Frugality and Patience, the Millionaire-Next-Door’s Secret

March 2015 Client Letter

This past June, at the age of 92, longtime Brattleboro, Vermont, resident Ronald Read passed away. Friends of Ronald knew him as a hard worker who lived modestly. He worked as a maintenance worker and janitor at a JCPenney store after years pumping gas at a service station partially owned by his brother. Mr. Read would often go to great lengths to cut costs by parking his car far from his final destination in order to avoid the parking meter.

But what shocked Mr. Read’s friends was when they learned his estate was valued at almost $8 million. When Mr. Read died, he left behind a large stack of stock certificates in a safety deposit box. The shares comprise the majority of his estate.

According to Anna Prior, reporting for The Wall Street Journal, “Besides being a good stock picker, he displayed remarkable frugality and patience—which gave him many years of compounded growth. Mr. Read owned at least 95 stocks at the time of his death, many of which he had held for years, if not decades. They were spread across a variety of sectors, including railroads, utility companies, banks, health care, telecom and consumer products. He avoided technology stocks. Mr. Read typically bought shares of companies he was familiar with and those that paid out hefty dividends. When dividend checks came in the mail, he plowed the money back into more shares.”

Investing Benefits of Patience and Compounding

Mr. Read’s strategy is not unlike the one we execute for clients. We favor many of the sectors included in his portfolio, which tend to be the higher-dividend-paying sectors. Perhaps more importantly, we favor the investing benefits that can come from being patient and allowing the compounding process to take hold. Patience gives you time. And time can accelerate rewards. The keys to compounding is having something to compound (dividends) and giving those dividends time to grow. The annual compounding of dividends is, as Einstein is said to have noted, the greatest mathematical discovery of all time.

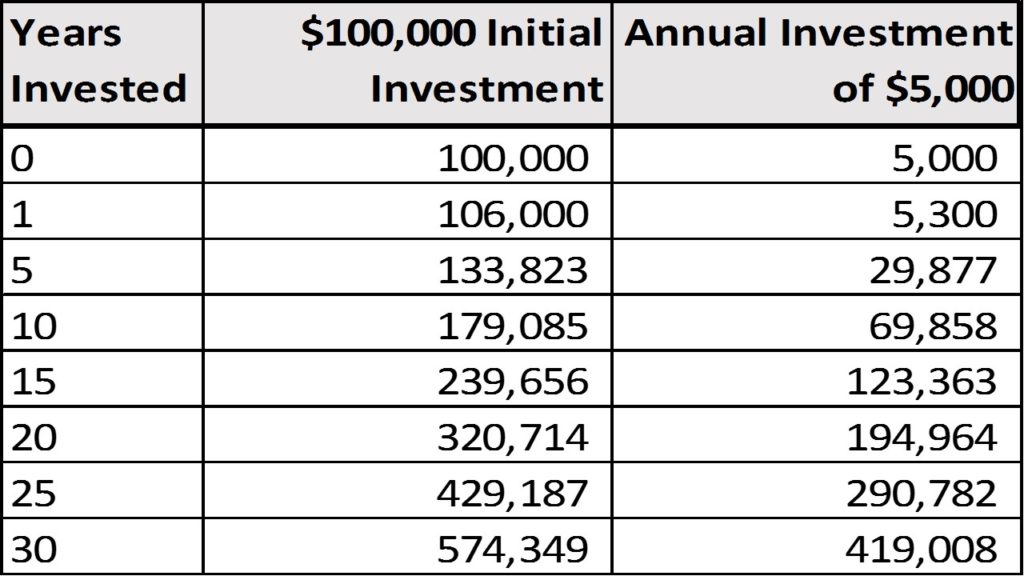

The table below shows two hypothetical scenarios. In the first example, an initial $100,000 is invested for 30 years using an annual fixed rate of return of 6%. The second example, also using an annual fixed rate of return of 6%, shows regular investments of $5,000 at the start of each year during the 30-year period. As can be seen, the longer the compounding process is allowed to work, the greater the value of the portfolio.

Dividends a Vital Component of Long-Term Returns

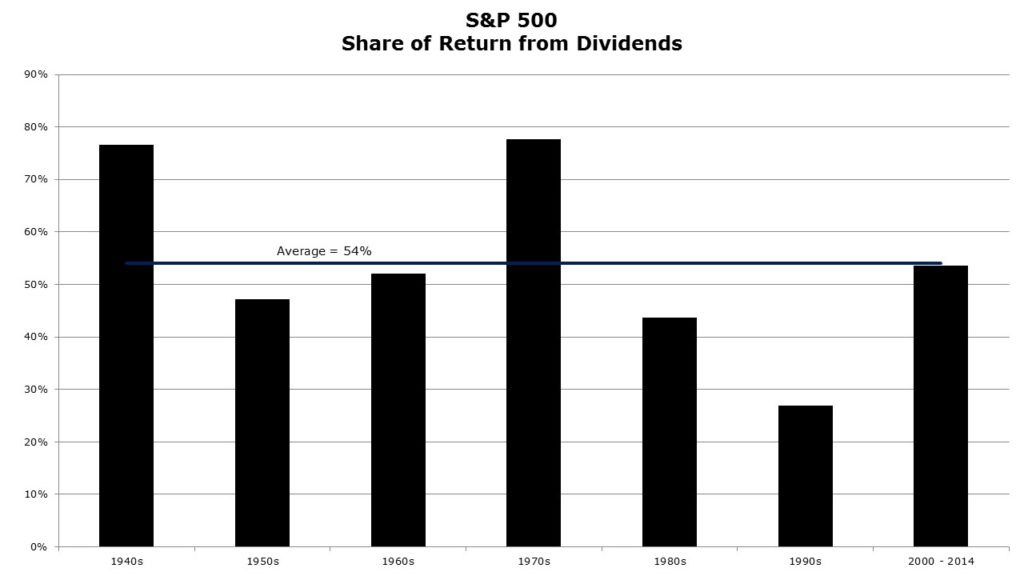

Over time, dividends are a vital component of long-term investment returns. This is not a recent phenomenon. Contrary to what some investors believe, dividends and the reinvestment of dividends have played a leading role in common-stock returns. During bull markets, dividends can seem like an afterthought; but, over the last seven decades, dividends have accounted for an average of 54% of each decade’s stock market returns.

Today, dividend securities are becoming more popular in Europe as a result of the European Central Bank’s $63 billion a month bond-buying program, which began in March. The bond-buying program, also referred to as quantitative easing (QE), has increased government-bond prices, resulting in much lower bond yields.

According to the The Wall Street Journal, European equity dividend funds have seen the fastest pace of inflows since the 2008 financial crisis. Already this year, the flow of money into dividend funds, sometimes viewed as substitutes for bonds, has exceeded the amount for all of 2014.

Said European money manager Toby Nangle, “With bond yields having fallen so far, retail investors are increasingly looking to take on more risk and go into European equities”.

For the European saver, though, equities are still a riskier bet than bonds. While many higher-dividend-paying stocks tend to be seen as less volatile than the broader market, they will still decline during bear markets. And, as money has poured in, European equity dividend yields have declined from about 4% last October to about 3.8% today. As stock prices rise, the current yield declines.

Aside from causing a shift from bonds to dividend payers, the ECB’s quantitative easing policy has helped make Eurozone exports cheaper for the rest of the world, especially for the U.S. New export orders rose to their highest levels in over 10 months, encouraging manufacturers to hire at a faster rate compared to the last several years.

Investing in the Nordics

On the international front, one area of focus for us is the Scandinavian countries, with investments that include Orkla, Atlas Copco, and Fidelity Nordic. There is something unique about the Scandinavian countries; despite brutal cold and minimal sunshine, these countries consistently perform at the top of the world’s happiness rankings. In fact, Denmark and Norway were ranked the first and second happiest countries by the World Happiness Report (a U.N. publication). Sweden came in at fifth-happiest, followed by Finland at seventh and Iceland at ninth. The entire region lands in the top 10.

Nordics Among Happiest Countries

It’s not by accident that these countries are high in happiness. The Nordics are powerful innovators, with the four major Nordic economies ranking in the top 15 on Bloomberg’s list of the most innovative countries. The Nordics are also some of the most productive countries on earth. All four economies produce top-20-ranked per-capita GDP. That means the capital and human resources in these countries are being utilized efficiently and effectively.

A vital piece of progress for a country is peace. A quick look at the economic destruction wrought in countries like Ukraine and Syria, where peace has been shattered, will tell you just how important peace is to an economy. Nordic countries score very high on the Global Peace Index. Coming in at 1) Iceland, 2) Denmark, 6) Finland, 10) Norway, and 11) Sweden, these countries have avoided global turmoil.

The sum of all the ranking and indexes can be approximated by FutureBrand’s Country Brand Index. The index attempts to measure the world’s perception of each country as a brand. The Nordics all score in the top 15. Well-run countries tend to breed strong economies, and strong economies tend to make for strong businesses.

Orkla

Orkla, by example, is one of Norway’s oldest business conglomerates, founded over 350 years ago. Orkla has transformed itself to become a pure branded-consumer-products company with a concentration in the Nordics. Orkla owns a portfolio of well-known brands that primarily sit at the No. 1 and No. 2 positions in the Nordic region. The stock has a current yield of 5%.

Atlas Copco

Atlas Copco, originally named AB Atlas, was founded in 1873 to produce and sell materials for the railroad industry. The company quickly became Sweden’s largest manufacturer. After a recession hit Atlas hard, it was forced to diversify into industrial production of other kinds. In its new operations, Atlas employees began using a pneumatic tool built in England. Without any access to spare parts for the machine, company engineers and craftsmen built their own. Soon they had reverse-engineered the entire pneumatic machine and could build the technology themselves. By the time World War I started, pneumatics were replacing railroad-related production as Atlas’s premier business, and that remains so today. Atlas Copco is also a worldwide leader in compressors, construction and mining equipment, power tools, and assembly systems. Atlas does business in over 170 countries and employs 37,500 people. The stock has a current yield of 2.0%.

In our view, it is sensible to gain exposure to both strong economies and strong businesses. Most often, dividend-paying companies are stronger and more durable businesses than non-payers. Payers often have higher barriers to entry and stronger balance sheets than non-payers. And because there is a stigma associated with cutting dividend payments, the consistent payment of dividends is a signal of management confidence in the future prospects of a company. This is especially true of companies that raise dividends. Management teams rarely commit to higher dividend payments unless they are confident that the dividend can be maintained through thick and thin.

Have a good month and, as always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Sincerely,

Matthew A. Young

President and Chief Executive Officer

P.S. According to a March 2015 study from Swiss Re, seven years after the financial crisis, central banks are still keeping interest rates at historically low levels. Low interest rates help finance governments’ debt and lower funding costs, as well as support growth. But such policy actions cause financial repression. This comes at a substantial cost for both households and long-term investors, such as insurance companies and pension funds.

With continued increases in bond prices, expensive stocks and relatively low volatility, the impact of financial repression on markets is indisputable. Meanwhile, the impact of foregone interest income for households and long-term investors has become substantial: in the U.S. alone, savers have lost about $470 billion in interest rate income (net) since the financial crisis (2008–2013).

P.P.S. In early March we began buying iShares MSCI EMU (EZU) and WisdomTree Europe Hedged (HEDJ). EZU provides unhedged exposure to euro-area stock markets. EZU is a market-capitalization-weighted index of euro-area stocks. The fund’s top holdings include Bayer (pharmaceuticals), Sanofi (pharmaceuticals), Total (oil and gas), Banco Santander (banks), and our favored Anheuser-Busch (beer). The fund has a .49% expense ratio and yields about 3%. The WisdomTree Europe Hedged Equity Fund (HEDJ) tracks the performance of the WisdomTree Europe Hedged Equity Index. The index is based on dividend-paying companies that are domiciled in Europe and traded in euros. Companies must have at least $1 billion in market capitalization and derive at least 50% of their revenue from countries outside Europe. The components of the ETF are weighted by their annual cash dividends, with 5% caps on individual positions and a 25% cap on sectors and countries. The WisdomTree fund has a .58% expense ratio. Its top holdings include Anheuser-Bush (beer), Telefonica (telecom), Banco Santander (banking), Unilever (consumer goods), and Banco Bilbao Vizcaya Argentari (banking).

P.P.P.S. We began purchasing EZU and HEDJ for several reasons. First, the ECB quantitative easing program and negative interest rates in the region should provide a tailwind to stocks. Second, the euro-area economy appears to be better. The Citigroup Euro-area Economic Surprise Index is soaring. The Citigroup Economic Surprise Index provides a snapshot of how an economy is performing relative to investor expectations. When the index rises, economic data is coming in better than expected. Positive economic surprises are often bullish for stocks, a trend that has proven true in the euro area. And lastly, we believe European stock valuations are more appealing than those in the U.S. With the euro depreciating by 20% against the U.S. dollar over the last year, euro-area company earnings are poised to improve.