June 2020 Client Letter

For over a decade, the reach for yield on Wall Street has been fervent, pushing some investors into making bad decisions. The insatiable thirst for yield spawned the slicing and dicing of mortgage-backed securities that led to a complex and confusing mess during the 2008 financial crisis. The Federal Reserve’s response to the Great Recession gave us the lowest Fed funds rate ever for many years. And today, thanks to the coronavirus, savers and investors once again face a most challenging fixed-income environment.

To counter today’s rock-bottom yields, we have been active with our bond portfolios. Seemingly overnight, the Federal Reserve slashed interest rates to zero and bought tens of billions’ worth of Treasuries and mortgage-backed securities daily. We responded by liquidating all our Treasury holdings, to be used for higher-yielding and higher-returning opportunities.

We have purchased corporate bonds at yields and spreads (yield advantage to Treasuries) that we haven’t seen in nearly a decade. Below are listed several of the bond issue purchases we made in recent weeks. You will note the maturity on some is much longer than we typically favor, but the yields and spreads were significant at the time of purchase. Higher yields and spreads drive down both the duration and the risk from a rise in Treasury rates. (Higher Treasury rates often coincide with narrowing spreads.)

Bond Purchases

Boeing 5.705% | Due 05/01/2040 | Rating: Baa2/BBB-

Boeing is a company that has been impacted significantly by the coronavirus. Flight capacity is down considerably worldwide, and new orders for Boeing aircraft will likely remain depressed for at least a year or two.

Boeing is, however, America’s largest exporter and a national champion. It is one of only two large commercial aircraft manufacturers in the world.

Our investment case on the Boeing bonds is that its minimum return is the 5.65% yield to maturity we locked in at the time of purchase. We are assuming that Boeing will not default. If business worsens significantly for Boeing, we anticipate a federal bailout of creditors. Money has already been set aside for Boeing in one of the stimulus packages passed by Congress. And if the federal government is willing to bail out small and large companies across the U.S., we believe America’s largest exporter would be offered similar assistance.

The potential upside we see over the coming years is in the range of a 10%–14% average annual return. How do we get to a double-digit return on bonds purchased at a 5.65% yield to maturity? In a more “normal” environment, we would expect Boeing bonds to offer a yield advantage to Treasuries of approximately 2% compared to the 4.5% yield advantage offered at the time of purchase.

If it takes three years from the purchase date for that to happen while providing room for long-term Treasury yields to rise, we estimate a total return on the Boeing bonds of approximately 10% per year. If it takes only two years for that scenario to unfold, the average annual return would be closer to 14%. There are, of course, no guarantees that Boeing will not default nor that the return on Boeing bonds will be positive over any given horizon.

Williams 3.50% | Due 11/15/2030 | Rating: Baa3 / BBB

Williams gathers, stores, and processes natural gas and natural gas liquids (NGLs). It operates refineries, ethanol plants, and terminals. Its interstate gas pipeline and gathering and processing operations span the U.S., including assets in the Gulf of Mexico, the Rockies, the Pacific Northwest, and the Eastern Seaboard. We purchased the Williams bonds at a yield to maturity of approximately 3.55%.

ViacomCBS 4.20% | Due 05/19/2032 | Rating Baa2 / BBB

ViacomCBS Inc. operates as a multimedia company. The company operates television and radio stations, produces and syndicates television and broadcasting programs, publishes books and online content, and provides outdoor advertising. ViacomCBS serves clients worldwide. We purchased the ViacomCBS bonds at a yield to maturity of approximately 4.4%.

Kraft Heinz 4.625% | Due 01/30/2029 | Rating Baa3 / BB+

Kraft Heinz is a household name. Kraft Heinz is one of the largest food and beverage companies in the world. The company’s brands include Oscar Mayer, Capri Sun, Ore-Ida, Kool-Aid, Jell-O, Planters, Philadelphia, Lunchables, Maxwell House, Velveeta, and, of course, Kraft and Heinz. We purchased the Kraft Heinz bonds at a yield to maturity of approximately 3.9%.

AT&T 2.75% | Due 06/01/2031 | Rating Baa2 / BBB

AT&T is also a household name, with operations in wireline and wireless communications as well as media and entertainment properties. We purchased the AT&T bonds at a yield to maturity of approximately 2.70%.

Rising Dividends More Important Than Ever

The threat of a prolonged low-interest-rate environment coupled with inflation due to our skyrocketing national debt means consistent and reliable dividend increases will be important. And searching for just the highest-yielding names is not always recommended. High yields can simply be a signal that a company’s weakness has driven its price down faster than management has been able to reduce its dividend. Consider this: Of the 10 highest-yielding stocks in the S&P 500 at year-end 2019, five have eliminated or reduced their dividend in 2020.

The stocks we purchase haven’t been exempt from dividend reductions or eliminations. Shutting down the nation’s economy full-stop is an unprecedented move that even some of the healthiest companies have struggled with. By example, Disney decided to forgo its June dividend to preserve liquidity, and will decide what to do about the December dividend later this year. (Disney pays dividends twice per year.) We do, however, favor companies focused on increasing their dividends regularly. A record of regular dividend increases is both a sign of company strength and management’s commitment to return value to shareholders. Both are essential for the successful dividend investor.

Dividend Stocks with Solid Payout Prospects, Safer Yields

Many of the companies we are buying offer, in our opinion, safer yields and solid dividend-growth prospects. These stocks include Caterpillar, McDonald’s, Medtronic, and Merck.

Caterpillar

Caterpillar Inc. (NYSE: CAT) is the world’s leading manufacturer of construction and mining equipment. Its products include excavators, loaders, and tractors as well as forestry, paving, and tunneling machinery. The company also manufactures diesel engines, gas turbines, and diesel-electric locomotives. Caterpillar’s business will be impacted by the recession, but cash-flow generation appears strong enough to weather the storm and maintain the dividend. CAT shares yield 3.1% today, and we expect mid-single-digit dividend growth over the medium term.

McDonald’s

McDonald’s is a dividend stalwart. It has paid and increased its dividend every year since 1976. Few restaurants have even been around since 1976, let alone paid a dividend since then. McDonald’s shares yield 2.5% today. We are looking for the dividend to increase at a 5%–7% annual rate over the next few years.

Medtronic

Medtronic is one of the world’s largest makers of medical devices, holding more than 4,600 patents on products ranging from insulin pumps for diabetics to stents used by cardiac surgeons. Look around a hospital or doctor’s office—in the U.S. or about 160 other countries—and there’s a good chance you’ll see Medtronic’s products.

Medtronic has increased its dividend every year for more than four decades, and its latest increase came in May. Over the last five years, the dividend has increased at a 12% compounded annual rate.

Merck

Healthcare stocks are a classic defensive sector as consumers rarely cut back on prescription drugs just because the economy is in recession. Merck is a blue-chip pharmaceutical company and, like others, it is vying to develop vaccines and treatments for COVID-19. Merck shares offer investors a yield of 2.9%. In 2020, Merck hiked its dividend by 11%.

What’s Your Investment Plan?

One of the keys to successful investing is having a plan in place and a portfolio suitable for your individual financial needs and risk tolerance. You do not want to be in the position of panicking and realizing too late that your nest egg’s strategy does not sync with your personality or financial goals.

Know Your Risk Tolerance

To assist in creating your investment plan, establish how much risk you are comfortable taking. Do not take on too much risk if market volatility causes you too much stress.

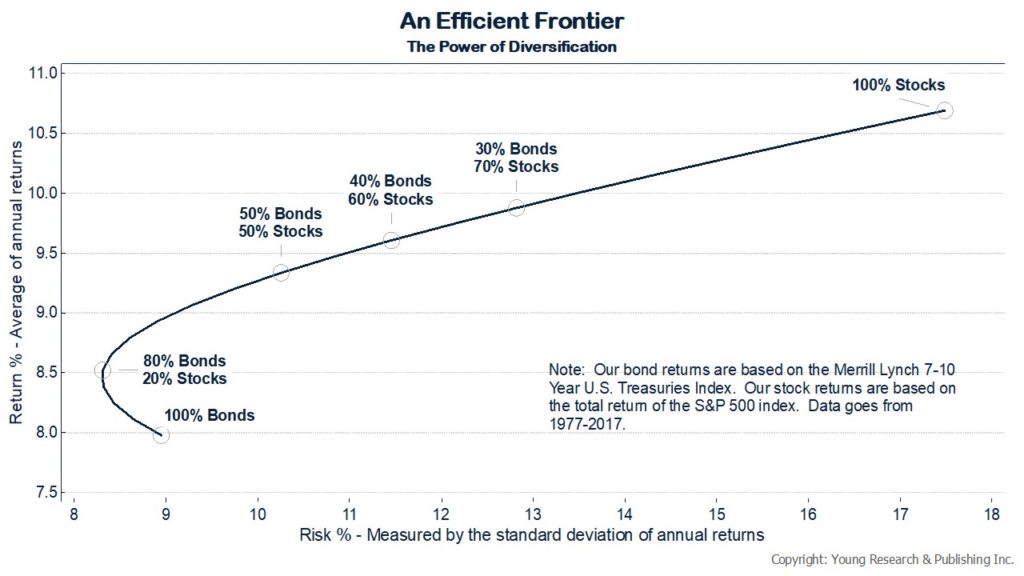

The following Efficient Frontier chart compares risk and return for different asset allocations. The vertical axis shows the return earned for each portfolio mix of stocks and bonds and, along the horizontal axis, is a measure of how much risk was taken to earn those returns.

As you can see by comparing the portfolio of 80% bonds and 20% stocks to the 100% bonds portfolio, as portfolios take on a small number of stocks, the benefits of diversification lower risk and increase reward. Anything above the line is unachievable because no portfolios earning those returns are available at the corresponding risk levels. And any portfolios that fall below the line can be outperformed with the same amount of risk or have their returns matched with less risk.

But to achieve higher returns along the line, investors adding more stocks to their portfolios are taking on ever greater amounts of risk. A portfolio of 100% stocks boasts a standard deviation of 17%. With that level of risk, you can expect the market to lose that much about once every six years. That may be optimistic, given what stock investors have endured in recent years. Be aware of the risk in your portfolio and manage it wisely.

Patience

When you have an asset allocation suitable to your personal situation, it can be much easier to practice patience and ride out volatility. Patience can be an overlooked component of a successful investment plan. Patience allows you to participate in gains when markets rebound. You do not want to be on the sidelines when markets have those big, powerful rallies. And trying to time those rallies with consistency is nearly impossible.

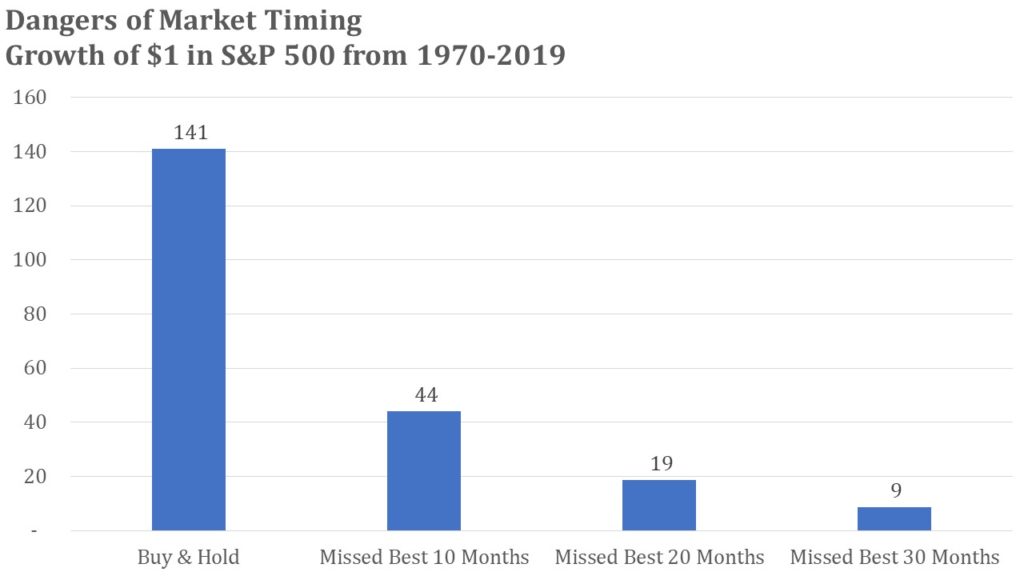

As I wrote last April, if a buy-and-hold investor put $1 in the S&P 500 at the end of January 1970, he would have $141 today. If that same investor tried to time the market, but missed the best 10 months, he would have $44 today. If he missed the best 20 months, that $1 would be worth a mere $19 today. Market timing not only risks losing out on significant gains, but it also risks missing vital dividend payments.

Don’t Forget Inflation

When we think of risk, market volatility usually comes to mind first. But inflation risk is just as bad, if not worse. The long-term return for stocks includes all bear markets. Historically, stocks’ prices rise. So, when bear markets occur, they can be considered normal events that will eventually end. Inflation, on the other hand, does not end. Inflation is ugly and continually chips away at the purchasing power of your wealth.

Think of inflation as reverse compounding. Annual price increases of goods and services will slowly but surely make the grocery bill or nights out at your favorite restaurant much more expensive in future years. As time passes, the purchasing power of your savings begins to erode. This is one primary reason we all invest: to keep pace with inflation. The negative impact of inflation is also why we focus so hard on buying stocks that raise their dividends annually. Those annual increases help us keep pace with rising costs.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. When my dad began writing monthly strategy reports in 1973, he emphasized an investment approach based on dividends, interest, diversification, patience, and compounding. Another proponent of compound interest was Richard Russell, editor of Dow Theory Letters. My dad subscribed to Russell’s newsletter for decades, and Russell wrote:

Compounding is the royal road to riches. Compounding is the safe road, the sure road, and fortunately, anybody can do it. To compound successfully you need the following: perseverance in order to keep you firmly on the savings path. You need intelligence in order to understand what you are doing and why. And you need knowledge of the mathematics tables in order to comprehend the amazing rewards that will come to you if you faithfully follow the compounding road. And, of course, you need time, to allow the power of compounding to work for you. Remember compounding only works through time.

P.P.S. Retirement Compounders® (R.C.) is our globally diversified portfolio of dividend- and-income-paying securities. Currently, the R.C.s offers a yield of approximately 3.1% or 80% more than the rate of inflation. Aside from an attractive yield, we also prefer our stocks to maintain annual dividend increases. Recent increases were announced by Microsoft (+11%), Kroger (+14%), American Tower (+20%), Procter & Gamble (+6%), and T. Rowe Price (+18%).

P.P.P.S. Congratulations to you for staying the course during a wicked three-month stock-market environment. If the volatility was not bad enough, we have been truly tested with weeks of elevated uncertainty.

In his last interview for CNBC, Vanguard Group founder Jack Bogle reflected on the volatility of the 2008 financial crisis and the mindset investors should adopt during difficult periods:

I always have said stay the course, and don’t let these changes in the market, even a big one that was a 50% decline, don’t let that change your mind and never, never, never be in or out of the market. Always be in it at a certain level and you may want to be 50% stocks like I am. You may want to be 75% or 25%. That’s probably a decent range. But never be out and think you can get back in because your emotions will defeat you totally.

Staying the course can be easier to execute with a balanced portfolio. While you may not get rich from bonds, they do offer a counterbalance when equity markets head south. The same goes for gold. Gold pays no dividend and can have mediocre performance when equities do well. But during an investing lifecycle, gold certainly has its moments. This year is such an example.

P.P.P.P.S. Some professional investors eschew diversification. This crowd tends to subscribe to the philosophy that you should carefully pick the best eggs and watch them closely. But how many best eggs (ideas) can one have? The problem we see with this approach is that today’s best idea may turn out to be tomorrow’s biggest loser. That isn’t a problem specific to concentrated portfolios. There is often a disaster or two in every portfolio (even the ones we manage!). The trouble is that you don’t know which are the disasters ahead of time and, in a concentrated portfolio, a single wipeout can cause financial devastation.

Consider that just before the turn of the century, a concentrated stock manager may have considered Enron, Bear Stearns, Lehman Brothers, General Motors, and G.E. to be his best-ideas portfolio. All were Fortune 500 companies at the time; but looking back today, four went bankrupt and one has lost 85% of its value.

Proper diversification is essential to earning a return of and on capital. At Richard C. Young & Co., Ltd., we craft portfolios focused on cash flow. We diversify geographically and across industries, sectors, and asset classes in an effort to achieve both a return of capital and a return on capital.

Client Portal

Client Portal Secure Upload

Secure Upload Client Letter Sign Up

Client Letter Sign Up