Maintaining a Long-Term Perspective

March 2021 Client Letter

Staying invested during extreme market downturns may seem counterintuitive when losses are piling up, but it is often one of the best decisions an investor can make. That doesn’t mean portfolio positioning and individual holdings should be set on autopilot. During the height of the pandemic and lockdowns, we were constantly reviewing portfolio holdings. The abrupt onset of COVID-19 and the government reaction to it, which was the real black swan in our view, created significant uncertainty. While we had concerns with some portfolio holdings, we were confident in the resiliency of the group of securities we held for you.

Why the confidence in the face of such great uncertainty? I would cite three reasons.

Diversification

Crafting a resilient portfolio is more than just deciding which stocks and bonds to buy and sell. In our view, proper diversification between asset classes, among sectors, and among individual positions is the key to crafting a portfolio that can offer comfort and confidence in uncertain times.

Cash Flow is King

Owning securities that pay a stream of income can also give you the confidence to ride out the tough times. The payment of income can cushion the blow of falling prices. And getting a regular dividend check in difficult economic environments indicates that the company you are investing in has confidence in its own business and the cash flow to pay it. We buy stocks and bonds expecting that their dividend and interest payments can be maintained through an entire economic cycle. It doesn’t always work out that way and, admittedly, lockdowns and social distancing weren’t much of a consideration when many of the stocks and bonds we own for clients were purchased. During the height of COVID-19 uncertainty last spring, we had concerns about which companies might have to suspend dividend payments; but we can count on one hand the number of stocks that actually did so.

Experience

I have been speaking to investors for nearly 30 years about the market and its impact on their life savings. One thing I have observed over this period is the importance of staying invested. When you start playing the game of getting out of the market because of some variation of “this has never happened before,” you greatly increase the risk of missing the rebound.

An old Wall Street adage says market tops are a process, and market bottoms are an event. Investors who want to catch a bottom have to invest at the point of maximum pessimism (and uncertainty). That’s a lot easier said than done in the heat of battle.

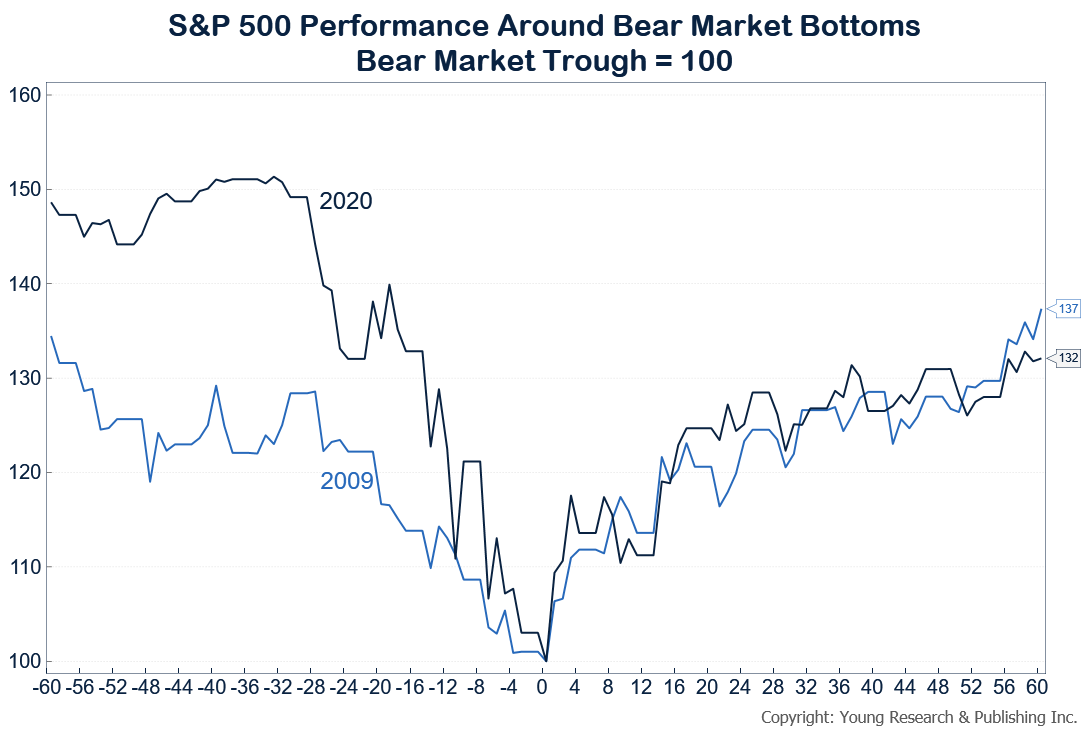

You can see in the chart below that the bull markets that started on March 9, 2009, and March 23, 2020, held to the pattern of an event. In the first 60 days (horizontal axis is days before and after bear market bottom) of both bull markets, the S&P 500 was up over 30%. It is unlikely many investors who sold in March of 2020 because of the uncertainty of COVID-19 would have had enough confidence to buy back in by the end of May.

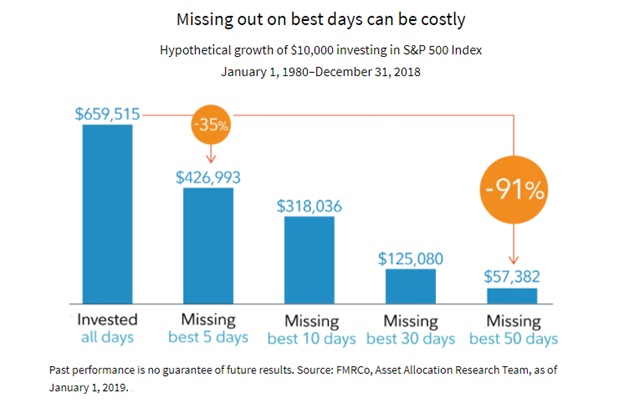

Being on the sidelines during these rallies can be detrimental to the long-term value of your portfolio. The chart below from Fidelity compares the growth of $10,000 in the S&P 500 from 1980 through 2018. Investors who owned stocks for the entire period saw their $10,000 investment turn into $659,515. Those who missed the 10 best days saw less than half of the gains, and those who missed the best 50 days saw about a tenth of the gains.

Remember: We are an investment counsel firm that invests your money, not a trading counsel firm that trades your money. Investing is a long-term endeavor that presupposes busts as well as booms. It is not always easy to keep your composure during a bust, but selling after a big decline is one of the worst mistakes a long-term investor can make.

Why Bonds Still Make Sense

One way we help clients avoid that mistake is by investing in bonds. With today’s interest rates at ultra-low levels, I am sometimes asked, “What is the point of owning bonds?” It’s a good question.

In our view, bonds are more than a source of income—though they do provide income. Perhaps more importantly, bonds act as ballast for your portfolio. Bonds give you the courage to own stocks, especially in down markets.

The Necessity of Owning Bonds

This is especially true for retired investors who no longer have the luxury of dependable wage income. For retired investors relying primarily on their portfolio to fund living expenses, bonds are necessary.

You will understand why bonds are necessary when you consider the poor hypothetical investor who bought $1,000,000 worth of an S&P 500 fund at year-end 1999 with plans to take a 4% inflation-adjusted annual draw through retirement. A nasty 3-year bear market that took the index down 49% from peak to trough followed. By the end of 2002, this investor’s portfolio would have been worth approximately $523,000. To maintain his purchasing power for his 2003 distribution, he would have been looking to take $42,000, or 8%, of his remaining wealth.

Talk about an ulcer-inducing way to begin retirement. And if this hypothetical investor is like many investors, he would have thrown in the towel and bought bonds after it was too late. Assume our hypothetical investor switched to a 50-50 portfolio at year-end 2002. The chances of running out of money over a 25-year retirement with an 8% withdrawal rate invested 50% in stocks and 50% in bonds may be as high as 91%.

Market Euphoria Reminiscent of Dot-Com Bubble

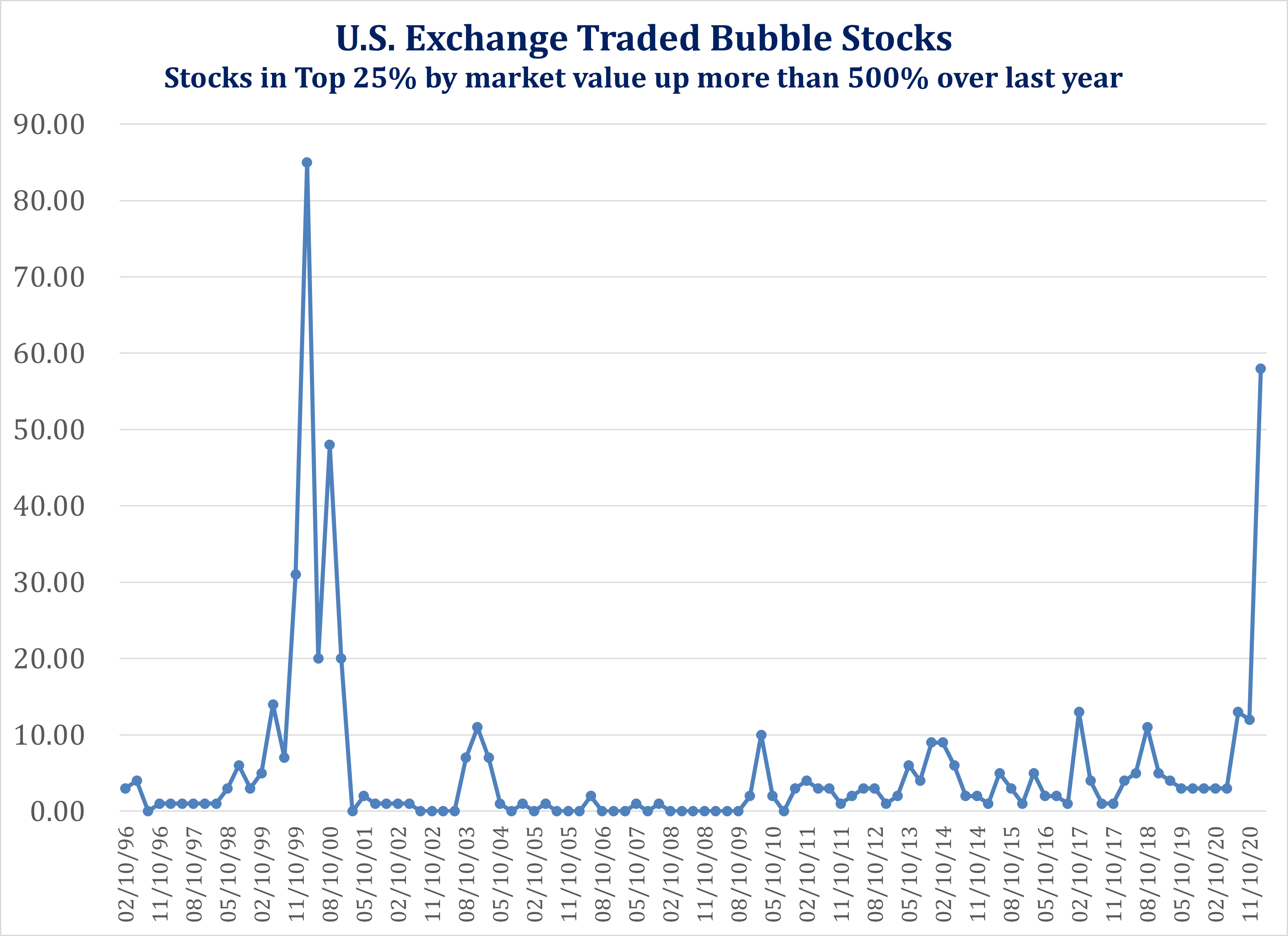

What is interesting about this example is that there are many similarities between today’s market and the market that preceded the dot-com bust. Take the number of bubble stocks (our definition) as an example.

What are bubble stocks? We define them as stocks that have increased more than 500% over the last year. Why 500% over a year? It is arbitrary, but it is a nice round number that is so high it would be difficult to explain as something justified by improving fundamentals (there are rare exceptions).

The chart below plots the number of bubble stocks by quarter. The last time we saw anything close to this kind of mania was during the dot-com bubble. Seasoned investors have the benefit of knowing how this type of mania often ends.

The good news is that bubble conditions in the market are not pervasive. The market is extremely bifurcated in terms of value. Some stocks appear to be priced at irrationally exuberant levels, but pockets of relative value can still be found.

We see pockets of value in the dividend-paying names we tend to favor. We also see better relative value internationally.

Home Bias

What comes to mind when you think of the stock market? For many Americans, the stock market means the Dow or the S&P 500. There is nothing wrong with that, but U.S. stocks are just one part of a much larger global equity market. There are 6X as many investable foreign stocks as there are U.S. stocks.

Investors around the world tend to think about markets in terms of their home country. Economists call this “home bias.” Home bias is rooted in the familiar. People are more comfortable with what is familiar to them, and that bias holds for their investing activities.

The problem with home bias is that it can result in a situation where assets become too heavily concentrated in one area. There are benefits to investing globally because U.S. and foreign stocks don’t tend to move in unison. Periods of volatility and performance don’t always sync up between domestic and foreign markets.

U.S. vs. International Market Leadership

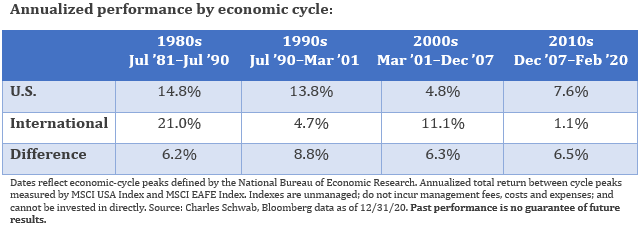

Charles Schwab recently pointed out that market leadership between U.S. and international stocks tends to last for many years before reversing. It tends to switch at the start of a new cycle. The table below from Schwab indicates that, during the 1980s, international stocks led U.S. stocks by an annualized 6.2%. The decade of the 1990s went to the U.S. The dot-com bubble helped U.S. stocks outperform by 8.8% during the 1990s. In the 2000s, leadership flipped back to foreign stocks; but since December of 2007, U.S. stocks have held the leadership role. What will the 2020s bring?

Currencies and International Investing

Currency fluctuations play a meaningful role in the performance of international stocks. When an investor owns stock in a foreign company, the value of that stock not only depends on the company’s performance but also on fluctuations in the exchange rate between the investor’s home currency and that of the company.

U.S. investors in international stocks may experience a gain in their investment’s value when the dollar weakens as the strengthening currency of the underlying security bolsters it. Australia’s performance during the 2000s offers an instructive example. From year-end 1999 through year-end 2007, the MSCI Australia Index was up 208%, but U.S. investors who purchased an ETF tracking Australia’s market would have earned 312% over this period as the U.S. dollar also fell against the Australian dollar. Currency fluctuations cut both ways. From year-end 2009 through year-end 2016, the dollar index rose 33%, dragging down the performance of international stocks in U.S.-dollar terms.

At Richard C. Young & Co., Ltd., we take a global approach to portfolio management. We invest in foreign stocks and, when the opportunity is right, foreign bonds. Today, approximately a quarter of the equities we hold for clients are invested internationally. Your allocation to international stocks may differ from that figure depending on when you started with us and which international stocks we currently favor.

The foreign stocks we buy for clients tend to have characteristics similar to the U.S. stocks we buy. We favor dividend-paying stocks with records of making dividend increases. Dividend-paying conventions internationally tend to be more focused on payout ratios as opposed to dividend levels. We put less weight on consecutive dividend increases with international stocks.

Today, we are favoring Swiss stocks for international exposure. In a world of negative interest rates and what seems like non-stop liquidity injections from global central banks, the Swiss franc could act as a haven if inflation and currency debasement take hold in countries more focused on monetary intervention.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. In February, we purchased additional positions in the iShares Broad High Yield Corporate Bond ETF. With another $1.9 trillion in stimulus likely on the way, on top of the $900 billion passed in December and vaccines rolling out at a pretty good clip, the near-term outlook for the economy is solid, in our view. There is even talk that the size of the stimulus may overheat the economy. That points to a lower risk of corporate defaults and higher Treasury rates. High-yield bonds are likely to perform stronger in relative terms than Treasuries in such an environment. The iShares ETF was purchased at a yield of 4.04%.

P.P.S. I also wanted to comment on your cash position. We recognize the elevated amount of cash in your portfolio. Most of this is earmarked for additional bond purchases. It is worth pointing out that since the end of July of last year, the Bloomberg Barclays US Aggregate Bond Index is down 3.2%, and the Bloomberg Barclays US Corporate Bond Index is down 2.84%. The long Treasury bond is up 1.08 percentage points in yield, and the 10-year Treasury yield is up 1.0 percentage points over this period. While cash yields nothing, the low yields in the broader fixed-income market mean the opportunity cost of holding cash is lower than normal, and the option value of having cash is greater than normal. We will be looking to invest this money, but we don’t want to force the money into bonds on unappealing terms simply to bring down your cash position.

P.P.P.S. “Electric is real. The stock prices of companies in the space are not,” said Erik Gordon, an assistant professor at the University of Michigan’s Ross School of Business. “The dot-com boom produced some real companies, but most of the overpriced dot-com companies were lousy investments. The electric boom will be the same story. Some great companies will be built, but most of the investors who chase insanely-priced companies will be crying.”

P.P.P.P.S. Is oil headed back toward $100 per barrel? With all the focus on green and renewable energy, one might think that the oil and gas business is finished. It’s possible that demand will peak within the next couple of decades, but don’t forget that supply and demand set the price. Every year without additional investment, the world’s oil supply falls by millions of barrels a day. Oil demand collapsed in 2020, but so did investment. That will limit supply in the near-to-medium term.

Quoting from a recent FT article, “We’re going to be short of oil before we don’t need it in the years to come,” JPMorgan’s head of oil and gas, Christyan Malek, told clients on a conference call last week. “We could see oil overshoot towards, or even above, $100 a barrel.”

Oil and gas shares are also a good sector to own should inflation become a problem. And oil and gas stocks offer some of the most attractive dividend yields in the stock market. The top four energy stocks we hold in client portfolios offer an average yield of 5.4%.