May 2018 Client Letter

The unemployment rate matched an almost five-decade low of 3.8% in May. The only other time in the last 48 years unemployment has been this low was at the height of the dotcom bubble. We are experiencing a best-of-the-best labor market. Economic growth remains strong as well. According to the Federal Reserve Bank of Atlanta, GDP is forecasted to rise more than 4% in the second quarter. Industrial production is again humming, and corporate earnings are booming. Bloomberg data shows that, with 97% of S&P 500 companies reporting, earnings are up over 23% from the first quarter of last year.

It would be difficult to find an economic and earnings growth environment much better than we have today. And yet, on an annualized basis, the Dow and the S&P 500 are on pace for returns of -1% and +3.55%, respectively.

While the modest performance for stocks over the first five months of the year may seem at odds with the economic backdrop, it isn’t so shocking, in our view. Depending on which benchmark you use, this is either the second- or third-longest bull market on record. After nine years of a bull market, stocks are far from cheap, judging by a variety of metrics. And with the ultra-loose monetary policy that has helped extend this bull market past its natural expiration date coming to an end, further gains become more difficult.

Markets are Forward-Looking

What’s to come in six to twelve months matters more to markets than the headlines of yesterday. Just as stocks rose sharply last year in anticipation of faster growth, they may be languishing today as investors look for growth to slow. Rising interest rates, economic expansion that is likely in the late innings, potential political risk in November, some choppiness in global growth, and trade risk may be among the concerns holding markets back.

Dividends Account for 45% of Total Returns

That’s not a positive forecast for stocks over the balance of the year. Short-term forecasts are unreliable. We leave the monthly and quarterly predictions to the traders and speculators. We spend our efforts thinking about the long run and the factors affecting long-term returns. One of those factors is dividends. Our projections about the future focus on dividends and dividend growth. Areas where long-term predictability and accuracy are much greater.

Dividends and the reinvestment of dividends account for a significant portion of the return on stocks. Even during the last 20 years, when the dividend payment has fallen out of favor in many corporate boardrooms, dividends and their reinvestment have accounted for 45% of the total return on stocks.

Two companies we own in many client portfolios, Verizon and United Technologies, recognize the value of dividends:

Like all telephone companies in America, Verizon’s history starts in July of 1877 when Alexander Graham Bell formed the Bell Telephone Company. Soon Bell telephone systems were popping up in all the major cities in America and were linked by Bell’s long-distance calling operation. In 1996 the FCC deregulated local markets, allowing competition and setting the stage for what would become Verizon.

In its relatively short history, Verizon has been a pioneer of communications technology and infrastructure in America. Verizon introduced America’s first 3G network in 2002, started building a fiber-optic Internet system known as FiOS in 2004, and deployed America’s first large-scale 4G LTE network in 2010.

Today Verizon is continuing to work on its network by rolling out 5G wireless technology. Verizon says the 5G system has “about 50 times the throughput of current 4G LTE, latency in the single milliseconds, and the ability to handle exponentially more Internet-connected devices to accommodate the expected explosion of the Internet of Everything.”

Verizon and its predecessors have paid investors dividends each year since 1984. The company is also a Mergent dividend-achiever that has been raising its dividend each year for 12 consecutive years. Verizon shares yield 4.85% today.

In 1934, United Technologies was incorporated with a mission focused mainly on building products for the aerospace industry. Today the company owns a broad variety of businesses, including Otis, the world’s largest elevator and escalator manufacturer; UTC Climate, Controls and Security, the leading provider of heating, ventilating, air conditioning (HVAC), refrigeration, fire, security, and building automation products; Pratt & Whitney, a leading global provider of technologically advanced aerospace products among the world’s leading suppliers of aircraft engines for the commercial, military, business jet, and general aviation markets; and UTC Aerospace Systems, a leading global provider of technologically advanced aerospace products.

Among United Technologies’ better-known products are the F135 engine, which powers the F-35 Lightning II jet fighter, Carrier heating and cooling equipment, Kidde fire alarms, and Otis’s elevators and escalators. Though passengers may not know it, they are surrounded by UTC Aerospace Systems parts on nearly every large airplane they board.

Worldwide trends are driving United Technologies’ businesses. Urbanization, a growing middle class, and increasing commercial air travel are powerful tailwinds for the company. Fewer than 20% of the world’s population has flown in an airplane. Soon many more will be wealthy enough to afford that luxury. There are presently around 29,000 commercial aircraft in operation. By 2030 that number is projected to rise to 47,000.

The board at United Technologies is focused on returning value to shareholders. The conglomerate has paid shareholders dividends for over 80 years straight. For the last 24 years, United Technologies has raised its dividend each year. That includes through the dotcom bust and the financial crisis.

Not All Dividend-Payers on Solid Ground

Many investors focus primarily on yield when buying dividend stocks, but we consider a broader set of factors. The highest-yielding dividend stocks are often not the best dividend stocks. Why not? Outsized dividend yields may be a signal of an unsustainable dividend. In fact, if you invested $10,000 in the highest-yielding 30 stocks in the Russell 3,000 Index (top 3,000 U.S. stocks by market cap) in 2003 and rebalanced that portfolio annually, you would have $15,900 today. That same $10,000 invested in a Russell 3,000 Index fund 15 years ago would be worth about $40,000 today.

That is not to say that high-dividend yields always mean a dividend cut is imminent. There are qualitative and quantitative factors that should be evaluated to foretell the sustainability of dividend payments. We seek to strike the right balance between yield and dividend reliability when crafting portfolios.

Tweaking the Portfolio

Last month the Wall Street Journal profiled a report on retirement. Among suggestions from the interviewed professionals: Go stodgy with stocks and look outside the U.S. This group also advised a diversified approach and caution on rate-sensitive stocks. Our Retirement Compounders® program checks many of the boxes advised in the piece.

For starters, stodgy is right in our wheelhouse. Our Retirement Compounders® program favors established businesses in slower-growing industries with high barriers to entry, above-average dividend yields, and good dividend-growth prospects. We don’t swing for the fences. A company that pays a 3% yield today and increases that dividend at 5% annually for nine years will likely double your money. For investors in or nearing retirement, it doesn’t get much better than that.

Diversification is the cornerstone of proper portfolio management, but many investors over-diversify. Owning numerous large-capitalization exchanged-traded funds or mutual funds is probably overkill. Our equity portfolios are primarily made up of individual common stocks. We build diversified common-stock portfolios but don’t own so many positions that our best ideas become too diluted to make a difference. Our thought used to be that for a U.S.-only portfolio, 32 stocks would provide about as much diversification as one needed. That number has risen slightly over time. Today we build globally diversified (not U.S.-only) portfolios that include 40 to 50 stocks—enough positions to provide good diversification, but not so many as to over-diversify.

Global Investing

The international component of our common-stock portfolios tends to fluctuate between a quarter and a third of the portfolio. Many foreign markets have lagged U.S. markets over the last five years and offer values that are more reasonable than they are in the U.S. Foreign stocks also tend to have dividend yields that are much greater than those on U.S. stocks.

Interest-Sensitive Stocks

The cautionary warning from the Wall Street Journal on interest-sensitive stocks has been an ongoing challenge for dividend-investors over recent years. The Federal Reserve’s insistence on holding short-term interest rates at zero and pushing long rates down drove many investors into dividend-paying shares to earn income. This reach-for-yield dynamic has led to a greatly increased correlation between dividend stocks and interest rates. When rates rise, dividend stocks fall, and when rates fall, dividend stocks rise. While dividend shares have always had some sensitivity to rates, the effect has been amplified by orders of magnitude in recent years. Unfortunately, it is a dynamic that dividend investors may have to endure for a bit longer; but as rates normalize, we expect the correlation between rates and dividend stocks to lessen.

Emerging Markets

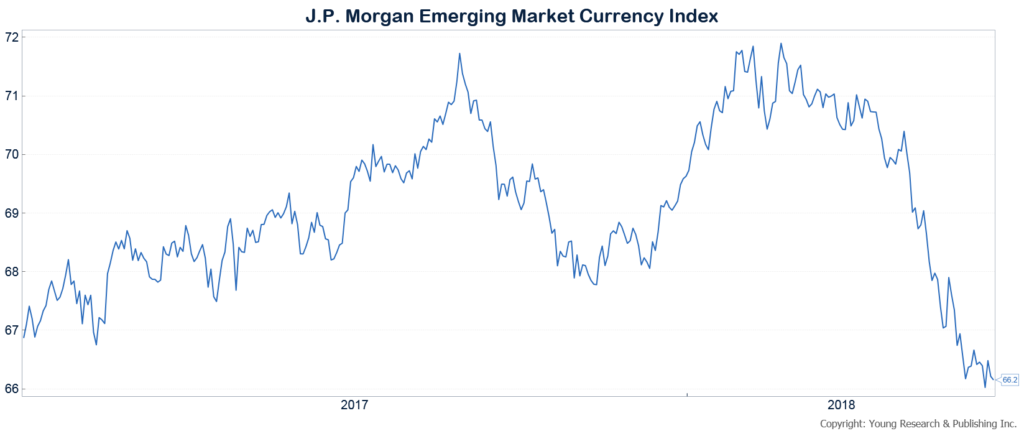

After a strong showing in 2017, emerging markets have become the favored asset class of many. EM stocks have been out of favor for so long that some investors are now anticipating a big payback period. That forecast may eventually come true, but we have remained cautious on emerging markets; they tend to run into trouble during periods of rising U.S. interest rates. While not all emerging markets are the same, some have stumbled as U.S. interest rates have risen. The currency channel is one of the big sources of volatility in emerging markets. The Turkish lira, Argentine peso, Brazilian real, and Russian ruble are all down between 10% and 30% YTD. The broader JP Morgan Emerging Market Currency Index is down 5% YTD and over 8% from its high earlier this year.

Falling currency values vis-à-vis the U.S. dollar has hurt investors’ returns in emerging market stocks. The MSCI Emerging Markets Latin America Index is down 8% YTD, and the MSCI Emerging Markets Europe Index is down 7% on the year.

Emerging markets are an area we have owned for clients in the past and may own again in the future, but the risk is often higher, and so we demand much higher prospective returns. Today we see more risk than reward in many emerging markets. Rising interest rates in the U.S. may continue to wreak havoc on emerging markets, especially in those countries with lots of foreign-currency-denominated debt and big current-account deficits.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. Last year, The Brookings Institute featured an article that began, “As released Thursday, President Trump’s ‘America First’ budget blueprint would actually put U.S. manufacturers and the national economy well behind their global peers.” The piece ended with “Trump’s budget, like much of his rhetoric, is fundamentally backward-looking. It attempts to support a 21st century economy with 20th century tools and ideas.”

Fortunately for America, the Brookings Institute appears to be off base—at least according to a recent report from the IMD Competitiveness Center in Switzerland that annually ranks countries by over 200 different factors to develop its global competitiveness rankings. For 2018, the U.S. improved three spots in the ranking and returned to first place. According to IMD, “The return of the United States to the top is driven by its strength in economic performance (1st place) and infrastructure (1st place).”

P.P.S. Not all bonds, and not all bond funds, are created equally. There are many varied degrees of risk in the bond market. You can take on maturity risk, credit risk, currency risk, political risk, prepayment risk, and extension risk, to name a few. Take a fund like famed Bond Fund Manager Bill Gross’s Janus Unconstrained Bond Fund. This fund can invest in a wide array of securities, including derivatives and foreign bonds. The fund can also take long and short positions in bonds. During a recent bout of political turmoil in Italy, the Janus Unconstrained fund was pummeled—falling by over 3% in a single day. Year-to-date the fund is down over 6%. A wrong-way bet on the spread between German and U.S. bonds cost the Janus fund dearly.

P.P.P.S. Our focus in fixed-income markets is on individual domestic bonds. Government bonds, government-backed mortgages, and investment-grade corporates with short-to-intermediate-term maturities are where we are concentrating purchases today. Our bond portfolio is designed to stabilize the volatility of stocks in our clients’ portfolios. There is minimal, if any, currency and political risk in our core fixed-income portfolios. Currency is not a risk we want here. Currency volatility can defeat the purpose of a fixed-income investment.

We do, as many of you know, venture overseas into foreign-currency-denominated bonds, but these are purchased strictly as a component of our currency portfolio and counted as higher-risk assets.

Client Portal

Client Portal Secure Upload

Secure Upload Client Letter Sign Up

Client Letter Sign Up