July 2018 Client Letter

Federal deficits and debt are a perennial worry for many investors, but while a burgeoning U.S. government is a long-term problem, public finance at the state level may be the more immediate concern. The Wall Street Journal recently ran a feature highlighting the troubling condition of state budgets.

Even nine years after the last recession, many state budgets still haven’t fully recovered. Soft revenue growth (partly due to the Amazon effect) and heavy pension and Medicaid costs have weighed on state finances. The WSJ reports 21 states had a rainy day fund last year that was smaller as a share of spending than it was in 2008. Because most states don’t run deficits, rainy day funds are necessary to fill the void during economic downturns. New Jersey emptied its rainy day fund in 2009 and hasn’t refilled it. Oklahoma’s rainy day fund is 1.6% of spending today, compared to 9.3% in 2008.

New York is another state unprepared for a downturn. The WSJ reported “The New York State Comptroller Thomas DiNapoli warned that the state badly needed to replenish its reserves. New York will face budget shortfalls, reduced borrowing capacity and possible cuts to federal aid, he said in a report. ‘Yet, there are no plans to add to our reserves, leaving the state with little cushion in the event of an economic downturn,’ he said.”

In 2009, total revenue at the state level fell 11%. States that haven’t prepared for the next downturn by replenishing their reserves are likely to face ugly choices in the future.

Preparation is Key

Whether dealing with public or personal finances, preparation is vital to make it through volatile periods. Unfortunately, when analyzing the state of the investment industry today, it appears many individuals are not prepared for the next crisis.

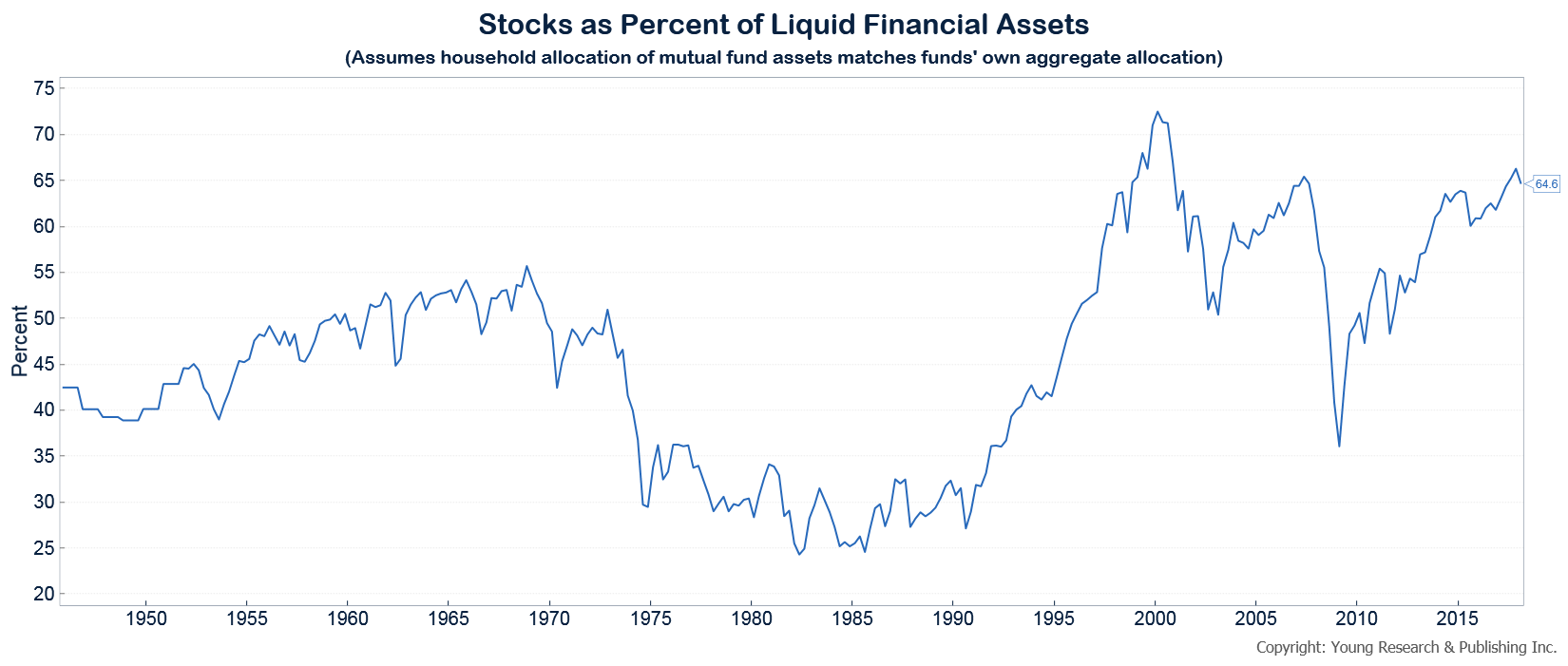

As a share of their liquid assets, households have only had this much invested in equities twice before—once during the tail-end of the dotcom bubble and again just before the financial crisis. Neither instance turned out well for investors.

But the allocation to stocks isn’t the only indication of a poorly prepared investing public. Index-based ETFs have become the preferred investment choice for many retail investors and even financial advisors. There was a time when index-based products comprised a meaningful share of our clients’ assets, but that is no longer the case. The environment has changed and so has the S&P 500—the most widely tracked stock market index.

Is the S&P 500 Diversified?

The S&P 500 is invested across 500 different companies, but a handful of the biggest ones dominate the index. Apple, the largest stock in the index, matters more to the S&P 500 than the aggregate of the bottom 100 stocks. And the top five stocks have a combined weighting in the index well over the total of the bottom 250 names. Sound like diversification to you? There are only a handful of companies steering the ship. You can see it in the YTD performance of the S&P 500. The FAANGs plus Microsoft account for 99% of the index’s YTD return.

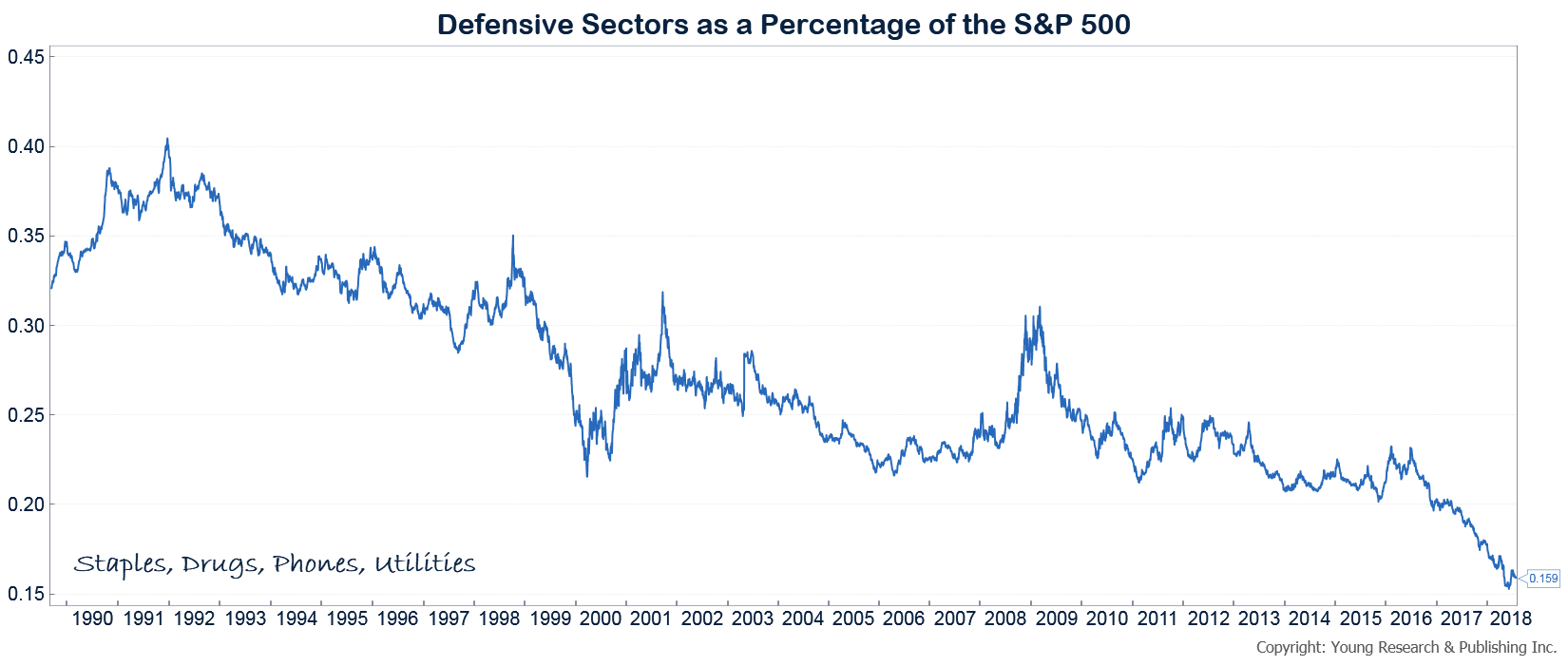

The makeup of the S&P 500 has also changed over recent decades. In the early 1990s, defensive sectors accounted for 35%–40% of the S&P 500. That figure drifted lower during the 1990s, but over the last two years the decline has accelerated sharply and sits at a mere 16% today.

If the S&P 500 was able to fall more than 50% during the last two big bear markets when defensive stocks were a greater share of the index, what happens during the next big bear market?

The biggest sector in the S&P 500 today is technology. During the dotcom bust, the S&P 500 technology index plunged 83%, eviscerating the savings of millions of investors loaded to the gills with technology shares.

According to the most recent Bank of America Merrill Lynch Fund Managers Survey, the most crowded trade on Wall Street today is big technology stocks.

Unsuspecting index-based ETF investors may have an unpleasant surprise in store during the next market downturn. That seems to be the opinion of Jim Rogers. Rogers was the co-founder of the Quantum Fund, one of the most profitable hedge funds on record. Rogers expects the next bear market to be “horrendous”—maybe even the “worst”—and he thinks ETFs could collapse more than anything else because that’s what everybody owns. ETFs are of course supposed to trade near the underlying value of their assets, but during sharp market moves we have seen prices diverge widely from the underlying value of those assets.

How is Your Portfolio Prepared for the Next Downturn?

As you are of course aware, we don’t invest in mutual funds or ETFs based on the S&P 500 index. We craft conservative portfolios comprised of companies that pay and increase their dividends. Our approach is defensive and global in nature. We are focused on meeting your goals and objectives, not on the performance of a tech-heavy index we view as inappropriate for retired investors and those approaching retirement. As a result, the portfolios we manage for our clients have as much as 40% invested in defensive sectors of the market. But even in the less-defensive sectors, our dividend-focused approach favors the more defensive end of the spectrum.

Take Lowe’s, by example. Lowe’s is in the consumer discretionary sector. Most discretionary stocks are sensitive to the business cycle. When the economy enters recession, consumers tend to delay big purchases and stick with the necessities. Remodeling activity undoubtedly slows during recession, and Lowe’s revenue and profits tend to fall as well. But compare Lowe’s, with its history of paying and regularly increasing its dividend, to something like a mall-based fashion retailer. Recession can mean ruin for some of the fly-by-night mall-based retailers.

Choose Your Investments Wisely

For most Americans, retirement is a giant and often scary leap into the unknown. In your working years, the occasional investment mistake can be taken in stride. There is time to get back on track or add to your savings to make up for misguided investment decisions. In retirement, the margin of error is smaller. You no longer have a steady stream of income to rebuild your savings. If you make a major mistake in retirement, you may not have a chance to recover. Retired investors often need their nest egg to last for the rest of their life, and their spouse’s. For a 65-year-old couple retiring today, the probability of at least one partner living to 90 years old is 49%, and the probability of one partner living to 95 is 23%.

A lot can happen over three decades. For starters, you can count on living through multiple recessions and bear markets. And if you are unlucky, you may retire at the start of a period of accelerating inflation. Investors who retired at year-end 1965 had to deal with a three-decade period that slashed the purchasing power of their dollars by 80%.

Investors who don’t prepare their portfolios properly may face the nightmare scenario of running out of money in retirement. The task is doubly difficult in today’s low-interest-rate environment. We help our clients craft portfolios designed to provide a reliable retirement income for decades, through bull markets, bear markets, low-interest rate environments, high-interest rate environments, economic expansions, and even recessions.

Fear of the FAANGs

The market’s obsession with Amazon and other FAANG stocks is telling: The mere rumor of a FAANG entering a new industry can shave 10% off the price of a company in that industry. The most recent victims of Amazon’s gaze appearing on our radar were the pharmacy stocks.

Amazon recently acquired a company called Pillpack, an innovative little firm that prepackages medicines for consumers who take multiple drugs regularly. The big pharmacy stocks sold off on the news that “big-bad” Amazon is entering their business, but in our view, there is much less to be concerned about than meets the eye.

Selling prescription drugs is very different from selling Amazon Kindles. A quick review of the Pillpack website shows just that. It takes 10 to 15 minutes to simply sign up. There is insurance that needs to be dealt with, regulation, pharmacy benefits managers, and back and forth between doctors and pharmacies when drugs are prescribed.

Is Cellophane a Competitive Advantage?

There will also be a competitive response to Amazon’s acquisition. PillPack’s idea to package multiple medicines together was a good one, but is cellophane really a sustainable competitive advantage? How long do you think it will take CVS and Walgreens to offer the same service? CVS is also in the process of merging with health insurer Aetna. Guess which insurer probably won’t include PillPack in their pharmacy network.

The share-price performance of the two big pharmacies is unfortunate if you are a value-conscious investor. The pharmacy stocks are among the most attractively priced in the market today. But overreaction to Amazon and other FAANGs isn’t an unfamiliar story.

Take retail shares, for example. The performance of the SPDR retail ETF over the last 12 months is instructive. The SPDR Retail ETF was down as much as 25% from its 2015 high (with many individual retailers down much more) on concern Amazon would bankrupt every brick and mortar business in America. Sentiment on the sector was rotten last summer and fall, but from its lows of last year the SPDR Retail ETF is up 30%, and many individual retailers are up much more.

Or take W.W. Grainger. Grainger is in the industrial supply business. They have a big online presence, and Amazon is gunning for them. Grainger even had to cut prices to stay competitive. The stock was down as much as 33% last year during the height of the concern, but the share price has more than doubled since then and now trades at a new high. Amazon is a much more serious competitor to Grainger than it is to the big pharmacies.

We anticipate a similar sentiment reversal in shares of CVS and Walgreens and continue to pursue other opportunities where investors overreact to FAANG news.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. The promise of lifetime income associated with annuities may sound tempting to retired investors and those approaching retirement, but if you bother to read the details of an annuity contract, the appeal can wear off quickly. I often hear about annuities that offer 6% or 7% returns. A “guaranteed” 6%-plus return in an environment where Treasuries offer 3% sounds too good to be true, and it is. 6%-plus income streams from annuities are not uncommon for retired investors, but an income stream is not a return. Let’s look at an example:

A 70-year-old couple who invests $100,000 in an annuity-guaranteeing income for life can expect to receive $6,310 per year, or about 6.3%, in income. The problem is that a large portion of the $6,310 annual check is simply the insurance company returning principal to the couple. And 30 years down the road, even with modest inflation your $6,310 would only buy about half of what it buys today. If our couple stuffed that same $100,000 under their mattress and withdrew $6,310 every year, their money would last until they were 86. They would pay no fees, no surrender charges, and no taxes, and they would have no insurance company default risk or lockups to worry about. In our view, it would make a lot more sense for this couple to invest in a diversified portfolio of stocks and bonds, take a 4% draw, adjust that draw for inflation so they don’t end up destitute, and still have the flexibility and potential to meet unexpected spending needs and have money to pass to their heirs.

P.P.S. Perhaps the biggest risk factor facing investors today is the unknown outcome of the November mid-term elections. Currently, oddsmakers suggest the GOP will retain control of the Senate but lose the House of Representatives to Democrats. If that happens, the progress of the tax and regulatory reforms currently underway could be threatened, leading businesses to pull back their investments. Polls tracking congressional and presidential approval, along with Americans’ feelings about the direction of the country, have been oscillating wildly, with changes in direction coming at every storyline covered by the media. A good proxy for what will happen all around the country will be a race right here in Florida between Governor Rick Scott (R) and Senator Bill Nelson (D). Scott is running to replace Nelson in the Senate, and the two well-established candidates will battle it out in what will likely be one of the most-expensive and most-watched races of the election cycle. Scott has the lead in the RealClearPolitics average of polls, but that lead has been shrinking and the race is close. We’ll be watching the race for clues to the mood of voters and how they feel about both parties leading up to the election.

P.P.P.S. Invest in your health. On Mercola.com, Dr. Joseph Mercola tells his readers about research showing that the more vegetables you eat, the lower your risk of heart disease. Read these key points and heed Dr. Mercola’s message. He writes:

• The more vegetables you eat, the lower your risk of heart disease, with different types of vegetables protecting your heart through different mechanisms

• Leafy greens have high amounts of nitrates that naturally boost your nitric oxide level. L-citrulline in watermelon also boosts nitric oxide

• Cruciferous veggies lower your risk of stroke and heart attack by promoting more supple neck arteries and preventing the buildup of arterial plaque

• Probiotic-rich sauerkraut has been shown to reduce inflammation, improve high blood pressure, reduce triglyceride levels and maintain healthy cholesterol levels, all of which benefit your cardiovascular and heart health

• The best way to maximize your benefits is to eat a wide variety of vegetables on a daily basis, making sure to include nitrate-rich leafy greens, cruciferous vegetables, magnesium- and quercetin-rich varieties, plus onions and some homemade sauerkraut

Client Portal

Client Portal Secure Upload

Secure Upload Client Letter Sign Up

Client Letter Sign Up