November 2020 Client Letter

One of the costliest investment mistakes you can make is overreacting to current events and political or economic instabilities.

You may know someone who exited their equity positions in March or April, consumed with COVID-19 fear. On the surface, you can appreciate the initial reasoning: a deadly virus with no cure in sight was infecting individuals around the globe. In response, governments shut down economies until further notice. How can companies survive without commerce?

Instead of panicking and selling, I counseled many of you about the additional inputs we considered that gave us the confidence to stay the course: the U.S. economy entered the crisis on solid ground; past civilizations have survived viruses; we have a sophisticated, modern health-care system; many sectors of the economy would remain open for business, and consumers were still flush with cash.

At Richard C. Young & Co., Ltd., we included all those inputs and more into our reasoning for not selling stocks. Additionally, we had confidence in our portfolio of companies and their ability to weather the storm and continue to honor their dividend commitments. Keeping a level head in the midst of panic is often the best strategy.

We did not, however, sit on our hands during the past eight months. In our view, portfolio adjustments were required. By example, we added to our gold position in March. We did not view this as a speculative trade. Given the elevated global uncertainty, the amount of government stimulus, and the Fed cutting rates to zero, we thought this to be a prudent trade. Our bond portfolios also required fine-tuning. Yields on government bonds hit rock-bottom, with the 10-year Treasury yielding 0.58% on April 21. As a result, we liquidated all our Treasury holdings, redeploying them for higher-yielding and higher-returning opportunities in the corporate bond market.

The month of October and the first days of November tested investors’ resolve once again. Instead of the virus, many were concerned with the looming election. Reading through poll results and listening to the media gave some investors concern that a “blue wave” would give single-party control of government to Democrats. As of this writing, either divided or single-party governments are still possible. The markets often favor divided governments as there is less momentum for major policy changes, potentially reducing uncertainty.

Regardless of your election-outcome prediction, making significant portfolio changes immediately before an event with an unknown outcome is often not the best way to manage your investments. Ideally, your portfolio is allocated in a manner reflecting your goals, risk tolerance, and time horizon. Once you consider these factors, a plan can be put in place. Then, moving forward, the changes made are more about fine-tuning than drastic action and disruption.

Unfortunately, many investors look at big events as a signal they should take portfolio action. But this is not an ideal, long-term strategy. Vanguard Group founder Jack Bogle said, “Don’t do something, just stand there!” Bogle also added, “We encourage investors to trade about $32 trillion a year. So the way I calculate it, 99% of what we do in this industry is people trading with one another, with a gain only to the middleman. It’s a waste of resources.”

Our View of the Landscape Post-Election

With the election behind us and the outcome not as bad as feared (pending the two Georgia Senate races), we see an economy continuing to progress. One of the brightest sectors of the economy is housing. Low-interest rates and a new wave of home-buyers have ignited a boom in the housing market.

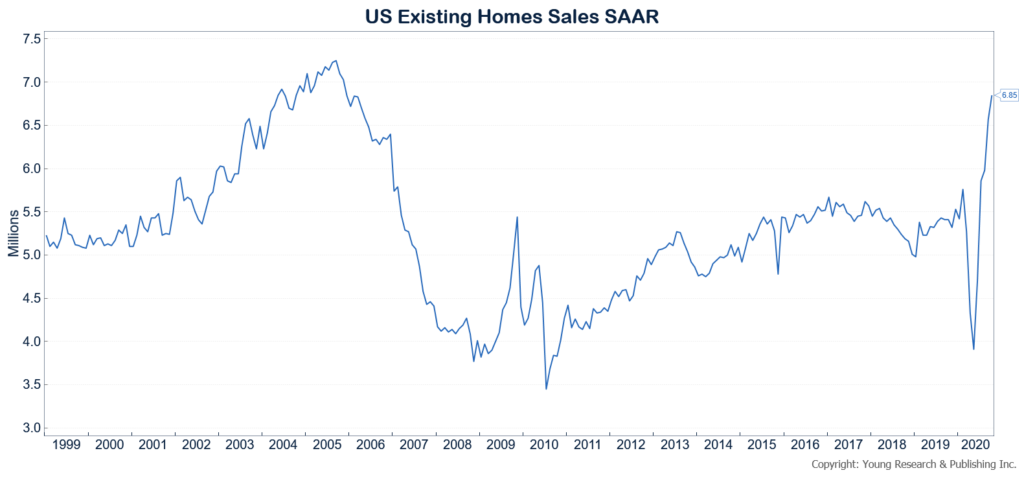

Existing home sales are at their highest level in 15 years. New home sales are showing similar strength, and the National Association of Home Builders Sentiment Index is at a record high. Housing activity is a major part of the U.S. economy, and it has a strong multiplier effect on other parts of the economy.

Homebuyers rarely just buy a house. Along with a new home comes new furniture, paint jobs, remodeling, new appliances, and improvements to the landscaping. Many parts of the economy benefit when the housing market is strong.

The consumer side of the economy also looks healthy despite a lapse in fiscal stimulus. Consumers have plenty of savings from earlier stimulus efforts. And once immunization against COVID becomes widespread, pent-up demand will be unleashed for services that have been restricted.

Bond-Market Strategy

How does the economic landscape shape our view of the bond market? With economic data holding up so far in the fourth quarter along with positive vaccine news, we expect the recovery to continue. We do anticipate a flattening of growth as the Biden administration’s regulatory efforts weigh on business sentiment, but it may not be enough to cause an economic contraction. Divided government, assuming at least one Georgia Senate seat is won by the Republicans, is likely to restrain additional deficit spending. And once the COVID crisis has passed, we would expect Republicans to clamp down on further spending. This should restrain inflation from what it otherwise might be under a blue-wave scenario.

Our base case, with an admittedly still-cloudy policy picture, is moderate economic growth and moderate inflation. In a moderate growth and inflation economy, we see some risk to longer-term yields. The 30-year Treasury bond currently yields 1.60%, which is lower than during the financial crisis. It would not be unreasonable to see long-term Treasury rates move back up to 2.5% or more as the economy recovers and inflation moves off today’s deeply depressed levels.

For some clients, we own bonds with maturities close to 30 years that we purchased in the spring at deeply discounted prices. One of those was a Lowe’s issue due in 2047, which has since been sold. We bought the Lowe’s bond at an extremely wide yield advantage (spread) to Treasuries. Wide spreads can provide a cushion from rising Treasury yields. With the spread on the Lowe’s bond moving back toward more normalized levels, it is now more susceptible to rising long-term interest rates. As a result, we sold. There are a handful of other issues with maturities similar to the Lowe’s bond that we are likely to sell as their yield advantage to Treasuries normalizes.

Paring Back Gold and Silver

We have also pared back our exposure to gold and silver. For a host of reasons, including a continued economic recovery, a likely divided Congress, an election outcome that points toward a rejection of the most liberal part of the Democratic party, and the risk that longer-term rates move higher, we are more neutral on gold and silver today.

We reduced gold and silver mostly in tax-deferred portfolios but also in portfolios where the weightings rose to levels that demanded action. We will likely make additional sales of gold and silver after the first of the year to avoid realizing additional taxable capital gains in 2020.

With the proceeds of the longer-term bonds and precious metals, we are increasing exposure to lower-grade bonds. That means high-yield bonds and floating-rate loans.

We believe high-yield and floating-rate fixed-income securities offer a relatively attractive way to add yield to portfolios. The current environment appears to be favorable for both where we have an improving economy and a Fed policy that supports corporate credit, and in which any additional fiscal stimulus efforts are likely to be focused on the most impacted areas of the economy. The latter tend to be sectors with more lower-rated bond issues.

Fidelity Floating Rate

The Fidelity Floating Rate Fund invests in bank loans of issuers rated below investment grade. Bank loans are senior debt in the capital structure of a company. In the event of default and liquidation, bank loan investors get paid before unsecured bondholders, preferred equity owners, and common shareholders.

Bank loans are floating-rate securities. Loan holders receive a spread above the rate on short-term interest rates. By example, a loan may pay SOFR (the replacement for LIBOR) plus 4%. When the SOFR rate rises, so do interest payments to loan holders.

Bank loans are best accessed by individual investors via a fund. There is lots of paperwork generated between each trade, and trade sizes are far outside the scope of what an individual can do while maintaining diversification.

The Fidelity Floating Rate Fund is our preferred vehicle for investing in bank loans. The fund has an SEC yield of 4.08% with a duration of essentially zero because of the floating rate nature of the loans.

Investing in High-Yield

In the high-yield space, we are investing in both a high-yield bond ETF and individual high-yield bonds. The high-yield bond ETF provides access to some issues that we cannot purchase on an individual basis. The fund is also easier to enter and exit than open-end, high-yield mutual funds that sometimes have minimum holding periods and redemption fees. High-yield bonds are not an asset class we favor as a permanent part of a portfolio. Liquidity and ease of entry and exit are essential. We tend to favor high-yield bonds during the early stages of the credit and economic cycles.

The high-yield ETF we favor today is the iShares Broad US High Yield ETF (USHY). USHY tracks the Bank of America High Yield Index, which is the old Merrill Lynch High Yield index. The fund has an expense ratio of 0.15% and an SEC yield of 4.70%.

Risks to Watch Today

In terms of identifiable risks in the near term, we would point to the outcome of the Georgia Senate elections. If Democrats win both Georgia seats, personal and corporate taxes are likely to increase significantly, and government will have a bigger role in the economy (bad for growth).

A failure of the various vaccines in development to meet safety or efficacy standards could also derail the economy. Case counts, hospitalizations, and deaths have prompted governors to institute additional restrictions that impede economic activity. The stock market is currently looking through these measures to sunnier days in anticipation of a successful vaccine. Should the vaccine disappoint, we could see a reversal of recent equity gains.

A significant rise in long-term interest rates could also be a problem for the market. Stock prices are baking in a long period of ultra-low long-term interest rates. Should long-term interest rates rise meaningfully, we could see a correction in stock prices.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. Part of our ongoing analysis on your behalf is determining the future reliability of a company’s dividend. Some have asked about the sustainability of AT&T’s dividend, given how high it is and how much debt the company owes. We remain confident AT&T has the capacity to continue paying its dividend. We tend to look at the statement of cash flows to judge dividend strength along with future business prospects and the balance sheet. Over the last year, AT&T has generated close to $30 billion in free-cash-flow. The dividend eats up about half of the free-cash-flow. In other words, AT&T’s free-cash-flow could theoretically fall by half, and the company would still be able to meet dividend payments. And while AT&T has taken on a lot of debt in recent years to make acquisitions, the company’s current cash flow supports the debt load. Low-interest rates are also helping AT&T’s cause. These factors are not a guarantee the dividend won’t be cut, of course, but a good indication it doesn’t have to be cut.

P.P.S. Price declines and volatility have made energy stocks a difficult sector to own in recent years. We view energy on a long-term basis, though. The energy stocks we own offer some of the best yields in our portfolios. Refiners Valero and Phillips 66 offer yields of 6.8% and 5.4%, respectively. Chevron’s dividend yield is 5.50%. Fifteen years ago, the energy sector made up 10% of the S&P 500, and the information technology sector made up 15% of the index. Today, energy accounts for 2.5% of the S&P 500, and technology (broadly defined) makes up 38%. The last time we saw such a wide divergence was March of 2000. Our seasoned clients know what happened over the subsequent decade. For the benefit of those who may not recall, from March 31 of 2000 through the next ten years, the S&P 500 energy index compounded at 9.35% while the S&P 500 technology index lost 7.98% on an average annual basis. Past performance is, of course, not a predictor of future performance.

P.P.P.S. I am pleased to announce that Richard C. Young & Co., Ltd. was named in the Top 10 of CNBC’s 2020 Top 100 Financial Advisors ranking. For the second year in a row, we are one of only a handful of firms with listed offices in Florida or Rhode Island to make the list.

P.P.P.P.S. Our equity strategy concentrates on blue-chip stocks with a history of paying dividends. A focus on quality companies paying out cold, hard cash each year can be comforting during periods of uncertainty. But annual dividends are not the whole story. We also target companies that raise their dividend each year. Annual dividend increases are critical in helping offset the nasty effects of inflation—one of the most significant risks investors face.

As we head into 2021, you may know a family member or friend with a New Year’s resolution to reassess or modify their current investment program. As I wrote in July, clients have been inquiring if there is flexibility with our new account minimums. The answer to this question is yes. If you have children, family members, or friends you believe would benefit from our investment counsel and our focus on blue-chip dividend-payers, please encourage them to give us a call or send an email. We are happy to help.

* Rankings published by magazines, and others, generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. Rankings are generally limited to participating advisors and should not be construed as a current or past endorsement of Richard C. Young & Co., Ltd.

Client Portal

Client Portal Secure Upload

Secure Upload Client Letter Sign Up

Client Letter Sign Up