October 2013 Client Letter

Most investors now realize the powerful influence monetary policy has on U.S. financial markets. And the most important player in the conduct of monetary policy is the chairman of the Federal Reserve.

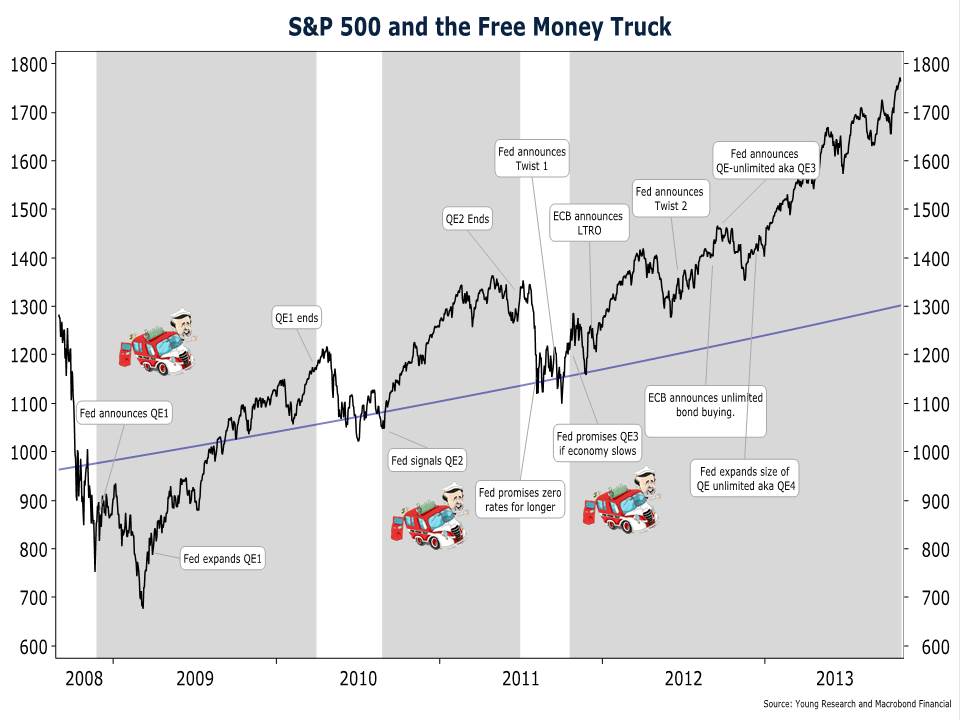

As we have witnessed, under the Bernanke Fed, an unprecedented amount of money has been electronically created for the purchase of bonds. As the Fed continues to buy bonds, interest rates are kept artificially low. Meanwhile, the extra cash created sloshes around the financial markets, and some is used to buy stocks, bonds, and real estate. In our view, the markets have not risen entirely due to increased economic activity and an improvement in efficiency but as a result of the additional cash in the system.

After President Obama’s first choice for Federal Reserve Chairman was shot down by the left wing of his own party, he appointed Janet Yellen. Ms. Yellen received her Ph.D. from Yale while studying under James Tobin, a pioneer in Keynesian economics. We have expressed concern regarding monetary policy under Ben Bernanke and believe it could get even worse under Ms. Yellen. She will most likely take a dovish stance on monetary policy, which means the printing presses will keep on trucking.

A Bloomberg article from earlier this year highlighted some of Ms. Yellen’s economic viewpoints. To economists who favor free-market capitalism, it is not a good read. To wit:

In an April 1999 speech at Yale, Yellen argued for activist policies. “Will capitalist economies operate at full employment in the absence of routine intervention? Certainly not,” she said. “Are deviations from full employment a social problem? Obviously.”

As early as 1995, when she was a Fed governor, Yellen was discounting [the] notion of the primacy of the inflation goal, saying both objectives—maximum employment and low and stable inflation—needed to be pursued in a balanced way.

“When the goals conflict and it comes to calling for tough trade-offs, to me, a wise and humane policy is occasionally to let inflation rise even when inflation is running above target,” she said during a debate on inflation-targeting in 1995.

A Yellen Fed is likely to sound and act a lot like the Bernanke Fed, but with a bias toward pumping greater amounts of liquidity into the financial system.

We may have even seen shades of a Yellen Fed at the central bank’s September policy meeting. The Fed was widely expected to announce a reduction in their massive money-printing campaign. Many expected a reduction in monthly bond purchases of $10 billion. But instead of making what amounted to a tweak in policy, the Fed hesitated. The economic impact of the Fed’s decision isn’t all that significant. The Fed’s own economists admit that quantitative easing (QE) boosts growth by only 0.10%-0.20%. But the signal the Fed sent with its decision was indeed impactful, both on future monetary policy and investment markets.

From the Fed’s September meeting, we came away with three takeaways. The first is that despite an emerging consensus among academic economists that money printing is ineffective and may even harm economic welfare (something ordinary citizens recognized long ago), the Fed’s faith in money printing hasn’t wavered.

Second, the Fed stubbornly continues to insist—five years after the official start of the economic recovery, and despite glaring evidence to the contrary—that the high unemployment rate is not structural (not related to the business cycle).

Third, Bernanke reaffirmed that his Federal Reserve is overly focused on the short term when monetary policy is known to work with long and variable lags. The reasons the Fed cited for not making a marginal reduction in its money-printing campaign were: 1) short-term fiscal policy; 2) the near-term trend in economic data; and 3) the near-term trend in core inflation.

Okay then. We know the Federal Reserve is going to be run by an uber-dove for the first time in over three decades. We also know the Fed still believes in the power of money printing and continues to deny there is a large structural component to the high rate of unemployment. Ms. Yellen has also publicly admitted she would not hesitate to put the Fed’s employment mandate ahead of its inflation mandate. (We take the primacy of the employment mandate under Yellen as a given).

Moving forward the bar for ending the Fed’s money-printing campaign will be even higher than under the Bernanke Fed. A continuation of the Fed’s aggressive monetary interventions may have unsettling implications for future stock market volatility. As our Free Money Truck chart shows, the Fed’s activist policies have boosted stock prices to levels that are far above our estimate of fair value. And in the past when money printing was halted, stock prices quickly reverted back to fair value.

The problem with continuing QE is the potential for creating another bubble. We have seen this bubble situation before. In the early 2000s, high valuations were justified as a result of new efficiencies from technology and the internet. Leading up to 2008, then Fed chairman Alan Greenspan pointed to new credit derivatives as one reason why risks could be controlled by financial institutions. Today, the justification for excessive stock market valuations is the TINA (there is no alternative) factor. The Fed’s policy of holding short-term interest rates at zero and putting pressure on long-term interest rates has convinced many investors to bid up stocks to prices that imply dismal medium-term returns. As in 2000 and 2007, the Fed appears unmoved by the financial excesses that its policies are creating.

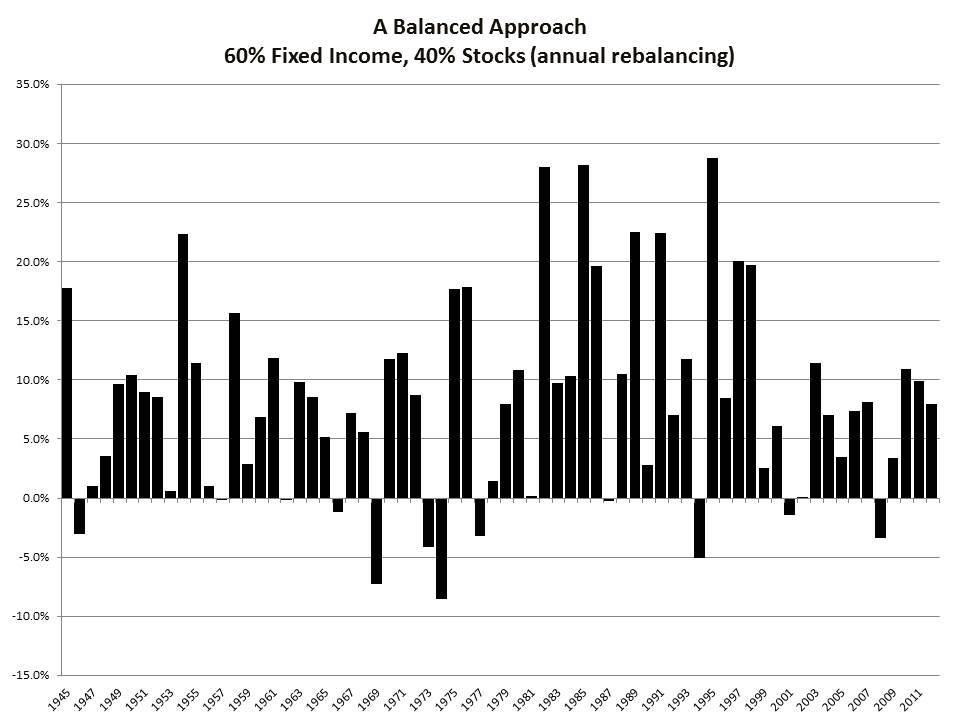

Our concern with Fed policy is one reason we favor a balanced portfolio. As our Power of Counterbalancing chart shows, a balanced portfolio can significantly reduce the magnitude of losses in down years for the stock market. Over the last six decades, the largest down year for a hypothetical portfolio invested 50% in bonds and 50% in stocks (rebalanced annually) was less than 9%. When the dotcom bubble collapsed and the NASDAQ fell 39%, 21%, and 32% in 2000, 2001, and 2002, our hypothetical balanced portfolio earned 6%, -1%, and 0%.

And when the real estate market plunged in 2008 and the S&P 500 cratered 37%, our hypothetical balanced portfolio was down only 3%. Retired investors and those soon to be retired cannot put a price on the comfort that a balanced portfolio offers when bubble-like conditions are prevalent in financial markets.

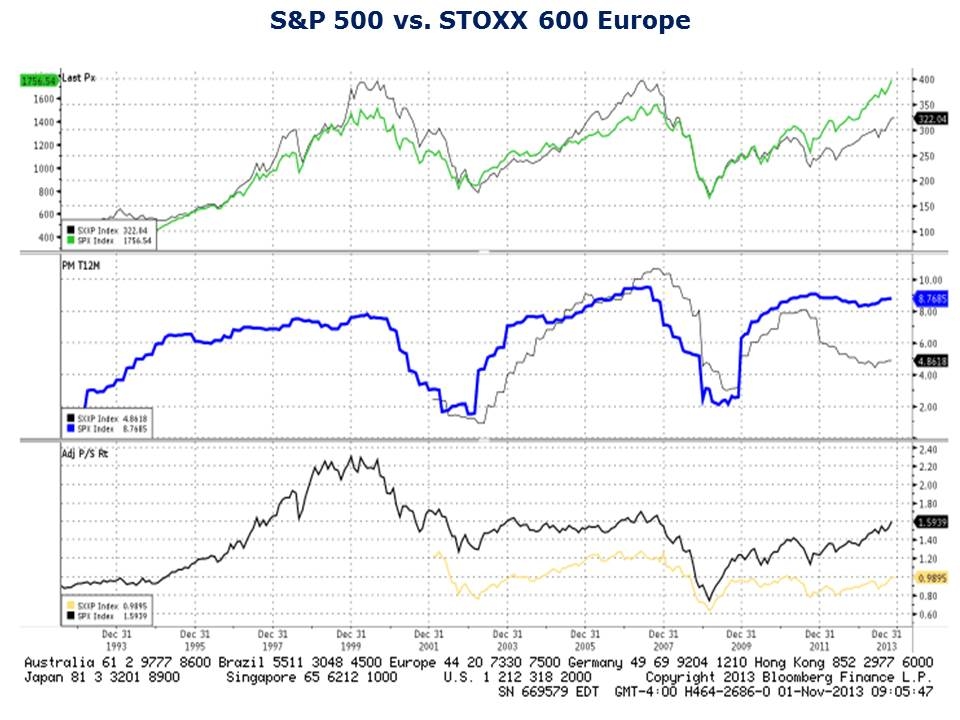

With U.S. stocks entering what we would describe as a speculative blow-off phase we are finding that international markets such as Europe offer investors more reasonable values. Our chart on the STOXX Europe 600 shows that 1) European stocks still haven’t surpassed their prior bull-market highs; 2) profit margins in Europe are depressed; and 3) European stocks trade at a 33% discount to U.S. shares on a price-to-sales basis.

European stocks likely trade at discounted valuations to U.S. stocks because investors are still concerned about the risk of a euro-area financial crisis. For the better part of the last year, the euro area has experienced relative calm, but that has more to do with Germany having elections in September than with any lasting solution to the crisis. With German elections now over, the risk of a flare-up in Europe has increased.

Angela Merkel (the sitting chancellor of Germany) won a resounding victory in recent German elections, but a surge by an anti-euro party in Germany helped push her junior coalition partner out of parliament. As a result, Merkel will have to form a new left-leaning coalition with the Social Democrats, who finished second in the German elections. The Social Democrats are strong backers of European integration, and are hostile toward the harsh austerity measures Merkel has required in order to support bailouts.

What does a left-leaning coalition between Merkel and the Social Democrats mean for the euro experiment and for financial stability in the region? Though the Social Democrats are pro-euro, the strong showing of the anti-euro startup party, Alternative for Germany, is likely to act as a check on more generous bailout packages for the euro area’s troubled governments. A banking union, which many non-German, euro-area policymakers view as a solution, is also likely out of the question, as both Merkel and the Social Democrats oppose it.

A probable scenario in the euro area is more of the same. Germany will agree to continue bailing out the euro area’s troubled governments, so long as painful austerity and structural reforms are conditions of the bailout money. This suggests that if the euro is going to break apart in the medium term, it will come as a result of political opposition in one of the PIIGS (Portugal, Ireland, Italy, Greece, Spain) countries.

Portugal, Greece, and Ireland may all require further assistance over the coming year, which could result in escalating tensions. But the elephants in the room are still Italy and Spain. Economic conditions in both countries are dismal. The Spanish economy is a disaster. Home prices are still plunging, loan delinquencies are over 10%, unemployment is astronomical, and wages are falling.

The root of the problem is that neither Italy nor Spain is competitive. And the only way for a country to regain competitiveness when they can’t print their own currency is to devalue internally. That means falling wages and prices.

The $64,000 question is whether the populations of both countries will sit idly by and endure these miserable economic conditions for the sake of staying in the euro-zone. That isn’t a question that we (or anybody else) can answer with any degree of confidence today. Because of this uncertainty, our advised strategy to profit from the more favorable valuations in Europe is to pursue a targeted approach. We currently favor mostly non-euro European country shares and select issues within the euro-area. Sweden remains one of our favored markets. We invest in Sweden via the iShares MSCI Sweden fund and via individual companies in our Retirement Compounders equity portfolios.

Some of our other favored plays in Europe include global blue-chip dividend payers such as British American Tobacco (UK), Vodafone (UK), and Philips Electronics (Netherlands).

At Richard C. Young & Co., Ltd., the balanced portfolios we craft for clients include more than just U.S. stocks and bonds. We invest in precious metals and foreign currencies to hedge against currency and inflation risk and we include international stocks to participate in global growth. Under most normal investing scenarios, investors benefit from a diverse asset mix without relying too heavily on one asset class.

Have a good month, and as always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Sincerely,

Matthew A. Young

President and Chief Executive Officer

P.S. In our August letter we wrote to you about the tailwind we expected Koniklijke Philips NV shares to receive from the company’s Accelerate! restructuring program. In the third quarter that tailwind began to propel Philips’ results. During the last quarter, Accelerate! helped produce a 33% increase in operational results. CEO Frans van Houten said of the successful program, “We continued to make good progress on the Accelerate! journey. Our overhead-cost-reduction program has resulted in EUR856 million in total gross savings to date, including EUR183 million realized in Q3 2013.” Philips isn’t done with its Accelerate! program, nor is that the only driver of growth at the company.

Another efficiency program called End2End is streamlining logistics and inventory management at Philips. And scientists and engineers at Philips are pioneering new tools to lead the way in image-guided medical procedures and therapies. In consumer electronics, Philips is innovating products for air purification, monitoring, and personal care.

The strong results encouraged a sharp rally in Philips shares on the day they were announced (Oct 21). And, in an effort to return more value to shareholders, Philips is beginning a share buyback program worth EUR1.5 billion.

P.P.S. We expect the Janet Yellen appointment to eventually be bullish for gold. It is our belief Yellen will be less focused on price stability and inflation and more interested in employment. The Yellen mandate will require more QE, leading to higher inflation down the road.

P.P.P.S. According to an October 21 opinion article in The Wall Street Journal by Fred Barnes, “Democrats, especially Senate Majority Leader Harry Reid, are fit to be tied as they watch cherished social programs gradually shrink. The sequester, enacted during the struggle over the debt limit in 2011, was the brainchild of the White House. It requires $1 trillion in cuts over 10 years in non-entitlement spending, $84 billion in 2013 and $109 billion in 2014.

To say the sequester has backfired for Democrats is putting it mildly. The specter of automatic cuts was supposed to scare members of a Senate-House panel assigned to forge a bipartisan budget accord. If they failed, the sequester would become law. Democrats believed this would never occur. But it did.

Now across-the-board cuts go into effect annually without the need for a fresh vote in Congress or the president’s signature. Nor are Republicans forced to offer Democrats the sweetener of tax increases. The sequester is cuts and only cuts. As a result, Senate Minority Leader Mitch McConnell noted proudly last week when announcing the end of the shutdown that “government spending has declined for two years in a row [for] the first time in 50 years.”

Client Portal

Client Portal Secure Upload

Secure Upload Client Letter Sign Up

Client Letter Sign Up