December 2013 Client Letter

Lehman Brothers was founded in 1850, became a member of the New York Stock Exchange in 1887 and in 1906 teamed with Goldman, Sachs & Co. to bring Sears, Roebuck and Company to market. Over the next 20 years, Lehman and Goldman paired up to underwrite F.W. Woolworth Company, R.H. Macy & Company, The Studebaker Corporation, B.F. Goodrich Co. and Endicott Johnson Corporation, among many others.

A little over five years ago, Lehman’s fortunes drastically changed. On Monday, September 15, 2008, the world watched in disbelief as Lehman employees removed files, company items and other belongings from its world headquarters on Seventh Avenue. Earlier that morning, the 158-year-old investment bank announced it would file for Chapter 11 bankruptcy.

The Lehman crises could be described as a black swan event. Nassim Nicholas Taleb popularized the term black swan in his 2007 best-selling book The Black Swan. Taleb regards many major scientific discoveries, historical events and artistic achievements as black swans. These events include the rise of the Internet, the personal computer, World War I and September 11.

According to Taleb, a black swan event has three attributes. First, the event is an outlier, as it lies outside the realm of regular expectation. Second, the event has a major impact. And third, in spite of the outlier status, the event is rationalized by hindsight as if it could have been expected.

The Lessons of the Lehman Collapse

This past September The Wall Street Journal’s Brett Arends reflected on the 2008 financial crisis and how much we really learned from the event. Noting that many people lost their home, their savings or their jobs, Arends wondered if investors are any wiser or even better prepared than before the crisis.

Here are five lessons that, according to Arends, could be takeaways from the Wall Street collapse and financial crisis kicked off by the Lehman black swan event.

- Ignore Wall Street’s optimistic forecasts. According to the conventional wisdom on Wall Street in 2006, house prices would just keep going up. The reason: They always had. “We looked at the data since 1945,” said Treasury Secretary Hank Paulson later, “and we concluded house prices don’t go down. “Conventional wisdom also said then that stocks would produce average returns of about 9% a year and bonds about 5%. The reason: Those were the historical averages in Wall Street’s spreadsheets. The problem didn’t lie with the data, but the reasoning. You cannot reliably extrapolate a guide to the future from a limited set of past experiences. Yet today too many households are still basing their financial planning and retirement hopes on the same flawed forecasts.

- The people in charge don’t know much more than you. The International Monetary Fund was taken completely by surprise by the financial crisis. So were most of Wall Street and most economists. The Federal Reserve thought the subprime-mortgage blowup would be “contained.” Few economists predicted the recession before it was nearly over.

- Debt is dangerous. The three decades leading up to 2008 saw the entire U.S. go on a debt binge. That included households, companies and the government. Conventional wisdom on Wall Street viewed these debts as largely benign. Household borrowing was OK, the experts said. It allowed people to use their future income today to purchase better homes and consume. Today, many consumers are borrowing freely again. Good luck if they lose their jobs, or the economy turns down again. Asset prices and incomes can fall, but the debt-service payments march on regardless.

- We are more risk-averse than we think. When the stock market collapses, people sell. Seeing your net worth halved is very different in practice than in theory. From September 2008 through March 2009, as the Dow Jones Industrial Average plummeted from 11700 to 6500, mutual-fund investors withdrew more than $200 billion from stocks—at precisely the wrong time. Today, as the stock market hits new highs, Mom and Pop are feeling complacent again and are piling back into stocks.

- Cash isn’t trash. When times are good, Wall Street treats cash as…well, as a four-letter word. Conventional wisdom considers it “dead money,” a poor investment earning low returns. Investors prefer to swap it into more exciting assets—to “put that money to work,” as they like to say. They are assuming a liquidity crisis cannot or won’t happen again. Yet when it does, as in 2008, those who have wisely held cash in reserve hold all the cards.

A concerning element of today’s stock market, which has substantially appreciated since March 2009, is that the structural problems from the last financial crisis were never corrected. Monetary and fiscal authorities prevented a necessary deleveraging and market clearing.

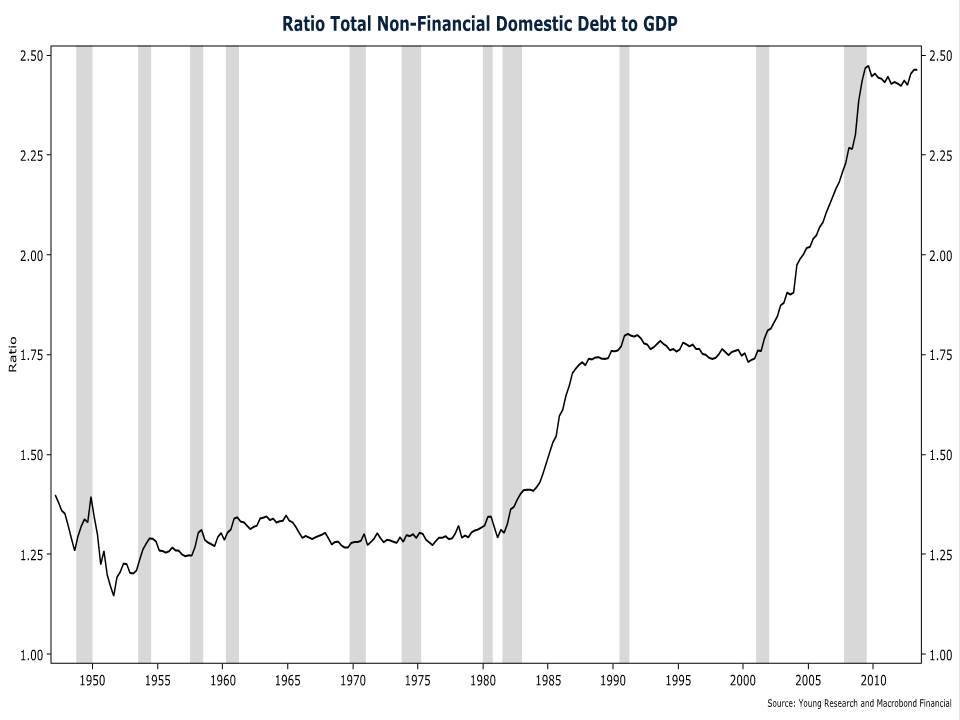

Our debt-to-GDP chart shows the U.S. economy remains overly indebted. Non-financial debt to GDP is higher today than it was at the start of the last credit crisis. Deleveraging that occurred in the household sector was replaced by borrowing in the public sector. And much of the household deleveraging occurred as a result of mortgage defaults. Consumer household debt has already returned to the pre-crisis highs of 2007. (The shaded areas indicate recessions.)

If this stock market inflates further and eventually bursts, the financial and economic dislocation could be significant. The Fed is already running a full-tilt monetary stimulus. And the capacity for fiscal authorities to pump up demand in a future downturn is more limited than in 2008.

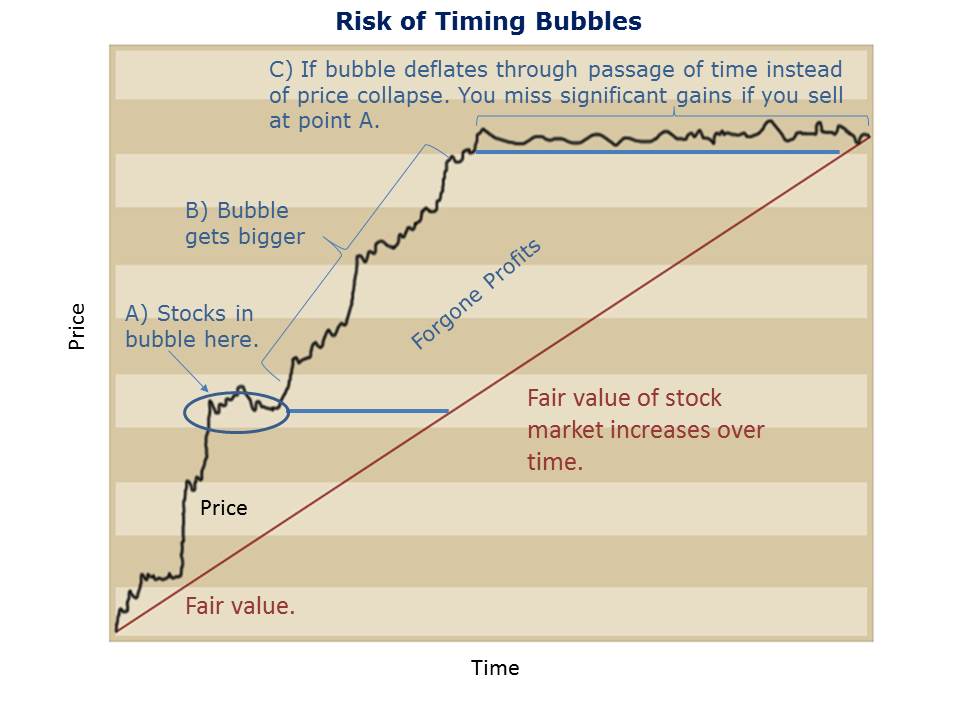

As for investment strategy, it’s important to recognize the uncertainty in today’s markets. Stock prices could go higher over a longer period of time than many expect before the cycle is complete. And there is no guarantee today’s market will collapse in the same manner as in the past. It is possible (though not probable) the market will correct by drifting sideways for an extended period of time, during which company fundamentals catch up to prices. If you were to liquidate your entire equity portfolio today you may miss out on stock market gains. Our diagram below illustrates this point.

Diversification is also critical to help protect against high volatility. An important component of diversification is to include portfolio counterbalancers. Ideally, a counterbalanced portfolio would have some assets rise in price when the stock market falls. Historically, bonds have been the most reliable counterweight to stocks. But because the Federal Reserve is pinning short-term interest rates at zero, the counterbalancing power of short and intermediate-term bonds is impaired. Short bonds may continue to offer the benefit of stability in a bear market, but they are unlikely to offset stock market losses as is typical during down years in the stock market.

Gold and precious metals also act as counterbalancers. The year 2013 will be the first down year for gold in 12 years. If the stock market continues to inflate, it is possible for gold and other precious metals to fall further in price. However, if the stock market collapses and the economy enters a recession before the labor market reaches the Fed’s hoped-for employment target, the Fed may shoot for a higher explicit-inflation target. Support for a higher inflation target is already building among the more liberal Keynesians, many of whom dominate policymaking circles. If the Fed raises its inflation target, look for gold and precious metals prices to soar.

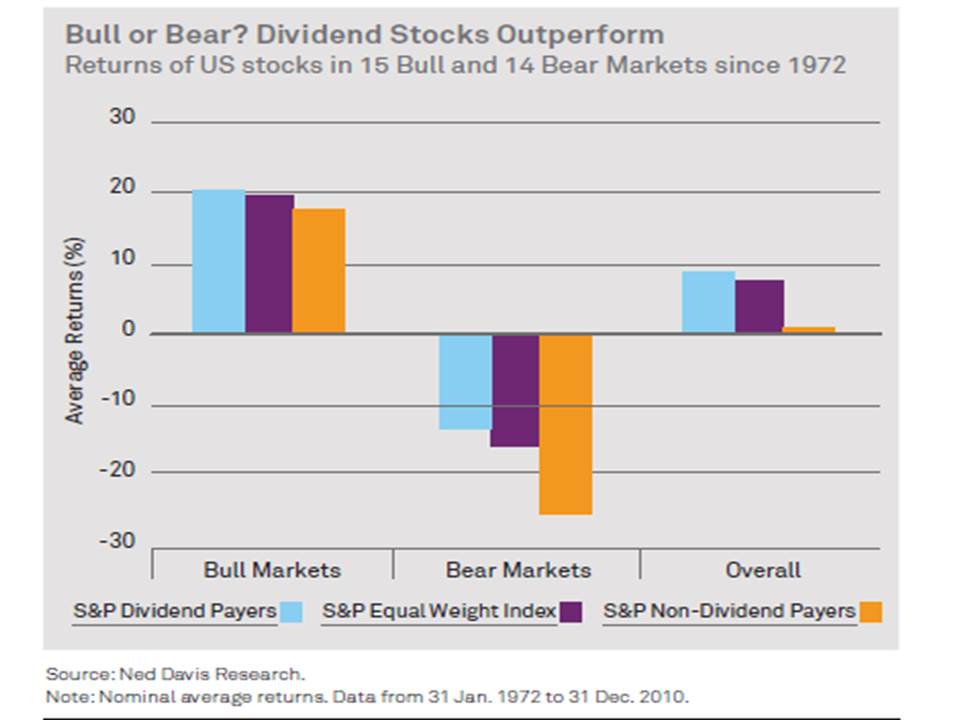

To help reduce volatility within equities, we favor dividend-paying stocks. We prefer to take returns up front in the form of high dividend payments today and the prospect of higher dividend payments tomorrow. Should the stock market enter a period of low growth, portfolios with a high dividend-yield will at least provide a modest income return.

Dividend payers also tend to hold up better than non-dividend-payers when markets correct. In up markets, dividend-paying stocks have historically kept pace with the market; but in down markets, dividend payers have fallen less than stocks paying no dividends at all.

Over the long haul, a portfolio balanced across asset classes is generally the best idea for conservative retired and soon-to-be-retired investors. That’s not because balanced portfolios will necessarily post the highest long-term returns—over most long time-periods, stocks have posted the highest returns. Rather, balanced portfolios tend to work best because investors find it easier to ride out market volatility with this type of portfolio. By diversifying, investors help themselves to avoid the fear and regret that can emerge when one part of the financial markets takes a dive.

Have a good month and a great new year. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Best regards,

Matthew A. Young

President and Chief Executive Officer

P.S. Monetary scholar Kevin Dowd, while delivering a paper last month at the Cato Institute’s 31st-annual Monetary Conference, concluded: “The modern financial system has not only kicked away most of the constraints against excessive risk-taking, but positively incentivized systemic risk-taking in all manner of highly destructive ways. We have gone from a system that managed itself to one that requires management, but cannot be managed. We have gone from a system that was guarded by market forces operating under the rule of law to one that requires human guardians instead—but we have not solved the underlying problem of how to guard the guardians themselves.”

P.P.S. Stock and bond prices are not the only asset prices that have risen in part due to the Fed’s QE policy. Various real estate markets have also taken off. Across the state from me in Miami, real estate is certainly on the rise. According to The Wall Street Journal, “For several years after the housing bubble burst, a glut of towering condo buildings sat largely empty. Condo values plunged nearly 60% from peak to trough. Now nearly all the once-vacant units are filled up, and demand is outstripping supply. There are 118 condo towers proposed in the Miami area, including 35 under construction. Said Peter Zalewski, principal at Condo Vultures, a real-estate consultancy, “This boom is very reminiscent of where we were a decade ago.”

Client Portal

Client Portal Secure Upload

Secure Upload Client Letter Sign Up

Client Letter Sign Up