Silver Soars

July 2020 Client Letter

If you thought the FAANG stocks were hot, check out silver. The FAANG stocks may grab the headlines in the financial press, but silver has doubled from its March lows. Gold prices have also been in an uptrend. Gold hasn’t rallied as much as silver, but gold is trading at a new all-time high, and it is up an impressive 28% YTD.

As many of you know, we have long invested in precious metals and currencies for clients, even when it wasn’t popular. My dad’s interest in gold and currencies goes back even further. He recently wrote the following:

Gold’s 50-Year Price Explosion

I was there from the start. In early August 1971, I had just joined internationally focused research and trading firm Model Roland & Co.

On 15 August 1971, President Nixon shocked the world by announcing that the U. S. would no longer officially trade dollars for gold. At that time, gold’s fixed price was $35/oz.

By 1980, gold would hit an astronomical $800/oz.

OK then, back to Model and the firm’s wonderful head partner, Leo Model. From my first day onboard at Model, I started covering a bevy of major Boston institutional accounts. I was 30 years old, and I would become friends with analysts, portfolio managers and traders at Wellington Management, Fidelity Investments, First National Bank of Boston, State Street Bank, State Street Research, Endowment Management, Studley Shupert, and Keystone Management through my entire investment career on Federal Street in Boston.

I immediately realized that international trading (including gold shares and arbitrage), as well as monetary strategy and world currencies, was going to be my focus from August 1971 onward.

Five decades later, these subjects remain today my daily focus. I have been a buyer of gold, silver, and Swiss francs for decades, and I have never sold a single one of my positions.

By 1972 I was off to London on a mission for Leo Model. My job was to produce a strategy report for Model, Roland & Co. on the international gold shares market. It took eight days in London to meet all the insiders with whom Mr. Model had arranged visits. Except for a single, most unpleasant glitch (understatement), all went well.

I went on to submit a 25-page strategy report to Mr. Model. Shortly thereafter I was informed that Mr. Model had sent my report along to the firm’s chief monetary guru, one Edward M. Bernstein, one of the architects of the Bretton Woods monetary agreement.

Remember, I was 31 years old, and quite terrified to hear that EMB had been brought into the loop.

On 7 August 1972, I received the surprise of my young life: EMB wrote back on his corporate letterhead:

I think the collection of papers on gold is excellent. It seems objective and pointed. I have no suggestions. Put me on the list to get what you put out on gold.

Sincerely,

Edward M. Bernstein

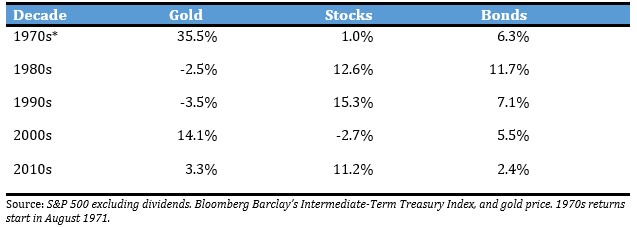

Like many financial assets that have risen over the long run, the 50-year price explosion in gold hasn’t been a straight line. Gold has compounded at 8.5% since August 1971, which compares favorably to stocks and bonds; but as the table below shows, gold has also experienced long dry spells.

The 1970s were gold’s best decade, with the price compounding at more than 35%. Over the next two decades, gold was down in price. During the 2000s, gold prices soared again, rising at a compounded annual rate of over 14%. During the 2010s, gold didn’t perform as well as it did during the 2000s, but it kept pace with inflation and edged out bonds.

Historical Return of Gold, Stocks, and Bonds by Decade

We Buy Gold and Hope It Goes Down

Gold is the only asset we buy with the hope that it will fall in price. Why? Because, as you can see in the table above, when the price of gold is down, everything else in your portfolio is likely to be up. The 1980s and 1990s were a dismal time for gold, but they were boom times for stock and bond prices. Likewise, the 1970s and 2000s were a great time to own gold, but stocks were down in price, and bonds delivered modest returns given the interest rate environment at the time. During the 2010s, stocks boomed and, while it didn’t decline in price, gold was a laggard.

We would like nothing more than to be able to say with conviction that gold prices have peaked and are likely to fall over the coming decade. Sadly, no such claim can be made. The horse has left the barn with respect to the scale of U.S. debt, deficits, and monetization. Central bankers and politicians seem to be on track to print and spend until inflation smacks us all on the nose.

What’s more, the stock market, as measured by the S&P 500, has reached extreme levels of concentration and valuation reminiscent of major market-tops. Think 1929 and 2000. That’s not a prediction that the S&P 500 is poised for a sharp reversal, but we wouldn’t rule it out.

A handful of technology companies now dominate the S&P 500. Broad diversification no longer seems to properly describe the index. The technology sector’s share of the S&P 500 (we include interactive media and internet commerce companies) is now a staggering 39%. Technology has become a more important part of the economy, but the technology sector has also historically had the most companies experience catastrophic losses (70% loss with little recovery).

How much of your retirement portfolio are you willing to gamble on a handful of companies (mostly non-dividend-payers) and one sector with a spotty record?

In a recent MarketWatch article, “The Hidden Risk Hiding in your S&P 500 Index Fund,” Brett Arends quoted an economist and a money manager to highlight risks with the S&P 500 that don’t seem to be appreciated.

“The performance of stock markets, especially in the United States, during the coronavirus pandemic seems to defy logic,” notes Yale’s Nobel Prize-winning economist Robert Shiller. “With cratering demand dragging down investment and employment, what could possibly be keeping share prices afloat? The more economic fundamentals and market outcomes diverge, the deeper the mystery becomes…”

And as he points out elsewhere, the index right now is valued at 30 times average per-share earnings of the past decade. Prior to this year, it has only matched or exceeded that level twice since records began in the 1880s: In 2000, and 1929.

Arends continues:

Where does this leave the ordinary index fund investor? In a nutshell: Possibly exposed to fundamental index risks that they may not realize. They’re betting heavily on the FANMAGs. (If skyrocketing Tesla TSLA, now valued at nearly $300 billion, joins them maybe we can call them the FATMANGs).

“The notion that equity indexes are somehow risk-free states has to my mind always been a dangerous fallacy which has been amplified by the rise of passive investing,” comments Mark Urquhart, money manager at Baillie Gifford in Edinburgh, Scotland.

Actually, all three of the significant market crises which my career has contained—technology, media and telecoms (TMT), the financial crisis and now the coronavirus—have been linked by so much damage being done to particular parts of the index that it demolishes the thesis that index investing can diversify away such risk.

Dotcom-Style Speculation

Valuation and concentration are not the only similarities to the late 1990s. We also see a level of speculation we haven’t seen since the dotcom era.

Tesla and other electric vehicle stocks seem to be the epicenter of this cycle’s speculative fervor. Tesla’s market value is greater than the combined market value of Toyota and Volkswagen. Together, Toyota and Volkswagen will produce about 20 million vehicles this year. Tesla will likely produce about 500,000 vehicles.

The EV dreamers will tell you that Tesla’s market value makes perfect sense and that the electric vehicle market will become a winner-take-all situation. Maybe, but we view that as a long-odds loser’s bet given that many global auto companies are national champions. If Tesla begins to dominate in EVs, foreign automakers will likely get government support. EVs are also likely to become extremely commoditized, as electric motors tend to be much simpler than internal combustion engines.

Don’t Confuse Speculation with Investment

There is nothing wrong with the people who want to speculate in Tesla or other stocks. Speculation has always been part of the financial landscape, and it always will be. The problem occurs when speculation is confused with investment. Speculating with your serious money is never a wise decision. That is true even though some speculators make money some of the time—just as some gamblers make money some of the time. But as we all know, the longer you sit at the roulette table, the greater are your chances of leaving it a loser. The same is true of stock market speculation.

Investing offers opposing odds. The longer you invest, the greater your chances of making money. Measured over a one-year holding period, the historical record shows that the odds of losing money in stocks is one in four, or 25%. Extend the holding period to 15 years, though, and history says the odds drop to 0. That’s right, since 1926, stocks have not lost money over any 15-year period.

Investment vs. Speculation

So how does one distinguish investment from speculation? According to Ben Graham, the father of value investing, “An investment operation is one which, upon thorough analysis, promises safety of principal and a satisfactory return. Operations not meeting these requirements are speculative.”

Graham’s definition is useful, but it leaves much open to interpretation. We would clarify the difference by saying speculation is concerned primarily with price, whereas investment is concerned primarily with value. Value is measured by a future stream of earnings, dividends, or growth in business worth. Philip Carret, author of The Art of Speculation and founder of one of the oldest mutual funds in America, explained, “The man who bought United States Steel at 60 in 1915 in anticipation of selling at a profit is a speculator. . . On the other hand, the gentleman who bought American Telephone at 95 in 1921 to enjoy the dividend return of better than 8% is an investor.”

Retirement Compounders Grounded in Investment

Our dividend-focused Retirement Compounders® (RCs) strategy is grounded in investment. We aren’t stock market traders or speculators. We don’t offer strategies for either approach. We buy only dividend- and income-paying securities in the RCs. The prospective yield on dividend stocks is known at the time of purchase, and a majority of dividend stock returns come from dividends and the reinvestment of those dividends. If we know the yield today and have a sense of how the income stream will develop in the future, we can make a judgment about a stock’s investment value.

Stocks lacking a dividend stream, and especially an earnings stream, require a crystal ball approach to divine what the future may hold. No, thank you.

When you invest in stocks that pay dividends today and offer the prospect of higher dividends tomorrow, price becomes an afterthought. By example, if you bought $10,000 worth of JNJ at year-end 1986, you would have earned $210 in dividend income during the first year you held the stock (the shares offered a 2.1% yield). In every subsequent year, JNJ raised its dividend. From 1986 to 2020, the dividend compounded at 11.9% annually.

Over that same time period, JNJ’s share price experienced six separate drawdowns (peak-to-trough declines) of more than 35%. A 35% drop is a significant correction and enough to rattle the cages of speculators and investors alike.

But consider this: If you held your shares for the entire period, that $210 of annual dividend income on your initial $10,000 investment would have increased to over $9,800 in 2020. Yup, JNJ would now be kicking off dividend income that is almost equal to your initial investment. Does it really matter that the stock fell over 35% a few times over the last 34 years?

That is the essence of investing.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. Did you know that intermediate-term corporate bonds are up 5.4% YTD, as measured by the Bloomberg Barclay’s Intermediate Corporate Index? The Dow is down 6% for the year. During the height of the volatility in the spring, we shifted entirely out of Treasury securities and began buying individual corporate bonds. The prospective yields on corporate bonds have come down significantly from levels earlier this year, but they still beat the less than 1% yields on every Treasury security out to a 20-year maturity.

P.P.S. Dividend suspensions and cuts have mounted in 2020, but some firms are still increasing shareholder payouts. Kiplinger notes:

But if dividend hikes are a sign of fiscal strength during normal times, they’re a downright bold statement when they’re made in the middle of a recession. And some companies have indeed provided payout growth throughout the past couple of months—many of them with longstanding streaks, including several members of the S&P Dividend Aristocrats that have improved their dividends for at least 25 consecutive years.

Some of the companies we own that have increased their dividend this year include Johnson & Johnson, Procter & Gamble, American Tower, Medtronic, and IBM.

P.P.P.S. As a result of all the uncertainty from COVID-19, potential political risk (this is an election year), and global risks including a Chinese property bubble, investors are wise to maintain a balanced portfolio. Most portfolios we manage for clients contain a portion dedicated to fixed income and gold. Bonds and gold may not keep pace with stocks during a bull market, but they offer much-needed ballast in down markets.

P.P.P.P. S. We recently filed our Form CRS relationship summary with the SEC. This document is intended to inform retail investors about the types of client relationships and services we offer. A copy of our Form CRS can be found on the home page of our website, www.younginvestments.com, under the Relationship Disclosure link. We encourage you to review the document and contact us with any questions.

P.P.P.P.P.S. During the last several months, we have had investment strategy discussions with adult children of current clients. Some clients reached out, asking if there is flexibility with our new account minimums. The answer to this question is yes. If you have children or other family members you believe would benefit from our investment counsel, please encourage them to give us a call or send an email. We are happy to help.