May 2013 Client Letter

It’s not easy finding a company whose share price is down 55% on the year. And you most likely would not expect such a collapse to come from a boring utility company. But such is the case for Atlantic Power, a utility company that owns a diversified portfolio of power generation assets in Canada and the U.S.

Why did the shares of a supposed staid utility, a utility that began the year with a dividend yield of over 10%, no less, crater 55%? Has the Federal Reserve’s endless money printing campaign finally caused investors to go mad? Well, yes, but in the case of Atlantic Power, the stock did a face-plant for a more basic reason: the dividend was slashed. In late February, Atlantic Power announced a 66% reduction in its monthly dividend. Shareholders were crushed. It turns out that Atlantic was shelling out much more in dividends than it was generating in cash flow—an obviously unsustainable arrangement.

I bring up Atlantic Power to highlight the potential perils of reaching for income and buying stocks solely on the basis of yield. With interest rates currently in the tank, income investors and conservative investors alike are reaching for yield in every nook and cranny of the financial system. Some probably saw the 10% yield on Atlantic Power and thought, “why not?” Those investors might have said to themselves, “What’s wrong with a 10% yield on a safe utility stock?” In hindsight, that would have been a costly mistake.

Companies operating in generally safe industries are not always a safe investment. Enron, after all, was classified as a boring pipeline company. Fannie Mae carried the implicit backing of the full faith and credit of the United States. Both companies cost many investors their fortunes.

At Richard C. Young and Company Ltd., we have made our share of mistakes (and will make more in the future), but our goal is to side-step the types of blunders that investors in Atlantic Power, Enron, and Fannie Mae made.

Dividend Stocks with High Barriers to Entry

We favor high-dividend-yielding stocks, but we don’t reach for yield. We favor companies with high barriers to entry that appear to have clean balance sheets or readily available access to capital markets. And we need to be confident in the long-term business outlook for a company. We don’t mind riding through temporary price volatility as long as we believe the company’s business prospects have not been permanently impaired. And, where we may be wrong? Well, that is why we craft diversified portfolios.

No matter how durable a business is or how high its barriers to entry are, there is always the risk of the unknown. New regulations, new innovations, and unforeseen liabilities, among other things, all have the potential to vastly change the value of a company. By example, you wouldn’t want your entire net worth tied up in a wireless telecom company even though the industry’s long-term prospects look promising. What if a new satellite technology comes along, making today’s wireless providers obsolete? Or what if a new cellular phone operating on wi-fi networks comes along and drastically reduces the demand for wireless bandwidth?

We will never be able to avoid unknown risks entirely. What we can do is reduce the potential for risk. One of our favored strategies to reduce risk is to favor companies owning a strong record of dividend increases. Annual dividend hikes do not just boost shareholders’ returns and help investors keep pace with inflation, they are a powerful signal. A higher dividend is a strong indication that management and the board are confident in the future prospects of their business. Rarely does a company hike a dividend if it is not confident it can generate the additional cash flow to fund that dividend.

Many companies we own have recently raised their annual dividend, including Johnson & Johnson (J&J), Procter & Gamble (P&G), Phillip Morris, and AT&T.

Johnson & Johnson

It may not be surprising, but one of the highest-profile companies in the world is also one of the stock market’s longest-serving Dividend Aristocrats. J&J recently said it would raise its quarterly dividend by 8%, extending a streak that has run for half a century.

The history of J&J is replete with innovation. Firsts they’ve developed include mass-produced dental floss, first-aid kits, maternity kits, feminine sanitary products, adhesive bandages, tearless baby shampoo, acetaminophen, and more.

But the real value for J&J lies in its branded consumer products business. Band-Aid, Neutrogena, Johnson & Johnson baby products, Listerine, Tylenol, Carefree, Visine, and others fill out a portfolio of famous brands J&J can rely on to generate mountains of cash for dividends.

Procter & Gamble

No company works harder than P&G to know its customers. Management at P&G has invested more in market research than any other company. P&G reaches out to millions of customers each year, spending more than $400 million on over 20,000 customer research studies. A measure of P&G’s success is its top placement on the SymphonyIRI Group New Product Pacesetters report, where it has placed 132 products in the top 25 over the last 16 years. That’s more than P&G’s six largest competitors combined. P&G has paid a dividend since 1891 and increased that dividend for 59 consecutive years. In April, P&G raised its dividend by 7%, bringing the five-year compound annual growth rate in dividends per share to 8.5%.

Philip Morris

Philip Morris International is the world’s largest publicly traded manufacturer and marketer of tobacco products. Excluding China, the company’s estimated market share exceeds 27%. Philip Morris owns seven of the world’s top 15 international brands, including the world’s top brand, Marlboro. Marlboro outsells its next two closest global competitor brands combined. Geographically, 41% of the company’s revenues are generated in the European Union, 24% in Eastern Europe, the Mideast and Africa, 22% from Asia, and the balance from Latin America and Canada.

Although global cigarette demand is not expected to increase over coming decades, Philip Morris International is forecasting long-term revenue growth of 4%–6% and earnings growth of 10%–12%. The company expects to generate growth through a combination of market share gains, productivity improvements, and price increases.

Morris generates loads of free cash flow (cash flow from operations minus capital spending). Over the last 12 months, the company generated free cash flow of $8 billion—all of which was returned to shareholders in the form of dividends and share buybacks. In the five years since Philip Morris International has been an independent company, the dividend has been increased by 85%.

AT&T

The inventor of the telephone, Alexander Graham Bell founded Bell Telephone in 1877. Through a series of mergers and divestitures, eventually Bell Telephone would become part of its former subsidiary, AT&T. For decades AT&T would grow and eventually become a monopoly that would be dismantled in 1984. In 2005, one of the company’s progeny, SBC Communications, would buy AT&T Corp. and form the new AT&T that exists today.

Currently, AT&T owns the nation’s largest 4G network, which covers 275 million people and 105.2 million wireless subscribers. AT&T also has the best worldwide coverage of any U.S. carrier with voice service in 225 countries and data roaming services in 205 countries.

AT&T is a dividend stalwart. It doesn’t have as long of a record of consecutive dividend increases as P&G or J&J, but the record is an impressive 28 consecutive annual increases. What AT&T lacks in dividend increases it makes up for in yield. AT&T shares yield nearly 5% today.

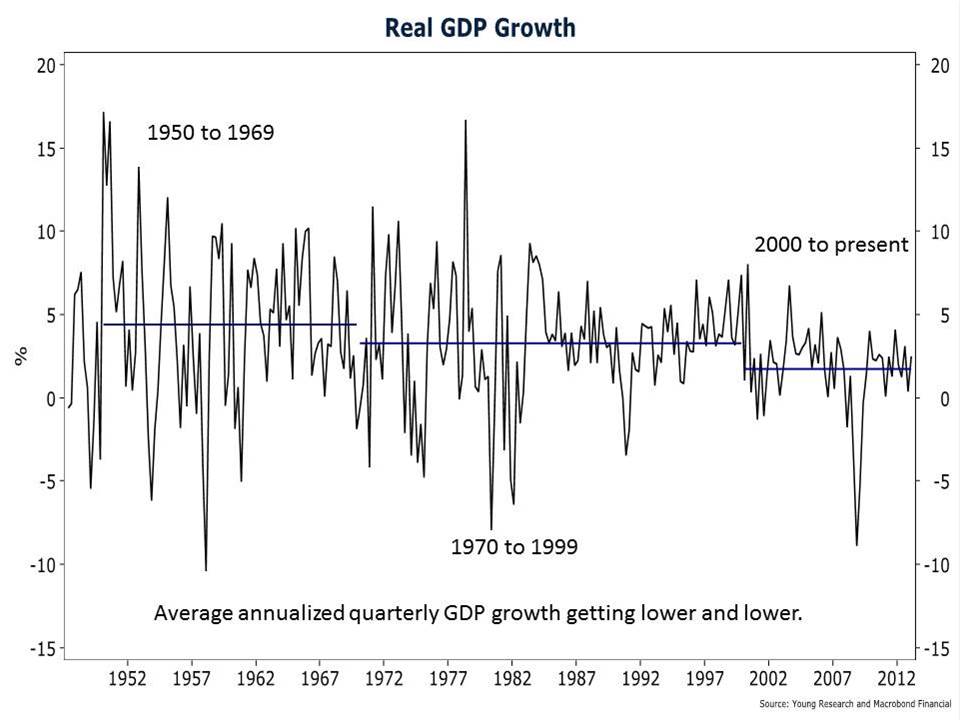

On the U.S. economic front, we are still seeing relatively weak GDP numbers. The initial estimate for first-quarter GDP was 2.5%. Economists had expected 3% growth. GDP numbers in general appear to be trending down. When people used to talk about trend GDP, it was at 3.5%, then 3%, and now it’s looking like something else altogether.

By example, from 1950 to 1969 the annualized rate of quarterly real GDP growth averaged 4.4%. In the post-gold-standard/pre-internet years from 1970 to 1999, the average was about 3.3%. But since 2000, the average has dropped significantly, to 1.73%.

The question is, is this the new normal, and, if not, what will get this economy moving at previous speeds? There isn’t a lot of growth in the various sectors of the economy. Overall spending accounted for 2.24% of the 2.5% increase in GDP. Personal consumption rose at a 3.2% annual rate, the fastest growth since the first quarter of 2011. Given the increase in payroll taxes and very low savings levels, consumption may be at risk.

If growth slows from here, which the most recent data suggests, we may be approaching stall speed in the next quarter or two. But then again, that may all get revised away as the Bureau of Economic Analysis (BEA) is doing a comprehensive revision to GDP with the July release. The BEA will be adding new and subjective categories to GDP that haven’t been present in the past. Odds are that the revisions will make growth look better than has been reported. The bottom line on GDP? Trend growth ain’t what it once was.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Sincerely,

Matthew A. Young

President and Chief Executive Officer

P.S. A little known fact about many 401(k) plans is that employees may be able to rollover plan assets into an IRA outside of their company while still employed. These in-service distributions can enable you to increase your investment options and diversify your portfolio. If you are interested in having Richard C. Young & Co., Ltd. manage your retirement assets, check with your plan administrator to see if you are eligible for an in-service, non-hardship withdrawal.

P.P.S. Lately, investors have been selling gold—citing tame inflation, a bull stock market, and a reduced need for safe-harbor investments. When we initiated our position in gold, it was for a hedge, and gold still fills that role today. At some point, interest rates will rise and inflation could significantly increase, which would most likely be bad for stocks and positive for gold.

P.P.P.S. Predicting when interest rates will rise from their historical lows is an increasingly difficult task. In a Wall Street Journal Survey conducted in May, 98% of economists predicted that the yield on the 10-year Treasury note would be higher in December. But consider: In May 2011, 98% of economists forecasted rising rates. Rates fell. In May 2012, 98% said rates would rise. They fell again. The Journal noted that betting on interest rates could lead investors into dangerous waters. Instead the Journal offered the following advice: “Investors need to make sure they’re not forgetting the primary role of bonds in a portfolio—to protect against a significant drop in stocks.”

Client Portal

Client Portal Secure Upload

Secure Upload Client Letter Sign Up

Client Letter Sign Up