BRICs and FAANGs

August 2018 Client Letter

Not long ago, Wall Street’s favorite acronym was BRICs (Brazil, Russia, India, and China). The BRIC countries were hyped by many of the big brokerage firms as an investment opportunity with profound promise. As a group, the BRICs were believed to have attractive natural resources, a young overall population, and years of robust growth ahead.

Did the BRICs live up to the hype?

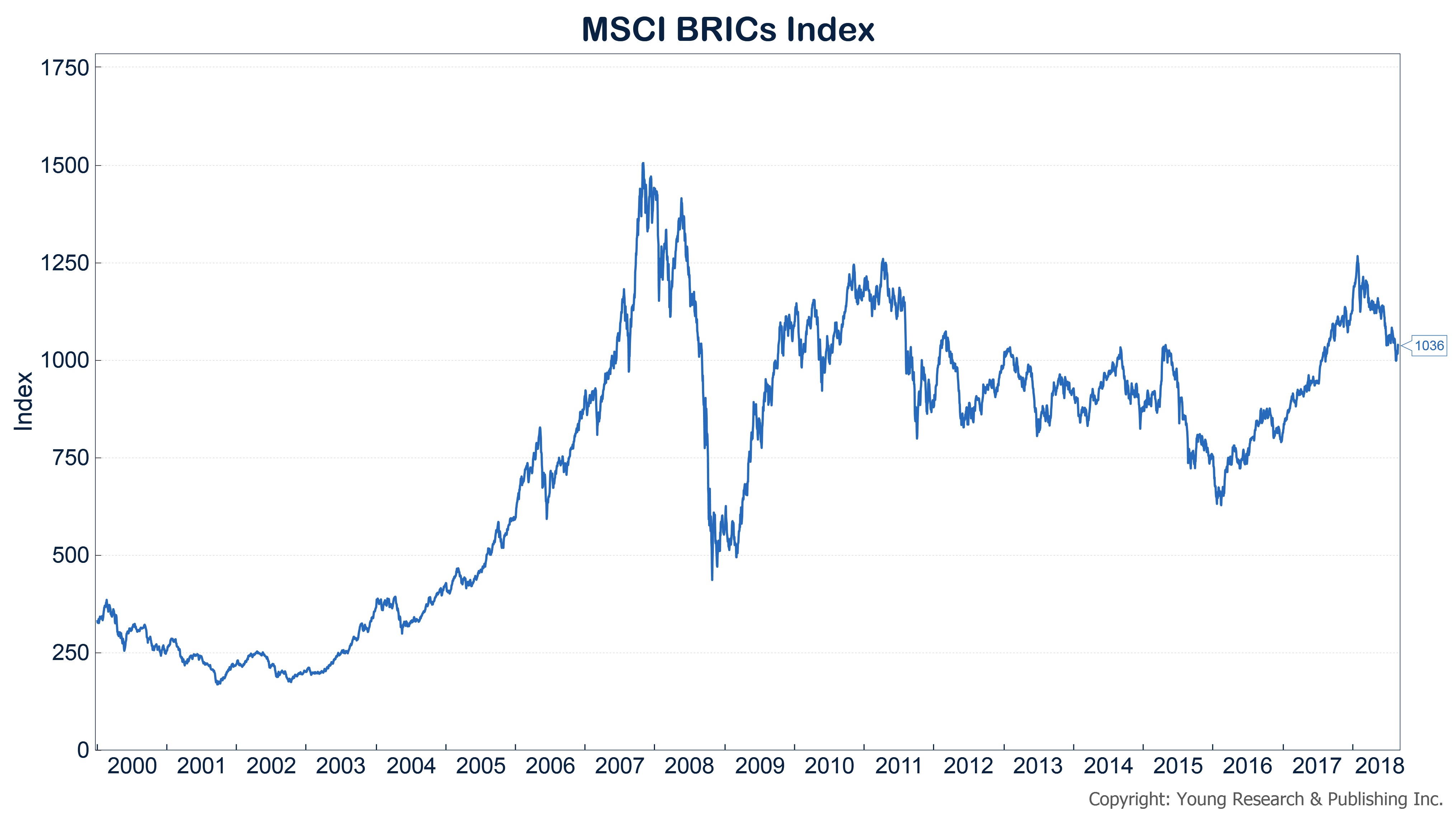

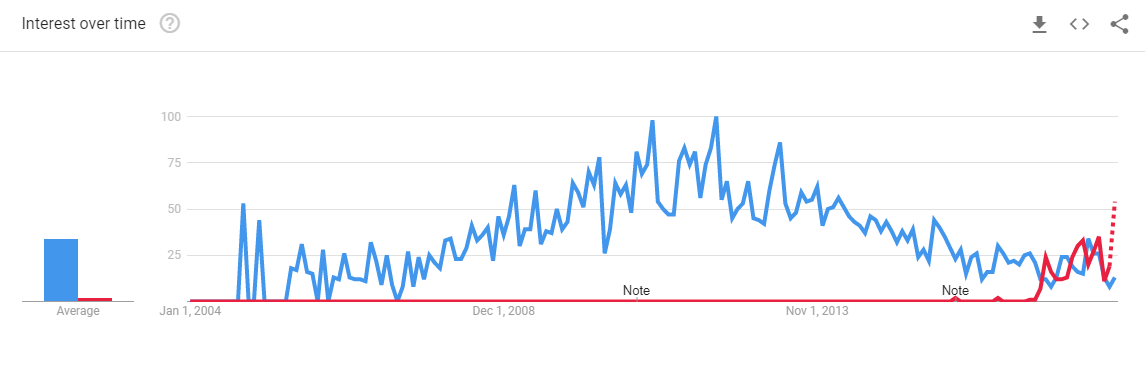

The following chart shows the performance of the MSCI BRIC Index. The BRICs have suffered a lost decade. The MSCI index peaked in 2007 and remains more than 30% below its high. My second chart shows the Google Trends chart for the search terms “BRICS Countries” and “FAANG stocks”. FAANG is the favorite acronym of many investors today—it refers to Facebook, Amazon, Apple, Netflix, and Google.

Google Trends chart for “BRICS Countries” (blue) and “FAANG stocks” (red)

The FAANGs have had an impressive run; but, if popularity was predictive of future performance, The New York Times would have a best-sellers list for stocks. Investing is rarely intuitive. Great companies and great growth stories don’t always make great investments. More often than not, we find the most compelling opportunities in companies and sectors that are unloved, out of favor, and underappreciated.

Cycles are Part of the Territory

Savvy investors recognize stocks, bonds, foreign economies, and even currencies go through cycles. Cycles vary in duration and magnitude. Some end quickly, while others extend far beyond their natural expiration date.

We craft portfolios with the understanding cycles are part of the territory. Some assets in a given portfolio are likely to be in an up cycle, while others are in a down cycle. Year-to-date, the S&P 500 health-care sector is up double digits, while the S&P 500 consumer staples sector (even after a solid three-month rally) remains in the red.

In relative terms, consumer staples stocks are in a down cycle, while health-care shares are in an up cycle. But just because an asset is in a down cycle doesn’t mean it should be sold. On the contrary, down cycles often sow the seeds of future opportunities.

Consumer staples shares have long been among our most favored areas of the stock market. The defensive nature of their businesses helps staples stocks hold up better during recessions than more cyclical businesses. Toilet paper, toothpaste, breakfast cereal, and groceries aren’t the most glamorous products, but they are purchased in good times and bad. The reliable nature of demand for toilet paper and toothpaste, by example, allows staples companies to offer investors consistent dividend growth regardless of the current position of the economic cycle. In fact, more than a dozen consumer staples companies are members of the Dividend Aristocrats club, which is comprised of companies that have increased their dividends for at least 25 consecutive years.

What companies do we favor in consumer staples today? We recently added Kroger to some portfolios, and Walgreens remains one of our favored consumer staples stocks.

Walgreens Opportunity

Amazon’s recent acquisition of PillPack sent a chill down the spine of some Walgreens investors; but, while Amazon is likely to take some market share in the retail pharmacy space, the threat may be overblown. A recent Marketwatch article put numbers to the story.

Americans currently spend $450 billion a year on drugs. Walmart is the fourth-largest pharmacy in the U.S., with sales of $21 billion, or 4.6% of the company’s total sales. Let’s say that over the next five years Amazon gets to Walmart’s sales level of $21 billion. If the U.S. pharmaceutical industry grows 2% a year over that time, total drug sales will have increased by $45 billion, or the equivalent of two Walmarts (we are ignoring compounding here), to $495 billion. Walgreens, with its pharmacy selling about $70 billion a year, would barely notice Amazon’s presence.

Walgreens’ U.S. business, which is about 75% of its total sales, is impressive. A single stand-alone store produces revenues of about $10 million a year—$7 million in the pharmacy and $3 million in front-end sales (milk, candy bars, T-shirts, etc.) A single store fills about 121,000 scripts a year (up from 97,000 four years ago). Walgreens has one of the highest sales-per-square-foot numbers in the retail industry, at around $1,000 per-square-foot.

Investors can purchase shares of Walgreens today for 11.6X next year’s estimated earnings. Walgreens offers a dividend yield of 2.54%. The dividend is up 10% over the last year, and we expect a similar size increase next year. Walgreens also returns billions to shareholders via buybacks. Over the last 12 months, Walgreens repurchased $6.1 billion in shares, reducing the number of outstanding shares by more than 7%. In June the company authorized an additional $10-billion-share-buyback plan, so investors should anticipate continued share buybacks.

Kroger

Kroger is a grocery company founded in Cincinnati in 1883. Kroger grew quickly, opening over 100 locations in its first 25 years. The business also innovated, becoming the first grocer to put a butcher shop inside the store for convenience. Today Kroger is America’s largest grocery company and operates nearly 2,800 supermarkets in 35 states, 269 fine jewelry stores, 38 food manufacturing facilities, 1,522 supermarket fuel stations, and 2,274 instore pharmacies. Now Kroger is taking its strategy overseas by partnering with China’s largest online retailer, Alibaba. With the new deal, the grocer will gain access to over 500 million consumers for its private-label brands. Kroger has proven its commitment to shareholders by increasing dividends in each of the last 11 years.

5% Treasury Yields

Jamie Dimon, the CEO of America’s biggest bank, recently warned about 5% Treasury yields. While “warned” may be strong, Mr. Dimon believes the possibility of 5% Treasury yields is greater than many assume.

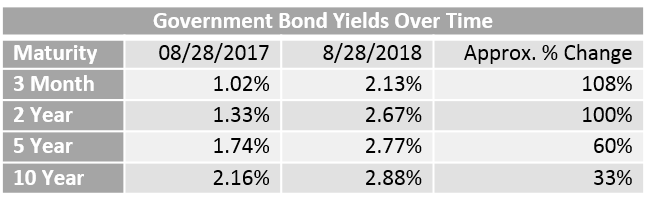

We would welcome a 5% Treasury yield. In fact, while many investors are focused on new highs in the stock market, we continue to cheer on rising interest rates. Short-term Treasury rates are now over 2.5%, and short-term corporate bond rates are over 3%. Long-term Treasury rates are also up over the last year, but not nearly as much as we would like to see.

The following table puts some context around the rise in interest rates across the yield curve. If short- and long-term rates increase by similar percentage amounts over the coming 12 months, income investors will be back in business in a major way. An almost 4% 10-year Treasury rate could mean 5% plus yields on comparable-maturity corporate bonds. And, if Jamie Dimon is right and we see a 5% 10-year Treasury rate, 6% plus corporate bond yields may be in your future.

What’s Going on with Gold?

After posting double-digit gains in 2017, gold has retreated this year. This should come as no surprise. In fact, the surprise should have been last year as gold did so well given the relatively poor environment. Gold does best in periods of fear, panic, unrest, or inflation. Last year was a rather calm year, which should not have favored the metal. This year, economic growth remains strong, interest rates are rising, and the dollar is strengthening. Not the best mix for gold. Gold is a counterbalancing asset. We own gold in client portfolios because gold may rise when stocks fall, or bonds fall, or stocks and bonds fall. Counterbalancing is, of course, the basis of crafting a diversified portfolio.

In the August 2013 issue of The Intelligence Report, my dad had this to say about counterbalancing.

Managing a common stock portfolio takes—above all else—patience. Your goal should never be what to sell next; rather, it should be what stocks you can hold through thick and thin. It is true that portfolio activity, for most investors, runs inversely to consistent long-term performance. How should you measure performance and how should you construct an all-weather portfolio?

First, “all-weather” means you do not want to be jumping in and out of the market attempting to predict bull and bear markets. For five decades, I have been investing my own money as well as advising conservative investors saving for retirement. As such, I have invested through many gut-wrenching bear markets and disastrous single years like 2008, which ended with the speculative non-dividend-paying NASDAQ down a frightening 40% for the year. Through all the years of turbulence, I have remained fully invested in a balanced, widely diversified securities portfolio featuring a counterbalanced approach.

I have firsthand experience of what happens when counterbalancing is not in force. The Harleys I rode back in the old days had engines bolted straight to the frame. Talk about vibration and calamity. The constant vibration caused nuts and bolts to loosen and fall off. When you’re on a long-distance road trip, a breakdown in the middle of nowhere is cause for concern. I have found myself in just such a situation and it’s no fun. Today’s Harleys feature counterbalanced engines offering both a smooth ride and a minimum of road trip calamities.

Counterbalancing simply makes common sense. Let’s look at 2008 as a test kitchen. All the broad averages got hit. High ground, so to say, was achieved by owning positions that got hit least. Consumer staples worked well; no matter how bad the times, investors are not going to forsake toilet paper, toothpaste, or their prescription drugs from Walgreens or CVS. Intuitive common sense, is it not? Well, in ’08, Vanguard Consumer Staples Index (VDC) fell by 16.6%, versus a 37% clipping for the S&P 500. You won big by going with the common-sense approach that was Vanguard Consumer Staples. So, what else worked in the 2008 debacle? The 60/40 balanced Wellesley Income Fund declined by only 9.8% before quickly rebounding, gaining over 16% in 2009 to wipe out all the 2008 bad memories in one fell swoop.

For various reasons, we have moved on from most ETFs and open-end mutual funds (a few exceptions remain), but the concepts my dad outlined above still apply. Instead of relying on the fund approach, we invest in a diversified portfolio of individual bonds and individual stocks. Our portfolios have similar characteristics to Wellesley, given our focus on blue-chip bonds and large-cap, dividend-paying, blue-chip stocks.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. Even for a government program, Social Security is complex. Many soon-to-be-retired Americans have misconceptions about what Social Security will and won’t do for them. In a recent post on its website, https://www.fidelity.com/viewpoints/retirement/social-security-myths, Fidelity debunked five common Social Security myths. Here is a much-abridged version of a few of my favorites from the post.

Myth #1: You must claim your Social Security benefit at age 62: Many people are adamant that Social Security benefits must begin at age 62. This is a myth: 62 is the earliest age you can claim your benefit, but it’s not the only age.

Myth #2: You can claim early, then get a “bump up” once you reach full retirement age: Many believe there is a “bump up” or “added income” once they reach their full retirement age. They’ve heard they can claim early at 62, then when they reach 66 or older, their checks will increase to the amount that corresponds to their full retirement age benefit. That’s a big misperception.

Myth #4: Your benefits are only based on wages that you’ve earned before age 65: Your benefit is calculated based on your highest 35 years of earnings; they do not have to be consecutive years or before age 65.

P.P.S. Last month I told you that perhaps the greatest risk-factor facing investors today is the outcome of the elections in November. That still holds true. Constant negative media stories regarding the president are adding uncertainty to the process of predicting an outcome in November. The number of Americans who feel that the country is headed in the right direction continues to trend upward, but polls also show Americans harboring a deep dissatisfaction with Congress. The president’s personal approval ratings have been stable over the last month, but during that time polls asking Americans whether they would vote for a hypothetical Republican or Democrat in November have been volatile, though they trend in Democrats’ favor.

In the close-to-home proxy race I’m watching in Florida, Governor Rick Scott has managed to slightly outpace Senator Bill Nelson in polls. Florida’s diverse population and multiple big-media markets make it a nice bellwether for American elections. If the race for Senate in Florida is any indication, this election season will come right down to the wire.

P.P.P.S. The physical benefits of regular exercise have been known since even before the codification of the principles of yoga in 600 BC. It is also commonly thought that physical activity helps clear the mind. Now researchers have performed a survey that gives some scientific weight to that idea. Sumathi Reddy reported on the research in The Wall Street Journal:

Researchers rated mental health based on a survey. It asked respondents how many days in the previous month their mental health was “not good” due to stress, depression or problems with emotions.

People who played team sports like soccer and basketball reported 22.3% fewer poor mental-health days than those who didn’t exercise. Those who ran or jogged fared 19% better, while those who did household chores 11.8% better.

In a secondary analysis, the researchers found that yoga and tai chi—grouped into a category called recreational sports in the original analysis—had a 22.9% reduction in poor mental-health days. (Recreational sports included everything from yoga to golf to horseback riding.)

P.P.P.P.S. The WSJ recently penned a downbeat article on Exxon. We own Exxon in many portfolios and continue to purchase it. We believe Exxon’s dividend is the most secure of all the major oil companies, and the company has a good record of dividend growth. Exxon also has a strong balance sheet—a necessity in a cyclical, capital-intensive business. We view Exxon as the most conservative of the major oil producers, and it generates the highest average return on capital. While Exxon may lag when oil prices are on the rise, it tends to fall less when oil prices drop. Today Exxon shares yield 4.1%.