Dining with Former BB&T Chairman John Allison

November 2012 Client Letter

This month I had lunch with retired BB&T Chairman and CEO, John Allison. Speaking with John was a special privilege given his unique background in the financial industry. John was the longest-serving CEO of a top-25 financial institution, serving BB&T from 1989 through 2008. During his 20-year term, BB&T grew from $4.5 billion to $152 billion in assets, becoming the 10th-largest financial services holding company headquartered in the United States.

In his book, The Financial Crisis and the Free Market Cure, John explains his bank’s relative success during various crises over the years:

BB&T has maneuvered through the financial storm extraordinarily effectively without experiencing a single quarterly loss. We avoided all the major excesses and irrationalities of the industry. Of course, BB&T has been negatively affected by the economic environment, as banks reflect the financial health of their clients and BB&T’s core business is real estate related. However, we have nothing for which we need to apologize. I was in charge of BB&T’s lending business during the significant recession of the early 1980s and CEO during the last major real estate correction in the early 1990s. BB&T weathered both of these storms extremely successfully.

With the elections now over, investors face the potential for a variety of policies that will make investing a challenge and could further regress Americans’ standard of living.

John said he used to believe the Federal Reserve was second only to Congress in destroying wealth and well-being. Now he believes the Fed has moved into first place. However, one need not be a former banker or an investment advisor to realize today’s harmful Fed policies.

Most would agree that low interest rates are one way to jumpstart a stalled economy. The Fed, though, has implemented a strategy where, if lower rates are good, then zero rates must be better. While a brief stint at zero rates may be necessary during emergencies, such as during the peak of a crisis, the Fed has now kept rates at zero for four years!

For retired and soon-to-be retired investors, the Fed’s policy has been a disaster. A zero-rate policy makes traditional low-risk investments—including CDs, money markets and short-term Treasuries—unattractive to savers. Federal Reserve Chairman Ben Bernanke appears to view the zero-rate environment as a benefit, hoping investors will abandon the idea of pursuing safer returns and instead put their savings into equities. If more funds are allocated to the stock market, then stock prices should rise. This strategy has the potential to destroy personal wealth if investors over-allocate to the stock market and the market experiences a correction.

Of course, not all investors will play the Fed’s game. Witnessing markets losing half their value twice in the last dozen years will prevent some from speculating. Instead, these investors will opt to save more and spend less. Their reduced spending will be a drag on economic growth. Growth in the economy is further slowed by Bernanke’s flooding the market with dollars. The strategy is to flood money into the system and hope the cash will find its way to stocks, increasing their value. The problem here is that investors become concerned about dollar debasement and invest heavily into commodities. Heavy commodity investment results in a rise in food and energy prices. I can’t think of too many events that can slow an economy more than rising energy prices.

On November 9, Barack Obama said, “We can’t just cut our way to prosperity. If we are serious about reducing the deficit, we have to combine spending cuts with revenue—and that means asking the wealthiest Americans to pay a little more in taxes.”

As congressional leaders and the White House negotiate on the fiscal cliff, we are hearing a lot about raising taxes on the “rich.” The debate has morphed from whether or not to tax the rich into how to tax the rich. Apparently a majority of Americans bought into the president’s dubious campaign pitch about taxing millionaires and billionaires to solve the budget crisis. And, based on the media’s coverage of the fiscal cliff, they did too. That’s a shame, because America doesn’t have a revenue problem. It has a spending problem.

You don’t have to be a budget gnome to recognize our problem is profligate government spending, not low taxes. As the president is fond of saying, it is just arithmetic.

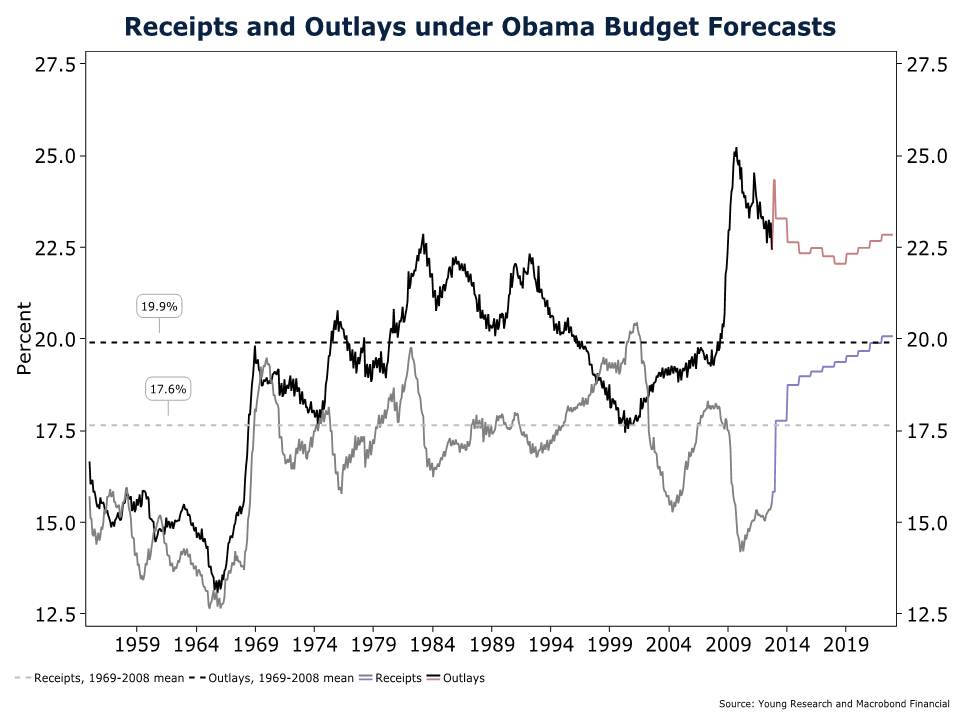

Pre-Obama, federal spending averaged 19.9% of GDP and federal revenue averaged 17.6% of GDP. That still leaves a modest deficit, but a deficit equal to about 2.3% of GDP is sustainable. To get back to a sustainable budget, a fiscal-cliff deal should target federal spending of about 20% and federal revenues of 17.5% to 18%, both relative to GDP.

Today, federal spending amounts to 23% of GDP and federal revenue, 15.5%. So spending is three percentage points above its long-run average, and revenue is two percentage points below its long-run average. But if you add back revenue from the payroll tax holiday that both parties agree should expire at year-end, federal revenue is actually 16.2% of GDP. Still below the historical average we should be shooting for, but don’t forget the economy is still floundering.

Unemployment is nearly 8% and GDP growth is limping along at less than 2%. In a more robust economy, the Bush tax code could easily generate 18% of revenue. In fact, with today’s very same tax code, federal revenue was 17% of GDP in 2005, 18% in 2006, and 18.2% in 2007. The structure of tax rates is not the problem. The problem is economic growth—or lack thereof, to be more specific. Even the Congressional Budget Office (CBO) recognizes that the Bush tax rates would generate plenty of revenue if the economy was stronger.

The CBO forecasts that if the Bush tax rates were made permanent and economic growth picked up, federal revenue would rise to 17.2% of GDP in 2014, 17.8% in 2015, and 18.1% in 2016.

So why are the president and his allies in Congress so resolute on tax hikes? Beyond extracting a pound of flesh from the “rich” to satisfy their base, they want to expand the size and scope of government. Look no further than the president’s own budget (chart below). If the president had his druthers, by 2022, federal revenue would rise to more than 20% of GDP, and federal spending would rise to a permanently higher plateau of 23% of GDP.

Richard Rahn, Chairman of the Institute for Global Economic Growth recently wrote the following. “When the president says, ‘We can’t just cut our way to prosperity,” he is ignoring the fact that much, if not most, of government spending does not meet the test of the highest and best use for the money. It does not even meet a much lower standard of spending benefits exceeding their costs. For example, Congress has extended the number of weeks that a person can receive unemployment benefits. It sounds like the humane thing to do, but many economic studies show that a high percentage of unemployed people do not really get serious about taking a job until near the end of the benefit period. The longer the period people can receive unemployed benefits, the longer people tend to stay out of work. The longer people are unemployed, the more apt they are to drop out of the work force. At first glance, extending unemployment benefits seems compassionate, but it is actually both destructive for the economy and the individual—like so many other government programs.”

As has been true through most of America’s modern political history, higher tax revenues are a ruse to expand the size and scope of government. Unfortunately, as best we can tell, a majority of Americans are still in the dark.

Those who are not in the dark understand that the fastest way to raise revenue is with faster economic growth. Growth would be achieved with lower taxes and a simplified tax code, less costly regulation, and monetary stability. The Federal Reserve should not focus on multiple monetary policy goals, but should instead concentrate solely on maintaining the stability of the dollar.

Based on the current monetary policy as well as the current tax and regulatory environment, we continue to favor an investment strategy that includes short-term corporate bonds, gold and foreign currencies, and a significant portion of equities focused on higher-quality, dividend-paying companies.

Have a good month and, as always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Sincerely,

Matthew A. Young

President and Chief Executive Officer

P.S. I write this after having just seen Florida Governor Rick Scott at breakfast at organic market and café Food and Thought here in Naples. Normally, I would have approached the governor, but I am aware of his mother’s recent passing and did not want to bother him. Obviously Governor Scott is in the center of attention right now as he deals with ObamaCare and whether Florida will create a health-insurance exchange. States will also have to decide whether to implement the law’s massive expansion of Medicaid. State-created exchanges mean higher taxes, fewer jobs, and less protection of religious freedom. States are better off punting the exchange creation back to the federal government.

P.P.S. The Wall Street Journal op-ed carried a piece call Saudi America. In its annual world energy outlook, the Paris-based International Energy Agency (IEA) says the global energy map “is being redrawn by the resurgence in oil and gas production in the United States.” According to the WSJ, the U.S. will increase its production to about 23 million barrels a day in 10 years from about 18 million barrels a day now. That’s more optimistic than current U.S. government estimates and a change from a year ago when the IEA said Russia and the Saudis would vie for number one.

P.P.P.S. A central investment theme for us is high-barrier-to-entry businesses of companies that pay dividends. Two examples include Norfolk Southern and Kimberly-Clark. Norfolk Southern operates approximately 20,000 route miles in 22 states and the District of Columbia, and serves every major container port in the eastern United States.

A new competitor for Norfolk would need thousands of miles of rail beds and right-of-ways. This would be nearly impossible for a competitor to replicate. Kimberly-Clark increased its dividend by 6% in 2012, the company’s 40th consecutive annual-dividend increase.