Hurricane Preparation and Investment Planning

September 2017 Client Letter

It’s unsettling when The Weather Channel and CNN camp out in your town to cover an incoming hurricane described as the biggest storm ever recorded in the Atlantic. Hurricane Irma was massive, with winds of at least tropical storm force covering 70,000 square miles—larger than Florida’s entire land area. Just several days prior to landing in Naples, it appeared Irma would track the east coast of Florida, more towards Miami, leaving our hometown in a much more desirable position.

But hurricanes, as with many things in life, are unpredictable. Irma blew into Naples as a Category 3, which was somewhat of a relief considering earlier threats of a Cat 4. We also dodged the storm-surge bullet, which could have caused flooding as high as 15 feet in areas. All told, the consensus is that Irma provided us with a scary, expensive, and exhausting ordeal, but we caught some breaks and avoided a more devastating outcome.

I want to thank you all for your kind wishes during Hurricane Irma and its aftermath. I am relieved to report that our Naples staff and their families made it through the storm safely. I am also happy to report that our new offices at 5150 Tamiami Trail North made it through the storm unscathed. As soon as power was restored to the office, we were back up and running at full capacity.

With Hurricanes Harvey and Irma still fresh in my mind, I want to take this opportunity to reassure you of our business continuity and disaster recovery plans. I know some of you had questions on business continuity during the storm.

We pride ourselves on being a boutique registered investment advisor that offers exceptional customer service and support to our clients. Our goal is not only to provide you with a professionally managed investment portfolio that meets your personal goals and objectives but also to ensure your investment and administrative questions are answered promptly and professionally.

The business continuity plans we have in place are updated and evaluated regularly for improvement. Having offices in both Naples, Florida, and Newport, Rhode Island, gives us the advantage of being able to continue to operate if and when one office goes down. In preparation for Irma, we powered down our Naples systems and prepared the office for a Category 5 hurricane. While the Naples office was closed and without power, our Newport office picked up the slack. We share staff, data, and information across locations for just such an occurrence. At no point during the hurricane was our Newport staff lacking your vital account information or unable to fulfill our portfolio management and oversight duties for your assets.

Safe and Secure with Fidelity

Your assets were, of course, safe and secure with Fidelity during the hurricane. Fidelity is one of the largest brokerage firms in the country, with its robust technology setup. Fidelity has redundant systems in multiple locations across the country to help ensure continuous operation in the event of a disruption at any one. We have also partnered with Envestnet for portfolio management and reporting software. Envestnet is one of the leading software providers to the financial industry. Data security and redundancy are an important component of their business. Envestnet’s software provides us with access to critical account information and holdings data that can be accessed both onsite and remotely. So, in the unlikely event that both our Newport and Naples offices are ever simultaneously without electricity, we could relocate staff to a location with power and conduct our business from there.

In short, we have planned for and prepared for many conceivable disaster scenarios to ensure proper oversight and management of investment portfolios. I hope you feel as comfortable as I do with our firm’s preparations.

Preparation and planning are not only part of our disaster recovery and business continuity efforts; they are also central to our investment management approach. Trying to time when the next financial disaster will strike is not a part of our investment strategy. Instead, we construct portfolios we believe can live to fight another day should another 2008–09-style crisis roil markets again. Preparation and planning for such a risk is part of the reason we include gold and precious metals in client portfolios.

Eschew Gold at Your Own Peril

In our view, too many investment advisors eschew gold. They criticize gold and the folk who invest in gold. They proclaim there are better ways to protect one’s money from inflation, geopolitical turmoil, a falling dollar, or a financial crisis. They view gold as an inferior asset class based on statistical evidence of gold’s performance over the past few decades. But the performance of gold over a few decades is insufficient to judge its true value. There is no other asset that matches gold’s history as a store of value and a medium of exchange—not fiat currency, bitcoin, oil, copper, wheat, nor bonds, and not even stocks. Gold has been widely accepted as a store of value and a medium of exchange for millennia. To ignore that history is, in our opinion, both foolish and naïve.

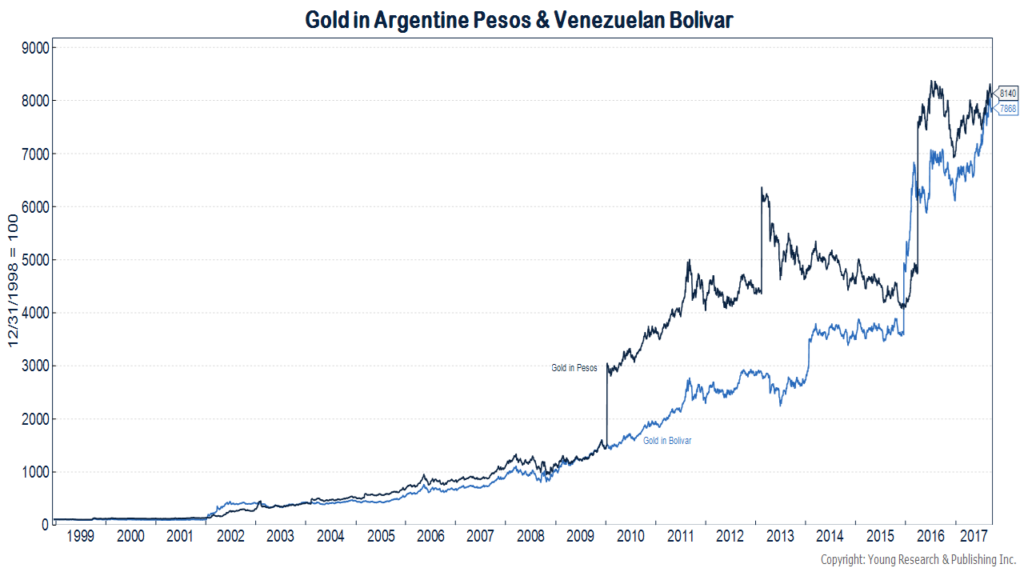

I doubt savvy financial advisors in Argentina or Venezuela would be so critical of gold. The chart below shows the price of gold in pesos and bolivar rebased to 100 at year-end 1998. The price of gold is up about 80X in both currencies. If an Argentinian investor put 500 pesos in gold at year-end 1998 and left another 9,500 pesos under his mattress, he would have 49,500 pesos today. That would still leave him with less purchasing power than he had in 1998, but he would be in a lot better shape than if he owned no gold.

Some may say it is far-fetched to believe that the U.S. could end up like Argentina or Venezuela. We agree, but a proper and complete reading of financial history would lead one to take a much more skeptical view of the preeminence of today’s fiat currencies. Gold is an insurance policy for risks both known and unknown.

Bond Market Risks

In the bond market, the risks are known. The two biggest risks a bond investor is faced with are credit risk and interest rate risk. Credit risk is the risk a borrower will default on its debt. Interest rate risk is the risk arising from fluctuating interest rates. Interest rate risk depends on the maturity of a bond. Everything else equal, the longer the maturity of a bond, the greater the interest rate risk.

Current Fixed-Income Strategy

For a number of years now, as interest rates have muddled along at historic lows, our fixed-income strategy has been to invest in short maturity bonds and to then roll the proceeds of maturing issues into higher-yielding securities.

Why Invest in Short Maturity Bonds?

With rates near their lowest levels in 5,000 years of recorded history, we don’t believe investors are being adequately compensated for taking interest rate risk. The U.S. is in year nine of an economic expansion, and 10-year Treasuries yield a full percentage point less than they did in the aftermath of the Lehman Brothers bankruptcy.

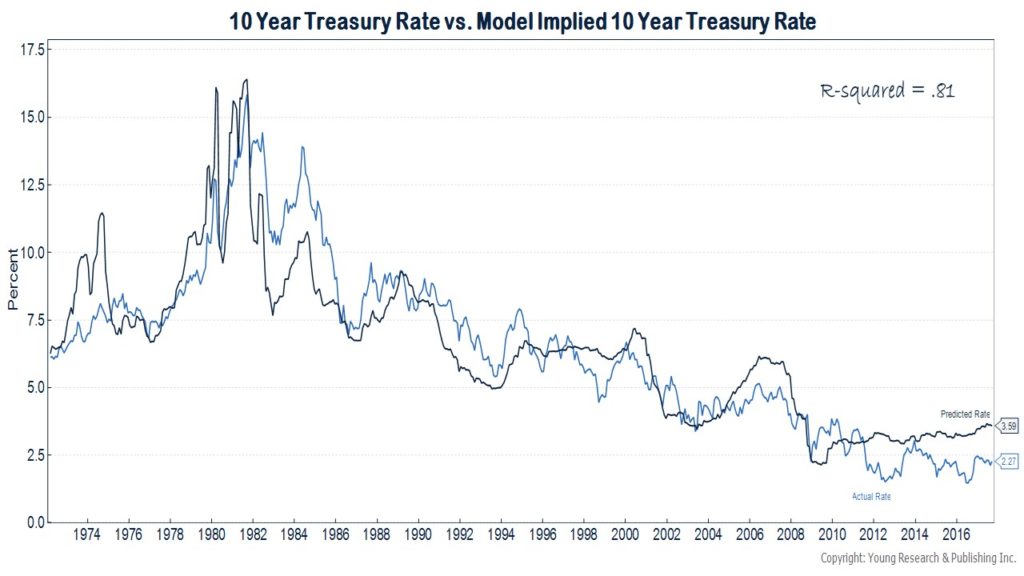

A Model of Interest Rates

A simple model that estimates the long-term level of interest rates based on the rate of economic growth, inflation and short-term interest rates shows 10-year Treasury bonds should be yielding at least 3.6% today. And if by the end of next year the Federal Reserve’s forecasts for the Federal Funds Rate, growth, and inflation are realized, this model would expect 10-year Treasury yields to rise to 4.3%. That’s a full two percentage points more than current yields.

Two percentage points may not sound like much, but a two-percentage-point increase in 10-year Treasury rates would wipe out seven years of interest income on a 10-year Treasury note.

We are not forecasting a two-percentage-point increase in interest rates over the next 15 months, though there may be a higher probability of that happening than many investors assume today. What we are saying is that the risk investors are taking in long-term bonds is not sufficient for the reward being offered. Not when you can invest in ultra-short-term Treasuries (you know them as T-bills) that maximize liquidity and optionality while paying investors an assumed risk-free 1.1% stream of income.

Over the last year or two, we gradually added a T-bill component to many fixed-income portfolios. This new addition has gone hand in glove with our decision to gradually increase the overall credit quality of our clients’ bond portfolios. T-bills will not become a permanent component of our fixed-income portfolio. We view them as a bridge to what we hope will soon become a higher-interest-rate environment.

When the Facts Change

That is how we assess the fixed-income landscape today, but our view is not set in stone. If the facts change, the economic environment worsens, long-term interest rates rise, or the Fed changes its outlook for short-term interest rates, our view of longer-term bonds could change. Despite the current and forthcoming pro-growth policies the Trump administration is working to put in place, we haven’t lost sight of the fact that this is still year nine of the economic expansion. The average post-WWII-era expansion has lasted just under five years.

Equifax: What Happened?

As you have probably heard if you’ve watched the news in the past two weeks, the credit reporting agency Equifax was hacked. The intruders had months to comb through Equifax’s data, accessing the personal credit information of up to 143 million Americans. If you have a credit card, mortgage, or car loan, there is a strong chance you are on the list of those affected. The accessed information included names, Social Security numbers, birth dates, and even some drivers’ license numbers. Also, the criminals stole credit card numbers from 209,000 people who had purchased services from Equifax.

What’s the Risk?

Today’s world is driven by credit scores. If you intend to get a loan, you will need your credit score in tip-top shape in order to qualify and to get the best rates. If you want to lease an apartment or simply get a new job, bad credit scores can sink your chances. The Equifax hack may allow criminals to take out loans in your name and never pay them back. That could ruin your credit score and suck up your precious time and money as you correct for the fraudulent activity.

What You Can Do

Equifax has set up a website, www.equifaxsecurity2017.com, where you can check on your potential exposure. The site will tell you whether or not you are exposed. If you are exposed, Equifax will let you enroll in a program called TrustedID Premier. TrustedID Premier gives you five complementary services from Equifax, including:

- A copy of your Equifax credit report

- Use of Equifax Credit Report Lock, a service that allows you to prevent access to your Equifax credit report by third parties

- $1 million worth of identity theft insurance

- Three-bureau credit file monitoring, providing automated alerts when your credit report changes in important ways at any of the three large credit-reporting agencies (Equifax, Experian, and TransUnion)

- Social security monitoring, which will search suspicious websites for the use of your Social Security number

Enrollment in TrustedID Premier is not mandatory. We are not endorsing TrustedID Premier, but you should know that it is an option available to you.

The free enrollment period ends on November 21, 2017. Whether you choose to use TrustedID Premier or not, the Federal Trade Commission suggests other steps you can take to protect your credit, including:

- Visit annualcreditreport.com to receive a free copy of your credit report from the three major reporting agencies. Use your free report to check for accounts that you didn’t open or other erroneous information.

- If you think your identity has already been stolen, visit IdentityTheft.gov to report identity theft and get a recovery plan.

- Consider a freeze on your credit reports with the three major agencies by calling the phone numbers listed below. Be warned, you will likely be charged a fee. Then the agency will send you a PIN or password that allows only you to unfreeze your report.

-

- Equifax — 1-800-349-9960

- Experian — 1‑888‑397‑3742

- TransUnion — 1-888-909-8872

- If you don’t freeze your reports, you can place a “fraud alert” on them. The alert will tell your creditors that you may have had your identity stolen and that they should verify any new activity on your accounts before acting on it.

- Watch your existing credit card and bank accounts for any odd charges.

- File your taxes early to prevent someone else from fraudulently filing in your name.

Unfortunately, hacking and identity theft have become a part of modern society. While we can’t prevent your identity from being stolen, in the accounts that we manage for you, we monitor all withdrawal activity and verbally verify transactions that were not initiated by our staff to ensure that the activity is legitimate and was initiated by an account owner.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. The British pound has been on a tear over the last month. The pound is up 6% from its low in August. More hawkish commentary from the Bank of England and a more conciliatory tone from the European Union President on the Brexit negotiations has helped the currency. Your U.K. stock and government bond positions have benefited from the rally. With a solid technical backdrop and strength in other European currencies, we see more room for upside in the pound vis-à-vis the USD.

P.P.S. After a nearly four-decade sabbatical, my dad has revived Young’s World Money Forecast in a new digital-only format. You can read his latest posts at www.youngsworldmoneyforecast.com.

P.P.P.S. In yet another sign of the reach for yield in global bond markets, Iraq recently came to market with a $1-billion bond and an expected yield of 7%. Demand that was more than six times the available supply drove the yield at issue down to 6.75%.

The information contained in this letter is for informational and educational purposes only. It is not intended nor should it be considered investment advice or a recommendation of securities. Past performance is not a guarantee of future results. It is possible to lose money by investing. You should carefully consider your investment objectives and risk tolerance before investing. Please contact our office directly with any questions regarding items appearing in the letter.