September 2019 Client Letter

It’s easy to declare a recession is on the horizon. The economy, like the markets, is cyclical, and eventually, our economy will go from a growth path to one of contraction. But today there are few signals that our economy is heading into negative territory. Despite a significant lack of recessionary evidence, some continue to beat the recession drum. By example, last month the Washington Post gave us this: “Most economists believe the United States will tip into recession by 2021.”

I’m not too concerned yet about a recession for the following reasons: For starters, trade negotiations with China could eventually get resolved. If the U.S. gets a deal with Beijing, ending the tariffs and uncertainty, then the economy could gain momentum. Secondly, current monetary policy is not aggressively tight. When rates are too high, the economy often slows. Thirdly, the leading economic indicators have yet to show the persistent monthly declines that often precede recession. Lastly, I hesitate to make any economic predictions beyond 2020 until we know the outcome of next year’s elections.

Your Bigger Concern

As reported in The Wall Street Journal,

Earlier this month, Mr. Powell cited Fed policy this year as an important reason the U.S. economy has proved resilient despite increased headwinds. Officials pivoted first from raising rates to putting them on hold, and then to cutting them as conditions shifted. His comment implicitly acknowledged how failing to deliver now on markets’ expectations of another rate cut could damage the outlook.

I think we can hold off on mailing the Fed a thank-you card for saving the day. In our view, bigger government is not the answer. Nor should we look for it to be. The Fed would be more helpful if it cited the real reasons we have a resilient economy, which include corporate tax cuts in the U.S. and less regulation.

Years of low and negative interest rates have done little to create sustained and robust global economic growth, but they have forced many investors into taking on more risk.

However, if I look on the bright side of low-interest rates, the drop in yields has made dividend- and income-focused stock portfolios fashionable again. Some sectors benefiting from the decline in interest rates include utilities, real estate, and consumer staples. We own positions in all three.

Fortis

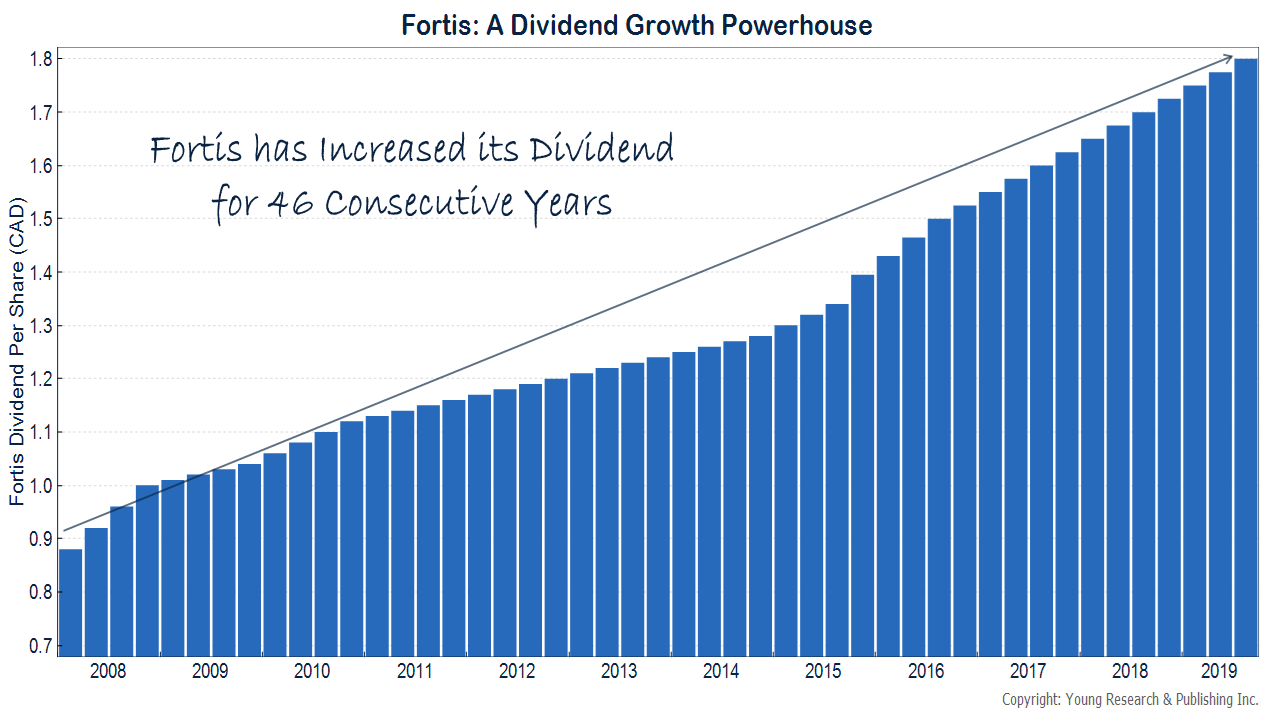

Not only have low rates improved sentiment toward utility stocks such as Fortis, but they have also been a boon for Fortis’s capital-intensive business. Fortis has increased its capital spending by $1 billion to $18.3 billion for the next five years. The additional capital spending will allow Fortis to modernize its grid, deliver cleaner energy, and invest in its U.S. and Caribbean businesses. Fortis also plans on expanding its liquified natural gas (LNG) facility at Tilbury, British Columbia, which is used to store and ship LNG. Tilbury is one of only two LNG facilities on Canada’s west coast. The other, Mt. Hayes, is also owned by Fortis. Alongside these valuable capital expenditures, Fortis is celebrating its 46th consecutive year of dividend increases. Fortis’s management has confidence that the company will maintain its investment-grade credit rating and deliver on its plan for 6% annual dividend growth.

American Tower Corp.

The capital-intensive mobile technologies industry is another area that may benefit from lower interest rates. Buying property and building towers costs a lot of money. Mobile data traffic grew at a rapid 87% compound annual growth rate from 2 petabytes back in 2006 to 3,570 petabytes in 2018. Carrier investment in wireless capex and spectrum has been increasing with each new technological enhancement. From 2000 to 2005, as the industry transitioned from 2G to 3G, it spent an average of $17 billion a year. During the 3G expansion years that lasted from 2006 to 2010, it was $23 billion annually. And in the 4G network expansion years from 2010 to 2018, it was $30 billion each year. Now, as the industry rolls out 5G, another significant expenditure will be needed. American Tower can use low-interest debt to expand its operations to accommodate its customers’ 5G rollouts.

Kimberly-Clark Corp.

A combination of strong second-quarter results and favorable capital markets are likely behind Kimberly-Clark’s plan to make what management called “growth investments” behind its brands. The brand portfolio that Kimberly-Clark is backing is filled with winners. The company has five so-called “billion-dollar brands,” which generate revenue of a billion dollars or more each year. Those include Huggies, Kleenex, Kotex, Cottonelle, and Scott. Other great Kimberly-Clark brands include Pull-Ups, Andrex, Depend, WypAll, and more. The company’s brands touch nearly a quarter of the world’s population each day in over 175 countries. Kimberly-Clark maintains first or second position in 80 of the countries in which it competes.

Gold

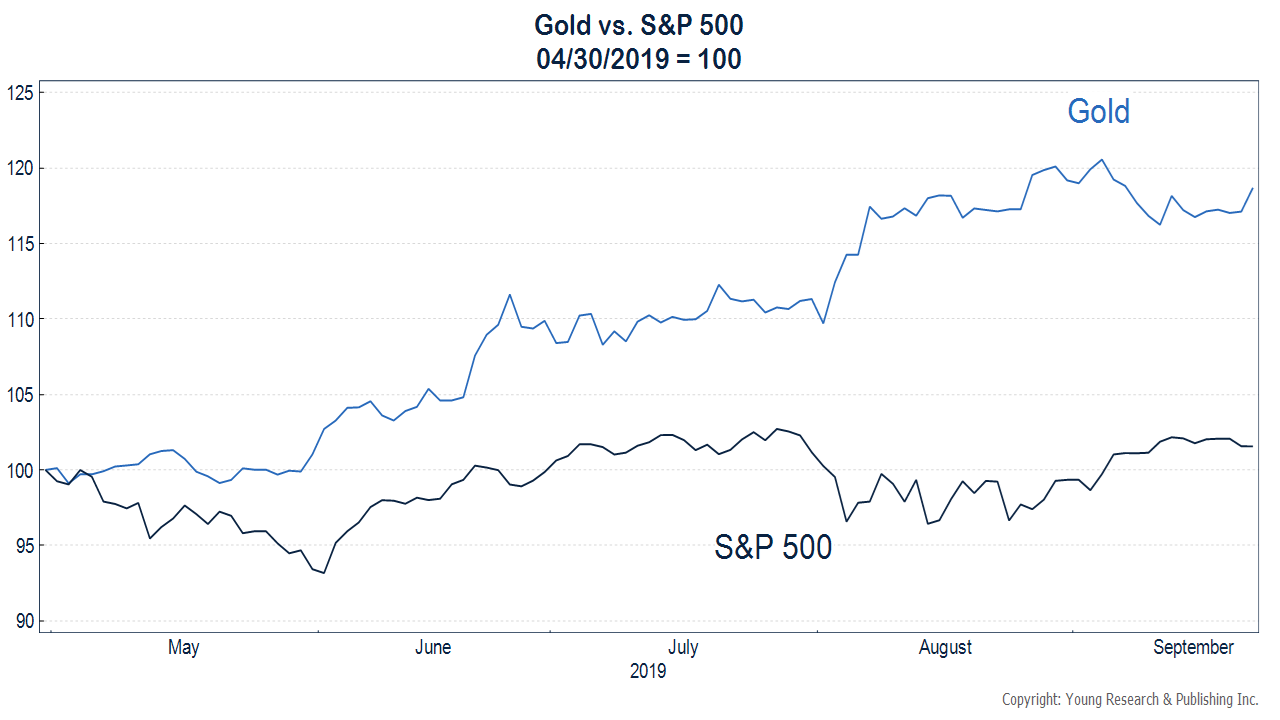

Gold is also benefiting from the low-rate environment. Gold, which tends to perform well during uncertain times, has surged this year. Much of gold’s positive return can likely be attributed to a lower-interest-rate environment as compared to concerns about the U.S. economy.

Gold is a Unique Holding

Gold is a unique holding within your portfolio. It is one of the few positions we own that pays no interest or dividends. Gold is also the only position we hold where we hope the price goes down. Today, jewelry is the primary use for the metal. But investors’ demand is what dictates the price of gold. And that demand is often driven by fear: fear of war, inflation, a currency crisis, or some other troublesome event.

We view gold as an insurance policy for your portfolio. For much of the last five years, gold has experienced little price movement; but, since the end of April, gold is up significantly compared to a modest rise in the S&P 500.

Jack Bogle and Dick Young

With gold rising, the China trade headline, and next year being an election year, many are expecting a higher degree of uncertainty and volatility compared to the last couple years. We believe it is wise to have an appropriate plan for your financial goals and your risk tolerance. With a solid plan in place, you will be in a better position to ride out market volatility and avoid panicking and the dangers of trading in and out of the market.

In his last interview for CNBC, Jack Bogle, as always, offered sound advice on why timing the markets never works.

The bad years, the crisis years, the Dow dropped by about 50% and people panicked and got out of course at the lows and now we are back. I think the gain from that level is maybe 200%. So, it shows you that when you act on the emotions of the marketplace, you’re making a big mistake.

I always have said stay the course, and don’t let these changes in the market, even a big one that was a 50% decline, don’t let that change your mind and never, never, never be in or out of the market. Always be in it at a certain level and you may want to be 50% stocks like I am. You may want to be 75% or 25%. That’s probably a decent range. But never be out and think you can get back in because your emotions will defeat you totally.

My dad had similar advice to subscribers of his monthly investment newsletter, Richard C. Young’s Intelligence Report. Back in March 1996, he urged readers to abandon the strategy of market timing.

I want to startle you, shock you, and convince you beyond any doubt that market timing is a bankrupt strategy whose time has never come.

Here’s the only example you’ll ever need to never market-time again. T. Rowe Price put these numbers out a year or so ago. The original research was done by Towneley Capital Management.

If you invested $1 for a 31-year period (1963–1993), your $1 grew to $24.30 at year-end 1993. But if you missed just the 10 best trading days out of the 7,802 trading days, your $1 investment grew to only $15.40. That’s right, by missing just 10 days, your return was slashed by 37%. Do you know what percentage of the trading days we are talking about here? Less than one-quarter of one percent (0.128%).

Now then, if instead of only 10 days you missed the best 40 days of 7,802 trading days, your $1 grew to only $6.50. By missing just 0.51% of the total trading period, your return was slashed by an unimaginable 73%. How’s that for missing the boat?

OK, what if you missed out on just 1.15% of the trading days? Well, by missing just 90 of the total 7,802 trading days, your $1 made a glacier-like advance to $2.10. You would have been head-faked out of 91.4% of your long-term profits.

Still with me? The news gets worse—a lot worse. In-and-out trading necessitates not one, but two correct buy/sell decisions. It does no good to get out of the market advantageously unless you can also get back in advantageously—and both are low odds, big “ifs.”

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. Retirement Compounders® (RC) is our globally diversified portfolio of dividend- and income-paying securities. Currently, the RCs offer yields of approximately 3.1% or 80% more than the current rate of inflation. Aside from an attractive yield, we also prefer our stocks to maintain annual dividend increases. Recent increases were announced by Microsoft (+11%), Kroger (+14%), Clorox (+10%), American Tower (+20%), and Lowe’s (+14%).

P.P.S. Some of you will notice a change in your gold holdings. In many tax-deferred accounts, we recently sold shares of SPDR Gold Shares (GLD) and purchased shares of SPDR Gold Minishares (GLDM). State Street manages both funds, and both invest in physical gold stored in London vaults. The primary difference between the two funds is the expense ratio. The Minishares fund has an expense ratio of 0.18% compared to an expense ratio of 0.40% for GLD. We continue to hold GLD in accounts where a sale would generate a taxable event, and in accounts where the transaction costs would eat up the potential savings from a lower expense ratio.

P.P.P.S. Recently in The Wall Street Journal, former Senator Phil Gramm and hedge fund consultant Mike Solon detailed some terrifying aspects of Sen. Elizabeth Warren’s plan to tax wealth. The writers noted the difference in the average $1.1 million of wealth held by Americans aged 65 to 74, and the average of $288,700 held by those aged 35 to 44 is the product of a lifetime of hard work and savings. But Warren’s plan only sees inequality in those differences. Most retirees have at least some of their wealth invested in stocks. Warren’s plan would diminish the value of their savings. The authors write:

Several Democratic congressmen and presidential candidates have proposed to limit stock buybacks, which are estimated to have increased stock values by almost a fifth since 2011, as well as to block dividend payments, impose a new federal property tax, and tax the inside buildup of investments. Yet among all the Democratic taxers and takers, no one would hit retirees harder than Sen. Elizabeth Warren.

Her “Accountable Capitalism Act” would wipe out the single greatest legal protection retirees currently enjoy—the requirement that corporate executives and fund managers act as fiduciaries on investors’ behalf. To prevent union bosses, money managers or politicians from raiding pension funds, the 1974 Employee Retirement Income Security Act requires that a fiduciary shall manage a plan “solely in the interest of the participants and beneficiaries . . . for the exclusive purpose of providing benefits to participants and their beneficiaries.” The Securities and Exchange Commission imposes similar requirements on investment advisers, and state laws impose fiduciary responsibility on state-chartered corporations.

Sen. Warren would blow up these fiduciary-duty protections by rewriting the charter for every corporation with gross receipts of more than $1 billion. Every corporation, proprietorship, partnership and limited-liability company of that size would be forced to enroll as a federal corporation under a new set of rules. Under this new Warren charter, companies currently dedicated to their shareholders’ interest would be reordered to serve the interests of numerous new “stakeholders,” including “the workforce,” “the community,” “customers,” “the local and global environment” and “community and societal factors.”

Eliminating corporations’ duty to serve investors exclusively and forcing them to serve political interests would represent the greatest government taking in American history.

Client Portal

Client Portal Secure Upload

Secure Upload Client Letter Sign Up

Client Letter Sign Up