May 2022 Client Letter

Recently, our family began the process of touring colleges for my son, Rick, who is finishing his junior year at Naples High. On our first round of visits, we flew Delta, connecting in Atlanta and finally arriving in Charlottesville. After a tour of the university and a stop at Monticello, we drove Route 29 to Chapel Hill, where we stayed a few nights before heading home from Raleigh-Durham. The following weekend we had a direct flight on Southwest for a quick 24 hours in Nashville.

I have been on a plane many times since COVID began. Mostly to bring my daughter to school in Tuscaloosa and for visits back home to Newport, RI. Traveling during that time was relatively pleasant. It was simple to book flights—sometimes the middle aisle was purposely left vacant—and crowds were thin. Best of all, airfares were relatively cheap.

Now, all of that appears to be over. Our flights were full during the college trips, and the airports were busy. If you are looking to find a cheap flight these days, good luck. A combination of robust demand for air travel and a significant increase in jet-fuel costs means cheaper tickets are tougher to find.

According to Delta this past April, “There are clear signs of pent-up demand for travel and experiences as consumers’ spending shifts from goods to services and experiences, travel restrictions lift, and business travelers continue to return to the skies.”

American Express conveyed a similar view, stating, “[Travel & Entertainment] T&E spending did show a dip in January, and early February due to the Omicron variant, but spending then rebounded tremendously, reflecting pent-up travel demand and essentially reached 2019 levels for the first time since the start of the pandemic in the month of March. And this kind of T&E spending growth has continued right into early April.”

As you are aware, not just travel has become more expensive. Prices have risen on many things we regularly buy. Heading into 2022, inflation was viewed as one of the biggest risks for investors. And while the Fed has begun to raise interest rates, I do not believe the inflation concern is less now than in January.

Investors focus on several factors when looking to protect themselves from inflation. Obviously, energy is viewed as a solid hedge and has not disappointed this year. The sector is up 48% YTD and is ahead of every other sector in the S&P 500 by a mile. Today’s higher prices are allowing energy companies to pay off debt and raise dividends. Energy companies in our portfolios, including Chevron, Exxon, Phillips, Valero, Williams, and Kinder Morgan, have all benefited. As a bonus to this year’s significant returns, the average dividend yield of this group is approximately 4%.

The Charm of Boring Stocks

Another sector viewed favorably during inflationary periods is the stodgy consumer-staples sector. Due to a combination of inflation concerns and market volatility, investors have been allocating money into consumer staples stocks along with other defensive sectors. As the WSJ reported on May 2, “Investors are rediscovering the charms of boring stocks. Investors appear to be turning their focus to companies offering everyday necessities—a preference that has been amplified as many such companies post strong quarterly results. The consumer-staples group was the sole S&P 500 sector in the green for April, with a gain of 2.4%. With U.S. inflation at a four-decade high, investors are keeping a close eye on how companies are holding down their costs or passing increases along to customers through higher prices. Reports from some consumer-staples companies suggest households have yet to flinch at higher prices for basic items.”

Consumer staples shares have long been one of our favored groups. Why? For starters, the dampened cyclicality of the sector provides a greater degree of confidence in the long-term prospects of firms in the space. Many companies in the staples sector are durable businesses with long operating histories and formidable brand portfolios.

What startup will outspend P&G to gain market share in diapers or detergent? Or, when is the last time you saw a new candy bar not created by one of the big incumbents gain a foothold on store shelves? The barriers to entry in the branded consumer goods industry are significant.

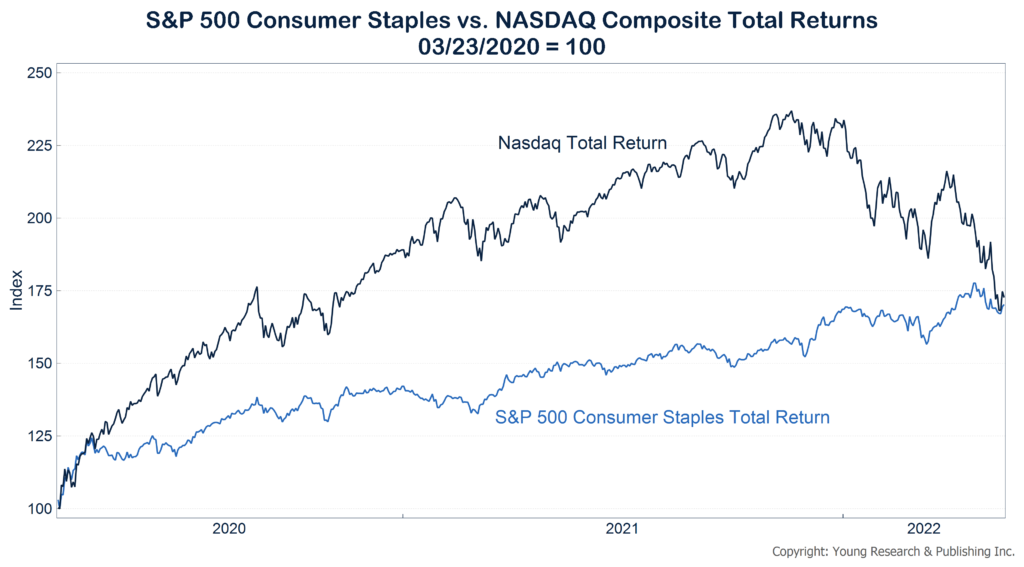

The trade-off for investing in high-quality businesses such as P&G or Hershey is that they don’t tend to keep pace with the more speculative end of the market when investors’ risk appetite is high. By example, you can see in the chart below that until recently, consumer staples stocks trailed the more speculative NASDAQ Composite by a meaningful margin in the current bull market.

The performance gap started to narrow in November of last year. Since that time, the NASDAQ has fallen sharply while consumer-staples stocks have continued to plod along. As of this writing, the Consumer Staples Index and the NASDAQ returns from the 2020 bear-market lows are within a couple of percentage points of each other. The distinction to make is that to earn a similar return, investors in staples stocks took on less risk than investors in the NASDAQ.

Consumer staples stocks, and reliable dividend payers in general, are rarely as sexy as the newest technology firms in the NASDAQ; but when you are in the business of long-term compounding, boring, routine, and dull are desirable.

Hot New Investment Theme… But Not for Us

It has been a while since we could say this, but the broader investing public looks to be coming back around to our way of thinking on dividend investing. As Barron’s put it in a recent feature, “The hot new investment theme isn’t socially nuanced crypto space finance or metaverse charging networks for virtual vehicles. It’s dividends—cash payments to shareholders.”

According to strategists at BofA Securities, the S&P 500 is poised for minimal price returns from here, and dividends could make a big difference in terms of total return. BofA notes that since 1936, dividends have made up more than one-third of total returns. When you factor in the reinvestment of dividends, you find that dividends and reinvested dividends have accounted for close to half of the total return on stocks over the last 30 years.

Regular Dividend Increases Are Key

Throughout the year, your monthly brokerage statement shows the dividends paid into your account. When viewed individually, these payments may not appear as large numbers. But when added up for an entire year, you will most likely be pleased with the final figure.

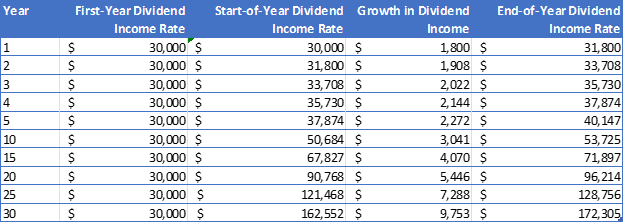

We seek companies with track records of making annual dividend increases. Typically, these increases are in the single-digit percentage range. As time passes, these annual increases have a big impact on the dividends you receive.

As an example, let’s take a hypothetical portfolio with $1 million invested in dividend-payers. Assume a starting yield of 3% and annual dividend growth of 6%. After 20 years, that initial $30,000 in dividend income will have increased to $96,214. After 30 years, this hypothetical portfolio would generate $173,305 in annual dividend income, which doesn’t include the additional dividend income that would be generated by reinvesting dividends.

Bond Market Suffering Worst Period in Decades

In early May, the bond market hit a new milestone, with the 10-year Treasury reaching 3% for only the third time since 2011. Prior stays above 3% were brief. The rise in longer-term yields to 3% represents a 90% increase from 10-year yields at the start of the year. The four-month return on the most widely cited bond index (Bloomberg Aggregate) for the period ending in April was the worst on record, going back almost 50 years.

Many investors anticipated a rise in interest rates this year, but longer rates have moved much faster than many expected. The significant rise in longer rates has pushed the value of bonds down during the same period that stocks have also been falling.

The Silver Lining in the Bond Market

The good news is that you have survived the worst bond market in a generation. The fixed-income portfolios we manage for clients are down less than the broader bond market after taking into account our intentional overweighting in cash and some shorter maturity high-yield bonds and loans, but they are still down.

While disappointing that bonds are down at the same time as stocks, it is important to keep in mind that bonds are not like stocks. Projecting the past five months of returns into the future could be a mistake. A 90% rise in yields from current levels brings the 10-year Treasury yield to nearly 6%. Ten-year Treasury yields haven’t been near 6% in over 20 years.

It is also important to keep in mind that, except in the event of default, bond prices will gravitate upward, back toward par value as they approach their maturity date. There is no such force acting on stocks. Excessive valuations or a new earnings growth trajectory can lead to what is effectively a permanent loss on individual stock positions.

That is not to say that yields won’t continue to rise, but we anticipate the pace of increase to slow, providing time for interest income to accumulate and lessen the blow of any further decline in prices.

And while stock and bond prices have moved in tandem so far this year, if the Federal Reserve pushes interest rates to a level sufficient to increase the likelihood of recession, we expect bonds’ traditional counterbalancing role to reassert itself in portfolios.

4%-Plus Yields in Corporate Bonds

The upshot of poor bond performance this year is that interest rates on investment-grade corporate bonds are at levels that offer the prospect of decent interest income over coming years. We recently purchased a Constellation Brands bond due in 5 years at a yield of 4.35%. Constellation is a leading wine, beer, and spirits company. Brands include Mondavi and Corona Extra. We also purchased a Clorox bond with a slightly longer maturity at a yield of 4.4%.

After too many years of being punished by a 0% interest rate policy, income investors and those in or nearing retirement can now earn a decent stream of interest income without taking undue risk.

Have a good month. As always, please call us at (800) 843-7273 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. In NFT Sales Are Flatlining, the WSJ reports, “The sale of nonfungible tokens, or NFTs, fell to a daily average of about 19,000 this week, a 92% decline from a peak of about 225,000 in September, according to the data website NonFungible. The number of active wallets in the NFT market fell 88% to about 14,000 last week from a high of 119,000 in November. NFTs are bitcoin-like digital tokens that act like a certificate of ownership that live on a blockchain. Rising interest rates have crushed risky bets across the financial markets—and NFTs are among the most speculative. Many NFT owners are finding their investments are worth significantly less than when they bought them.”

A few important takeaways from this article can help you maintain a steady course toward long-term investment success. First, new technologies that offer profound promise are not always profitable investments. Maybe things don’t pan out as expected, or maybe they do. In the latter case, often the hype cycle of the latest and greatest leads to prices or valuations that can never be lived up to. You should evaluate what you can lose on any potential investment before you think about what you can make. Be comfortable with the loss you would incur if things don’t pan out. Size your position accordingly. Finally, don’t forget that sentiment can change swiftly and without notice. The NFT market was booming last year. Beeple sold a piece of digital art for $69 million in 2021. The value of the Bored Apes and the Crypto Punks shot up into the millions. Now interest seems to be waning. Will it reverse again? Probably. Will NFT values shoot back up if sentiment improves? Maybe is our best estimate, and maybe is not how you compound wealth.

P.P.S. I’m surprised I’ve not seen this quote before because it’s right up our alley. It’s from money manager, author, and Warren Buffett–follower Mohnish Pabrai: “You don’t make money when you buy stocks. And you don’t make money when you sell stocks. You make money by waiting.”

P.P.P.S. Today’s financial headlines are dominated by inflation, interest rates, supply chains, and Russia. But as the year rolls on, increased attention will be paid to the midterm congressional elections. As of now, it appears the Republicans will pick up a significant number of seats, which would deliver an even more divided government in Washington D.C. Political gridlock is often a situation the markets favor.

Here in Florida, Alex Roarty and Bianca Padró Ocasio report in the Miami Herald on a new worry among Democrats:

Liberal grassroots groups in Florida are reducing staff and scaling back voter-outreach efforts because of a growing reluctance from out-of-state donors to spend money on the state, say top progressive strategists.

If the financial pullback continues, they warn, it threatens not only the party’s chances in this year’s slate of midterm races but also Florida’s place as a top-tier battleground in the 2024 presidential election…

Concerns about Democrats’ competitiveness in Florida have festered on the left ever since former President Donald Trump’s victory here in 2016. But liberal strategists say that, while it’s not too late to turn things around, what they’re seeing now makes them concerned that Florida is entering a dangerous new phase, in which the failure of past elections saps resources for future races and makes winning even harder—pushing the party into a kind of death spiral here that could turn a former swing state into one Republicans dominate for a generation.

P.P.P.P.S. I have been asked why gold prices have not risen more, given the higher degree of volatility and uncertainty. Many factors tend to influence the price of gold, including these most important ones: interest rates, inflation, and the value of the U.S. dollar. Gold also reacts positively to geopolitical flare-ups, but this tends to be a more fleeting source of price fluctuation. Rising inflation is often positive for gold, while rising interest rates are negative for gold. A stronger dollar is often negative for gold as well. If we build a simple model of gold prices that uses the dollar, inflation, and real interest rates (since we already accounted for inflation), gold is trading right where we would expect. Inflation is helping to boost gold prices, while a strong dollar and higher interest rates (in real terms) are pushing it down. The net-net is that gold is about flat YTD. Exclude inflation from the model, and gold might be 20% to 30% lower than it is today.

Client Portal

Client Portal Secure Upload

Secure Upload Client Letter Sign Up

Client Letter Sign Up