Bond Strategies for a Low-Yield World

October 2010 Client Letter

One of the more surprising developments this year has been the relatively strong performance of most bonds and bond funds. One of our firm’s largest holdings, Vanguard GNMA, has a year-to-date total return of 6.5%. This return comes on the heels of steady performances in 2009 (up 5.29%) and 2008 (up 7.22%).

We invest in Vanguard GNMA expecting the fund’s total return to approximate the fund’s current yield. By example, if Vanguard GNMA’s SEC yield is 3.5%, we would expect its year-end total return to be approximately 3.5%. This year, the fund has exceeded our expectations by posting a total return several percentage points higher than its yield. The pickup in appreciation has been an especially welcome development in today’s low-yield environment.

Today, the current yield on Vanguard GNMA is 3.58%, compared to 0.50% on similar-duration Treasury securities. Given that GNMA securities are backed by the full-faith-and-credit pledge of the U.S. government, we continue to favor the fund. While annual positive performance of Vanguard GNMA is not guaranteed, we feel confident the fund will continue to pay out a predictable stream of monthly income. And, as with all fixed-income investments, Vanguard GNMA provides diversification away from the stock market.

With over $1 trillion of excess reserves already in the banking system, the efficacy of another round of quantitative easing seems questionable, but the Fed is out of good options. QE 2.0, as some are calling it, is a “Hail Mary” pass. The transmission mechanism from QE to the real economy is indirect. There is no guarantee that more QE will do anything but lower long-term Treasury rates.

If the Fed does move forward with more quantitative easing, the implication for investors is a low-for-longer interest rate environment. When rates are low, the temptation is to reach for yield in long bonds. A 3.6% yield on 30-year Treasuries sounds appealing when compared to a 1.23% yield on five-year Treasuries, but we believe the risk in long bonds far outweighs the reward. Remember, a 1% rise in the yield on a 30-year bond would result in a price drop of close to 20%—that’s equal to over five years of interest.

Instead of reaching for yield by taking maturity risk with long Treasuries, we favor a strategy focused on corporate bonds. Investment-grade corporate bonds continue to offer a substantial yield advantage to Treasury securities. According to Bloomberg, five-year A-rated corporates yield 1.35% more than comparable-maturity Treasuries. A disparity we feel adequately compensates investors for taking more risk.

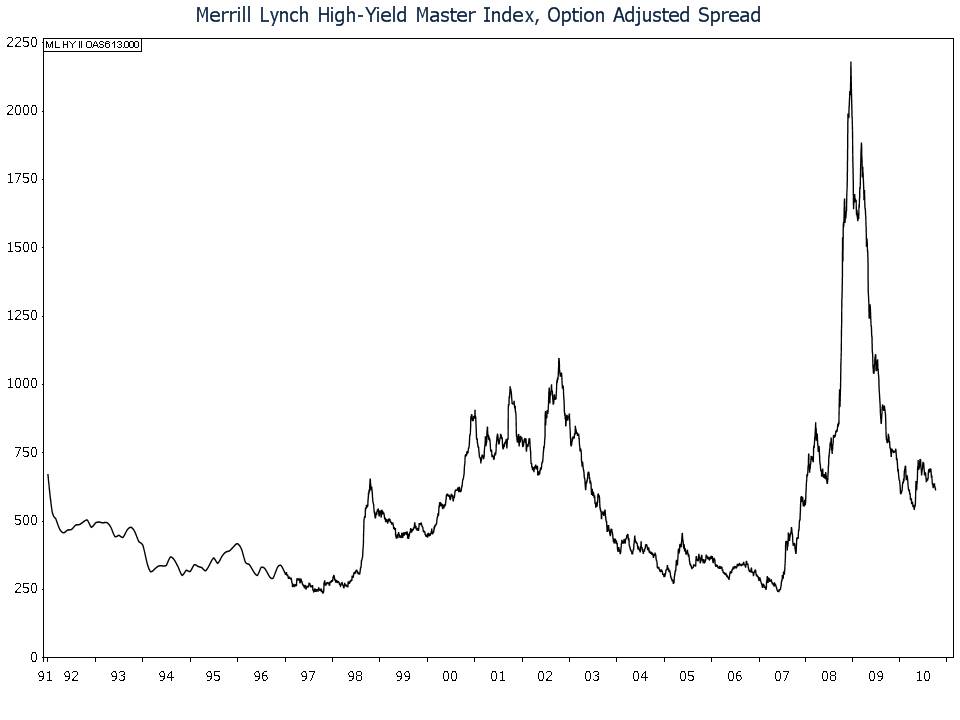

To further enhance the prospective returns on your fixed-income portfolio, we recently began implementing two strategy adjustments. First, we are selectively increasing exposure to high-yield bonds. Although high-yield bonds carry greater risk of default, corporate balance sheets are strong and corporate profits are robust, credit-ratings downgrades are at a 10-year low, and liquidity is abundant. Demand for high-yield bonds is also strong, which reduces rollover risk for issuers. And despite solid fundamentals, my chart shows high-yield spreads continue to offer value. Of course, if the economy were to enter another recession, spreads would likely widen, but careful issue selection can mitigate this risk to some degree. Additionally, a second dip in the economy is not likely to be as deep as the first, simply because demand is already subdued and inventory levels are not excessive.

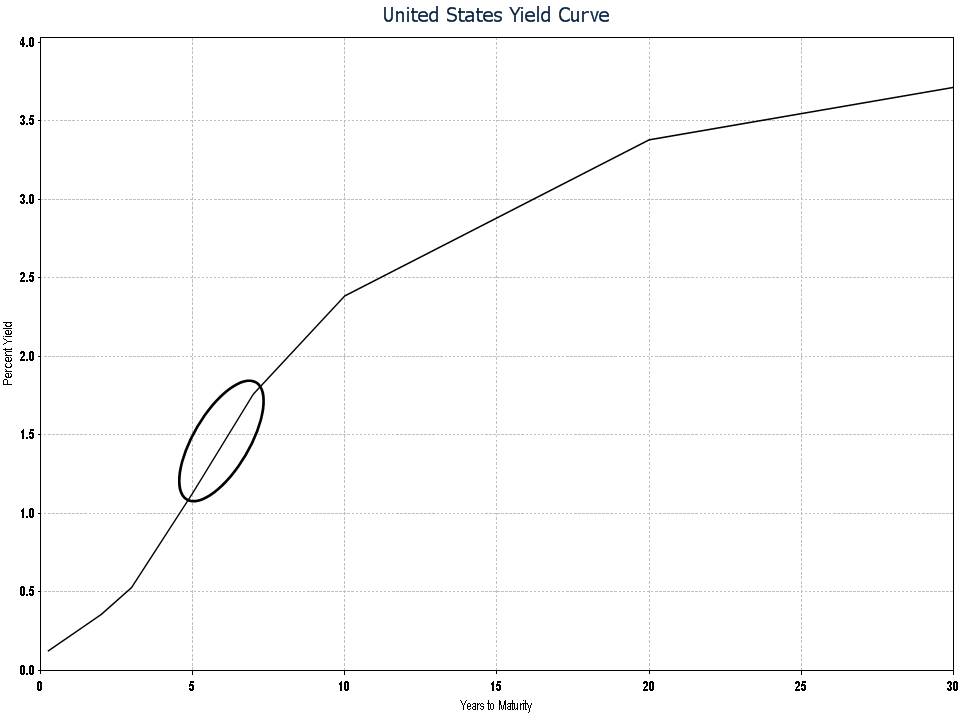

The second strategy adjustment we are making to corporate bond portfolios is positioning them to maximize roll-down return in order to improve prospective performance. This concept requires some explanation, so bear with me. Roll-down return is the return earned from rolling down the yield curve. For those of you unfamiliar with the yield curve, it is simply the relationship between the maturity on bonds and their interest rates. See our yield curve chart below.

When you buy a bond and hold it to maturity, the total return on the bond is approximately equal to the yield to maturity at cost. But what if you don’t hold the bond to maturity? What if you buy a five-year bond today and sell it in one year? Will your return match the yield to maturity at purchase? No. The return on a five-year bond sold after one year is equal to the income earned plus the change in the bond’s price. As you know, the income from a bond is determined by the coupon rate of the bond. The price of a five-year bond in one year is determined by four-year interest rates one year from now.

Let’s look at an example. Today, five-year Treasury securities yield 1.23%, and four-year Treasury securities yield 0.98%. For simplicity, assume interest rates remain constant for one year. The five-year Treasury security with a yield to maturity of 1.23% pays a 1.25% coupon and can be purchased for $1,000.94. After one year the bond will have paid $12.50 in income, and, at a 0.98% yield, the bond’s price will have risen to $1,010.35, an increase of $9.41. Adding $9.41 to $12.50 gives you $21.91. Divide by the purchase price, and you end up with a total return of 2.18%—almost twice the yield to maturity on the bond. After one year, you sell your four-year bond and buy another five-year bond.

In the current environment, we think the risk-reward of a roll-down strategy is appealing. You can pick up additional return without taking significant maturity risk. If rates remain the same or decline, you can almost double your yield to maturity, and if rates rise, your downside is limited to your yield to maturity at cost. To position your portfolio to maximize roll-down yield, we plan to overweight the steepest part of the yield curve. Today the five- to seven-year maturity range is the steepest part of the curve. We continue to craft corporate bond portfolios with a laddered approach, but we are overweighting the five- to seven-year maturity range to maximize potential roll-down return.

Two bonds we recently purchased in many portfolios appear to be ideal candidates for a roll-down strategy. We bought American Express Credit 2.75% issue due in September of 2015 and Total Capital 2.3% issue due in March of 2016. Both bonds were issued in size, so we anticipate strong liquidity. The Amex issue size was $2 billion, and the Total issue size was $1 billion. The American Express bonds are rated A2/BBB+ and were purchased at a yield to maturity of 2.80% for most clients, and the Total bonds are rated Aa1/AA and were purchased at a yield to maturity of 2.36%.

American Express is of course a household name. Amex is the world’s largest card issuer by purchase volume. The company caters to high-end consumers. Amex was not immune to the financial market disruption during the height of the credit crisis, but the company recovered sooner than most financial firms. In 2009, Amex earned $2.13 billion on $24.5 billion in revenue. In 2010, the company is projected to earn $3.8 billion.

Total is a name you may not be as familiar with. Total is one of the world’s largest integrated energy firms. Based in Paris, Total is engaged in all aspects of the petroleum industry, including exploration and production and refining and marketing. The company also produces chemicals and has interests in coal mining and power generation. At year-end 2009, Total’s proved reserves were 10.5 billion barrels of oil equivalent. Total’s refining and marketing business includes a retail network of over 16,000 service stations and refining capacity of 2.6 million barrels per day.

Despite the strong stock market performance in the third quarter, we continue to suspect our economy is not positioned to gain long-term traction. Last month, writing in the WSJ, former hedge fund manager Andy Kessler noted that Wall Street still faces headwinds:

We are at the bitter end of a 30-year interest rate cycle. Declining interest rates are the ideal environment for economic growth. In January 1981, short-term interest rates were 19.08%—now they are 0.14%. Thirty-year mortgages in October 1981 were 18.45%—now they are 4.28%. Over this period the stock market rose tenfold….

At some point, the powers that be will figure out that rising interest rates will be the cure for what ails the U.S. economy by driving the dollar higher, commodities back toward their extraction values, and encouraging commitments of capital based on market mechanisms, not the wishes of the government and the Federal Reserve. That will not be good news for Wall Street, which doesn’t do well in a rising interest-rate environment. See the 1970s. Time to hunker down and get back to basics.

I do not know specifically how Mr. Kessler would define hunkering down and getting back to basics. At Richard C. Young & Co., Ltd., we’ve always been back to basics with our focus on interest- and dividend-paying securities. In our view, investing for cash flow is about as basic as you can get. To hunker down, we emphasize high quality fixed-income securities. On the equities side, we concentrate on public utilities, consumer staples, and pipeline companies.

Have a good month and, as always, please give us a call at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. Today, one of our favored asset classes is blue-chip consumer goods companies producing goods few among us can do without. Coca-Cola, H.J. Heinz, and Kraft Foods fall into this category. Historically, consumer staples have been perceived as having pricing power—a trait we favor in today’s economic environment. Conversely, technology companies do not typically rank well in measures of pricing power. Technological advances typically drive prices down. The lack of pricing power, the general lack of dividends, and the fact that tech stocks are some of the most cyclical and volatile stocks in the market are reasons we do not favor the tech sector.

P.P.S. We recently sold all shares of Boeing (BA). For the most part, Boeing had a relatively good run for us. The sale was part of our ongoing effort to boost and maintain a high yield on our equity portfolios. With the proceeds, we bought Companhia Energética de Minas Gerais (CIG), the Brazilian electric utility or Statoil (STO). I highlighted CIG in my last letter. Statoil is an integrated energy company based in Norway. The firm’s primary operations are in Europe, Africa, and the Americas. Statoil offers one of the highest yields (4.6%) of the oil majors and provides some exposure to the Norwegian krone.