A Reliable and Repeatable Strategy

August 2017 Client Letter

Did you know that Tesla Inc., the electric car maker founded in 2003, is now the largest auto-manufacturer in the United States? Not as measured by the number of automobiles produced—GM still holds that crown—but by market capitalization.

Tesla’s market capitalization is even more amazing when you consider the company produced 84,000 cars in 2016 compared to the over 10 million and over 6 million that General Motors and Ford produced respectively last year.

Tesla has become a story-stock with a cult-like following. Investors apparently can’t get enough of the company. Every bold new pronouncement from Elon Musk seems to be greeted with a higher stock price.

Tesla bulls don’t seem to care about the massive premium they are paying for the stock. We are told Tesla is a growth story and a different kind of car company. You even hear it from the Wall Street analysts who follow Tesla: Tesla’s cult following makes it more like Apple than General Motors.

Tesla may indeed turn out to be a different kind of car company. Maybe after a century of buying Fords, GMs, BMWs, Mercedes, Mazdas, Toyotas, Nissans, VWs, and Jeeps, among other brands, consumers will decide variety and brand choice is overrated.

Anything is possible, of course, but at this stage in Tesla’s life, and at this valuation, we see too much uncertainty, too many unknowns, and too many maybes to invest in a company burning over $2.5 billion in cash per year.

Biggest Beneficiaries of New Technologies Not Stock Market Investors

My intention is not to discount the future of battery-powered electric vehicles (BEVs). The BEV is an exciting new technology with the potential to reshape the global economic landscape. But the internet was also an exciting technology. As investors, it’s important to not become over-enthusiastic about the prospects for new technologies. Trees don’t grow to the sky, and first-movers face fierce competition in time. The result is that the biggest beneficiaries of new technologies are not always stock market investors, but founders, venture capitalists, consumers, and society.

A Reliable and Repeatable Strategy

At Richard C. Young & Co., Ltd., our strategy is to favor more seasoned companies. We focus on firms with a strong record of paying regular dividends that have durable competitive advantages and operate in industries with high barriers to entry. The goal of investing is, of course, to make money, but the method used and the risks taken to earn that money can be just as important as the level of returns.

Over recent years, there have no doubt been investment managers who pursued strategies that earned exceptional returns. Take the hypothetical example of an investment manager who loaded his portfolio with Priceline.com a decade ago and held for the ensuing 10 years. Priceline.com shares have compounded at 41% annually over the last decade. This manager’s portfolio would have likely fared rather well. But looking forward, how confident can you be, as an investor, that the same manager can repeat his needle-in-the-haystack approach to achieving investment success?

We favor the tried and true. Our focus on seasoned dividend-paying companies provides a more reliable and repeatable stream of investment returns than trying to pick the next Priceline.com. Some investors equate investing in the tried and true to poor performance. The thinking is that when you eschew exciting new technologies and industries, you end up with a portfolio that generates middling returns. But the historical record may suggest otherwise.

Historically More Established Companies Have Performed Best

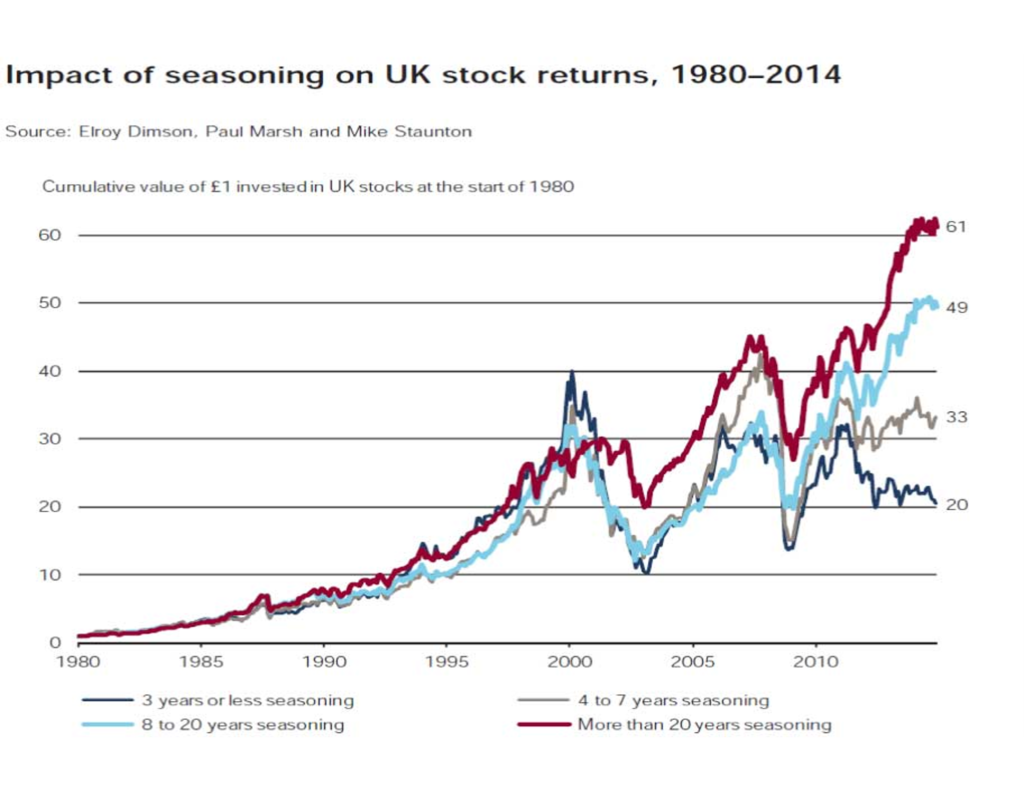

A study presented in the 2015 Credit Suisse Global Investment Returns Yearbook highlights the benefit of investing in seasoned companies. The Credit Suisse study looked at the impact of seasoning on United Kingdom stock returns. Seasoning was defined as “the time that had elapsed from the date of a firm’s initial public offering.”

The study broke U.K. companies into four groups: Companies at the start of the year with three years or less of seasoning, those with four to seven years of seasoning, those with eight to twenty years, and those with more than twenty. Portfolios were rebalanced annually. The study was for the 35-year period ending at year-end 2014.

The following chart from the study shows that, aside from a short period of time around the dot-com boom, the greater the seasoning, the higher the returns. At the end of the 35 years, $1 invested in the group of companies with the greatest seasoning was worth more than three times as much as the same $1 invested in companies with the least amount of seasoning.

Getting Rich Pumping Gas

Battleboro, Vermont, resident Ronald Read provides a real-world example of the power of investing in seasoned blue-chip companies.

In a 2015 story, the WSJ’s Anna Prior recounted how Read accumulated an estate valued at almost $8 million. Mr. Read, who passed away at age 92, made a modest living pumping gas for many years at a Gulf gas station in Brattleboro.

A Five-Inch Stack of Stock Certificates

How did Read manage to become a multi-millionaire? He invested in dividend-paying blue-chip stocks. As Ms. Prior writes, Mr. Read received the actual stock certificates and “left behind a five-inch-thick stack of stock certificates in a safe-deposit box.” At his passing, Mr. Read owned over 90 stocks and had held his positions often for decades. The companies he owned paid longtime dividends. And when his dividend checks came in the mail, Read reinvested in additional shares. Apparently, he was a master of the theory of compound interest. Not surprisingly, his list of stock holdings included such seasoned dividend-payers as Johnson & Johnson (dividend since 1944) Procter & Gamble (dividend since 1865), J.M. Smucker (dividend since 1949), and CVS Health (dividend since 1916)—all names we follow and own for clients. No high flyers for Ronald Read, and certainly no speculative, unseasoned technology names.

Anna Prior didn’t share every stock Read owned with readers, but based on the investment strategy Read followed as presented by Prior, we are confident he would have liked many of the common stocks included in our Retirement Compounders® Portfolios, including those I’ve profiled below.

Dividend Since 1899

Takeovers are often a positive for investors, and this case is no exception. But it is bittersweet that one of our longtime favorite utility stocks, Avista, is being acquired by Hydro One a Canadian power company out of Ontario. Avista has been paying dividends since 1899. And in each of the last 13 years, the utility has raised its dividend for shareholders. In the last 10 years, Avista’s dividend has compounded at 9.25% annually. For a utility during the worst recession since the Depression, that’s a compelling record of success. Avista is a solid utility business, with over 600,000 electric and natural gas customers in an area covering around 30,000 square miles of the North West. The company also owns Alaska Electric Light and Power. Avista shares popped on the Hydro One announcement, and YTD the stock is up 32%.

Boeing Poised to Benefit from Air Passenger Growth

In 2016, 3.8 billion travelers took to the air. The International Air Transport Association, the trade association for the world’s airlines, expects within the next 20 years the number of passengers will double to 7.2 billion. Feeding the airlines all the planes they’ll need will be Boeing and Airbus. Boeing, with its state of the art 787 Dreamliner, is the most technologically advanced aircraft producer today. The jet producer is also a leading contractor to the United States government for aircraft and other technologies.

Royal Philips: Shareholders Taking Notice

Royal Philips is a company I have written about in the past. Philips is a turnaround story. Investing in turnaround stories is a strategy that requires patience, but also one that offers potential. We initially started investing in Philips in 2013 and the shares were laggards. But since the start of 2016, they’ve been on a tear. Management’s turnaround strategy is gaining traction, and shareholders have noticed.

Philips is focused on using technology innovation to improve people’s lives. The company has a long history of innovation, tracing all the way back to 1891, when Frederik Philips, in support of his innovative son Gerard, purchased a factory in Eindhoven. Soon Philips would become one of the largest producers of filament lamps in Europe. Even now, Philips is innovating the light bulb. Philips’ Hue brand of “smart” bulbs allows users to change the color and brightness of their lights from their smartphones. It also allows lights to be connected to televisions, gaming consoles, and third-party apps, to enhance the experiences of each. Philips is, of course, much more than light bulbs. Today the company produces products for video, audio, grooming, dental care, medical devices, automotive parts, kitchen appliances and more.

152 Years of Dividends: A Commitment to Shareholders

Among the thousands of publicly traded companies in the United States, very few have paid dividends for 50 years. Fewer yet have paid for 100. A scant few have been paying dividends every year since 1865 as has PNC. PNC’s 152-year record of consecutive annual dividend payments shows a commitment to shareholders by management and the board. Generations of board members and executives have assured shareholders that they will be rewarded for their investments. One reason PNC has been able to maintain its dividend credibility for so long has been prudent management. An example of PNC’s prudence is its large stake in BlackRock. PNC owns about 21% of BlackRock, the world’s largest money management firm. The stake is valued on PNC’s balance sheet at a deep discount to its fair market value. PNC’s Blackrock position gives PNC an even stronger capital position than a simple reading of its balance sheet would suggest. In banking, the higher the capital, the better.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. Staying on the topic of the risks of investing in new technologies and unseasoned companies, Barron’s recently penned a bearish piece on Netflix, pointing out the key vulnerability for the highly- priced company. To wit:

Netflix shares fell only five percentage points this past week, even as the company’s key vulnerability was laid bare for investors—twice. Walt Disney, a vital source of Netflix content, said it will pull Disney and Pixar movies and shows after next year to start its own streaming service. And Facebook launched a video service with niche shows covering sports, cooking, reality contests, social-media celebrities, and more. For now, it’s far from a threat to the runaway leader in subscription streaming, but then, when Netflix was founded 20 years ago this month, it was far from a threat to Blockbuster.

One of the all-time great story stocks, Netflix (ticker: NFLX) has a plot flaw, one that could cut its share price by more than half by the end of the decade. It is chiefly a hit-renter, not a hit-owner. Even among the expanding universe of Netflix Originals, top performers like House of Cards and Orange Is the New Black, which have both run for five seasons, are licensed, not owned. There is only one example of an owned Netflix hit reaching a second season—Stranger Things, which returns in October.

There are two ways to accumulate owned hits: Make them or buy them. Both require copious amounts of cash, and Netflix is running low. This year, it expects to burn through $2 billion to $2.5 billion. That’s a remarkable acceleration from the $1.7 billion last year and just over $900 million the year before. For now, it is financing this spending with junk-rated debt. But its long-term debt stands at $4.8 billion….

A NETFLIX STREAMING SUBSCRIPTION COSTS $7.99 to $11.99 a month, depending on the picture resolution and number of screens allowed. Prices could push higher, but to generate enough cash to make sense of its stock valuation, Netflix might have to charge at least $20 a month, grow its subscriber count to 150 million, and bring spending under control—unlikely, given that its menu of content could become less compelling, not more. There’s always the possibility of a takeover, and having seen some doozies over the years, we can’t rule that out. But only a handful of media players can afford Netflix, and no company on earth can squeeze more economic value out of it than Disney. The fact that Mickey is walking speaks volumes….

Netflix co-founder Reed Hastings once attributed its market-leading stock gains to “momentum-investor-fueled euphoria.” That was in a shareholder letter nearly four years ago, when the stock was $51 a share. He was right then, and he’s even more right now. Our advice for readers is to enjoy the streaming service while it’s still a bargain, and to stay well clear of the shares.”

P.P.S. In a time dominated with news on the fate of Obamacare and any potential replacement, Dan Mitchell of the Cato Institute keenly refocuses attention on what is the world’s biggest government program, and one that is headed for a fiscal train wreck: Social Security. The program will soon have an annual budget of $1 trillion, a budget larger than that of all but six countries on Earth. But Dan points out the scary fact that the program will have a shortfall of $44.2 trillion between now and 2095. My question on Dan’s cogent analysis: With financial prospects like this, who exactly is lending the government money for three decades at a rate of less than 3%?

P.P.P.S. Caterpillar and other major corporations are getting optimistic about the global economy. Increasing demand for things like steel and construction equipment may be indicating increased economic activity. In its second-quarter earnings report, CAT highlighted growing demand in China’s construction sector and a revitalization of the mining industry. The company boosted its earnings outlook for the year, despite sluggish infrastructure spending in the U.S.

P.P.P.P.S. For the first time in six years, gold is on track to outperform stocks. What is driving gold prices higher? Some investors are worried about upcoming negotiations over the U.S. debt ceiling, while others point to a Federal Reserve that may be getting cold feet on the path to interest rate normalization. Still others point to increasing demand as a hedge against a stock market rally without a significant pull-back in 19 months. We include gold in portfolios to hedge against the anticipated risks described here as well as the unanticipated risks not yet on investors’ radar.

The information contained in this letter is for informational and educational purposes only. It is not intended nor should it be considered investment advice or a recommendation of securities. Past performance is not a guarantee of future results. It is possible to lose money by investing. You should carefully consider your investment objectives and risk tolerance before investing. Please contact our office directly with any questions regarding items appearing in the letter.