At Richard C. Young & Co., Ltd., we offer a range of globally diversified investment programs primarily geared toward conservative investors. Our programs are created in-house. We do not outsource investment management to a third party.

Our programs emphasize dividends and interest with reduced portfolio volatility. Currently, we craft our programs with a focus on individual government and corporate bonds, closed-end funds and dividend-paying stocks.

A description of each program is provided. For a custom option please contact Richard C. Young & Co., Ltd.

Global Income & Capital Protection Program

Seeks to provide current income with a secondary goal of conserving principal. Targets an asset mix of 65%-80% in fixed income securities and 20%-35% in equity type securities.

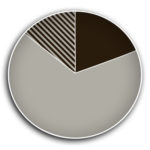

Global Moderate Income Program

Seeks to provide current income while maintaining the purchasing power of future income and capital. Targets an asset mix of 40-60% in fixed income securities and 40%-60% in equity type securities.

Global Moderate Income & Capital Appreciation Program

Seeks to provide income and the opportunity for long-term capital appreciation. Targets an asset mix of 30%-50% fixed income securities and 50%-70% equity type securities.

Global Moderate Capital Appreciation Program

Seeks to provide capital appreciation with a reduced amount of risk compared to an aggressive capital appreciation strategy. Targets an asset mix of 15%-30% in fixed income securities and 70%-85% equity type securities.

Retirement Compounders® Plus Program

A portfolio invested 90%-100% in equities which seeks to provide long-term capital appreciation.

Client Portal

Client Portal Secure Upload

Secure Upload Client Letter Sign Up

Client Letter Sign Up