personal side of the ledger, a reduction in rates and reforming of the code could give consumer spending a lift. It is also likely to help many of America’s small businesses, which are structured as pass-through entities and are taxed at a maximum rate of 43.4%, as opposed to the 35% corporate tax rate.

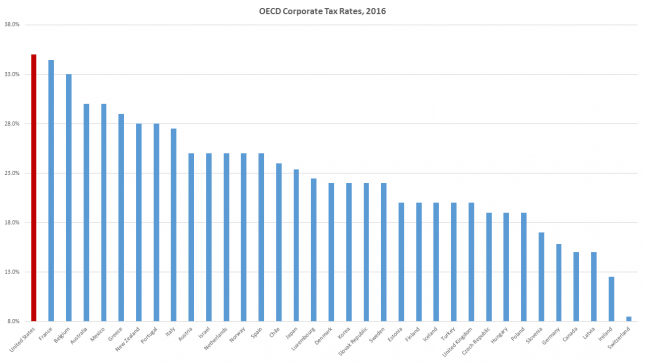

The corporate tax code in America has become one of the most uncompetitive in the world. As my chart shows, the U.S. corporate tax rate is the highest among rich-world countries (OECD). In the late 1980s, America had the fifth-lowest corporate tax rate in the developed world. A reduction in corporate taxes along with a potential repatriation holiday for the over $2 trillion in cash sitting overseas is likely to give corporate business and investment a lift.

A confidence boost:

A final potential positive I will mention from Trump’s victory is a boost in business confidence. Business investment has been subdued during this recovery. Rightly or wrongly, many business leaders have expressed a sentiment that the outgoing administration is fighting against them, or that they don’t have a friend in the White House. A Trump administration has the potential to change that.

For all the potential positives of a Trump presidency, there are also important negatives to consider.

Potential Negatives:

Trade war:

One of Trump’s major campaign planks was a promise to get tougher on trade. Trump promised to renegotiate NAFTA, and that if it could not be renegotiated on more favorable terms he would pull the United States out of the treaty entirely. Trump also said he would label China a currency manipulator and suggested that tariffs may be an option. While much of his talk may just be campaign rhetoric, if Trump makes an aggressive move toward protectionism, he risks starting a trade war with some of America’s major trading partners, which would likely hurt economic growth.

This is especially true for many of America’s publicly traded companies. Over 44% of revenue of S&P 500 companies is generated internationally. Supply chains are now global in nature. A tariff on certain goods exported from China to the U.S. could end up hurting Apple, as a hypothetical, more than it hurts China.

A budget blowout:

The U.S. has accumulated a mountain of debt over the last decade and a half. Total U.S. government debt to GDP is now more than 100%. Empirical research shows that as a country’s debt-to-GDP ratio rises, economic growth slows. During the campaign, Trump promised massive tax cuts and increases in spending. Should he follow through with those promises, U.S. debt and deficits will grow larger. That has implications for inflation, interest rates, economic growth, and economic stability.

Aggressive negotiating tactics:

Trump is a deal maker, and he has repeatedly said on the campaign trail that America doesn’t know how to negotiate. One can see a scenario where Trump takes positions publicly that seem cavalier and dangerous, but to him they are only opening bids in what he views as a negotiation. Floating the idea of a massive tariff on China may be one such strategy. If Trump decides to use these tactics throughout his presidency, financial market volatility may remain elevated.

Populism on the march:

A final risk from Trump’s win has nothing to do with America and everything to do with the populist and nationalist movements that are on the march. Brexit was the first domino to fall. Trump was the next. Neither have thus far caused much economic damage. The major risk of a populist uprising is in the euro area. The referendum coming in Italy in December could be the next domino to fall, and there are elections in France and Germany and the Netherlands within the next 12 months. All three countries have nationalist, anti-EU parties that are gaining support. Should these parties pull out surprise victories as Trump did, the risk of a euro-breakup and a global economic recession will increase markedly.

Trump’s victory will go down as one of the biggest upsets in U.S. political history. Americans across the country and especially in the Rust Belt states turned out for Trump in a big way. They’ve apparently had enough of the status quo from both parties.

Trump of course did not run on a traditional Republican message. He ran a populist-outsider campaign. He built a coalition of working-class Americans who are fed up with trade deals, done with Obamacare, want some respite from the aggressive regulatory approach of the Obama administration, are pro-border control, and desperately want an economic policy that provides real income growth to average Americans.

For the next several months we shall see if Donald Trump will honor his pledge to America’s small business owners, family farmers, and blue-collar skilled tradesmen who propelled him into office. Action could be taken quickly by ending taxation on savings and investment, including double taxation on dividends and taxation on interest, estates (see family farms), and capital gains.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. Copper prices have soared almost 30% over the last month. Copper is said to have a PhD in economics because of its applications in a range of industries: from construction and automobiles to electronics. Copper prices tend to move with the business cycle.

Copper prices started rising well ahead of the election, but the price increases accelerated after the election.

Did copper see a Trump victory when few others did? Maybe, but a new plan from China that calls for additional spending on building and construction projects is likely the driver here.

P.P.S. Technology is one of the most exciting sectors of the stock market. Tech companies are on the cutting edge of innovation and opportunity. It also helps that in tech, unlike in almost any other industry, massive fortunes can be made in a relatively short period of time.

The thrill of finding the next Microsoft or Apple before it takes off attracts many to tech shares, but investing in tech also has a downside.

Technology may be the most innovative sector, but that also makes it one of the most competitive. For the economy, competition helps increase growth and productivity; but in the stock market, competition doesn’t always turn out well for the incumbents. In fact, according to a study by J.P. Morgan, from 1980 to 2014, the tech sector had the highest rate of catastrophic loss of any sector. J.P. Morgan defined catastrophic loss as “a 70% decline from peak value with minimal recovery.”