July 2024 Client Letter

In a recent investor presentation given by Kinder Morgan, the company described its network of natural gas and refined product pipelines and terminals as “irreplaceable infrastructure.” That’s a theme that you’ll find holds true for a number of the companies owned in your account. These businesses own rights of way and infrastructure that can’t be easily duplicated. We favor infrastructure as an investment. After all, how can an economy operate without functioning highways, energy pipelines, electricity, and so on?

In Goldman Sachs’s May 2022 letter on “Stagflation Risk and What Investors Can Do About It,” the letter’s author, Simona Gambarini, said, “Investors may want to consider increasing exposure to real assets such as commodities, real estate and infrastructure, which may have the best chance of outperforming in an inflationary or stagflationary environment.”

Kinder Morgan’s infrastructure assets include 66,000 miles of natural gas pipelines that move around 40% of America’s natural gas production… as well as:

- 702-billion cubic feet of working natural gas storage capacity, or about 15% of total U.S. capacity,

- Around 9,500 miles of refined product and crude oil pipelines,

- 139 terminals,

- 16 Jones Act–compliant vessels,

- 135-million barrels of total liquids storage, and

- around 1,500 miles of CO2 pipelines that can move 1.5-billion cubic feet per day.

According to Wood Mackenzie, since 2015, demand for natural gas in the United States has grown from 78-billion cubic feet per day to 108-billion cubic feet per day. By 2030, demand is projected to rise to 128-billion cubic feet per day. Most natural gas demand in the United States comes from the power generation industry. With the expansion of cloud computing and artificial intelligence, the number of data centers in the United States is growing rapidly. The power-hungry data centers need supply. Demand for natural gas power generation could increase as much as 3- to 10-billion cubic feet of gas per day according to projections from BCG, McKinsey, Berstein, and Wells Fargo.

Kinder Morgan has worked to develop predictable cash flows, 68% of which are derived from take-or-pay or hedged contracts. In January, Fitch Ratings described Kinder Morgan’s contract structure:

Largely Fixed-Fee-Based, Mostly Take-or-Pay: KMI generates roughly 60%-65% of total segment EBDA (management term) from take-or-pay-type contracts. A further approximately 25% comes from fixed-fee but volume-exposed arrangements. KMI adheres to a five-year laddered hedging plan for directly commodity-price-exposed businesses. Collectively these provide a level of cashflow stability that is supportive of KMI’s credit profile.

Kinder Morgan shares yield 5.84% today.

MAP: Kinder Morgan’s Assets

Build America

Another company with a nearly irreplaceable portfolio of infrastructure assets across America is Union Pacific. Founded in 1862 when Abraham Lincoln signed the Pacific Railway Act, Union Pacific has been and remains one of America’s largest railroads. Today, Union Pacific operates nearly 33,000 route miles of track spread over 23 states with the slogan “Building America.” The tracks include 7 international border crossing points, 30,000 railroad crossings, and nearly 17,000 bridges. Along with nearly 33,000 employees, Union Pacific uses over 7,000 locomotives to move over 8,000,000 carloads a year. Imagine trying to build all that from scratch today?

Union Pacific is positioned to potentially benefit from some current market trends. As state and federal governments demand tighter emissions standards, rail could become more attractive as a shipping alternative when compared to trucks. Converting cargo shipments from truck to rail can reduce emissions by 75%. Trains are also great at reducing congestion on highways. One freight train can replace 300 trucks.

Alongside Burlington Northern Santa Fe, Union Pacific operates a duopoly that accounts for most of the freight rail traffic in the Western half of the United States. After the Trump administration’s efforts to lessen reliance on Chinese manufacturing, Trump’s renegotiation of NAFTA into the USMCA, and the pandemic-driven desires to shorten supply chains, Mexico has become a destination for manufacturers looking to near-shore their operations. According to the Brookings Institute:

The USMCA, along with nearshoring, have significantly influenced North America’s trade and investment dynamics, which have been particularly key for Mexico’s growth, industrial evolution, and job creation. The shift in global trade patterns, especially in the context of the U.S.-China trade war, the “China+1” diversification strategy, and the Biden administration’s nearshoring strategies, has positioned Mexico as the U.S.’ number one trading partner and a crucial investment hub within North America.

Union Pacific is the leading rail provider between the U.S. and Mexico and the only railroad that serves all six major gateways between the two countries. Union Pacific shares yield 2.32% today.

Building Things That Build Things

A company that builds the things that build infrastructure is Caterpillar, the world’s leading manufacturer of construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives. Caterpillar was founded in 1925 with the merger of the Holt Manufacturing Company and the C.L. Best Tractor Co. The first new machine created by the merged company was the Model Twenty, designed by a young engineer named Harmon Eberhard, who had joined as part of Holt Manufacturing. Eberhard went on to become the chairman of Caterpillar’s board of directors, retiring from the company in 1966 after a 50-year career at the company. Eberhard attributed Caterpillar’s success to putting the customer first.

Today, Caterpillar has been in business for nearly 100 years, and in 2023 more than four million Caterpillar products were operating worldwide. Caterpillar has corporate operations in 25 countries, including around 150 locations. Its independent dealer network includes 156 dealers serving around 190 countries. Undoubtedly you have seen Caterpillar equipment at construction sites and road work projects throughout America and the world. In 2023, Interbrand ranked Caterpillar’s brand as the 83rd most valuable in the world, worth an estimated $8.065 billion. That’s just the brand name and logo.

The future of Caterpillar includes all the earth-moving equipment you’ve seen, but Caterpillar is about more than just dirt and ore. The massive engines Caterpillar builds can produce a lot of energy, and the rapidly growing number of commercial data centers in the world need reliable backup power. Caterpillar has been building engines and electric power systems for over 80 years, and power-hungry data centers around the globe are adopting them as alternative sources for the electricity they need. The company’s generators were even installed at the tallest data center in the world in New York City owned by Sabey Corporation.

The market for data center generators was valued at $7.49 billion in 2022 and projected to grow at a compound annual growth rate of 7.3% until 2030, according to Grand View Research. An analysis from the Electric Power Research Institute (EPRI) found that internet searches using artificial intelligence will require 10 times the electricity that traditional internet searches have used. By 2030, data centers could consume 9% of America’s electricity generation capacity. Data centers are one of the world’s fastest growing industries. Between 2017 and 2021, Meta, Amazon, Microsoft, and Google (owned by Alphabet) more than doubled their electricity usage. Maintaining the constant uptime required by these data centers requires, according to EPRI, “robust backup power solutions.”

In 2023, Caterpillar’s operations generated sales and revenues of over $67 billion, and profit per share reached $20.12, a 59% increase compared to 2022. In 2023, Caterpillar increased its dividend by 8.2%, returning $5 per share to shareholders. Today, shares of Caterpillar yield 1.73%, and the board has raised the dividend each year for the last 29 years.

Big Energy Future

This Spring, Vermont became the first state in the United States to attempt to hold fossil fuel companies liable for climate change damages. The state envisions funds coming from oil companies for flood and weather damages. There will most likely be legal challenges to Vermont’s new law that seeks to retroactively penalize fossil fuel companies for participating in what was, at the time, legal activity.

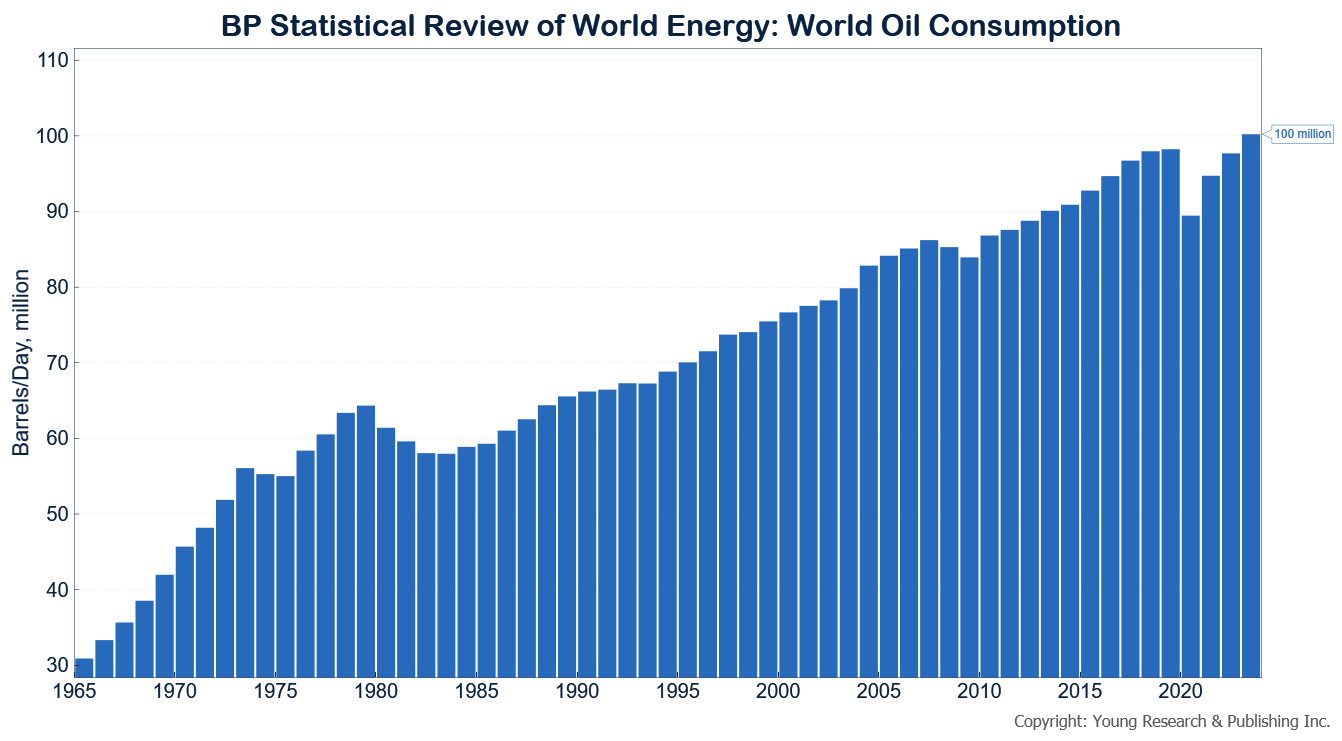

But despite efforts like those in Vermont, oil use is not going away. In fact, global oil consumption, which briefly fell during the pandemic response, has increased to its highest levels ever.

As explained by Andrea Guerzoni in Fortune, climate activism and legislation like that enacted in Vermont is making it difficult for smaller oil and gas companies to find funding. Those difficulties have led to consolidation in the oil industry, with bigger, better-funded companies buying smaller companies that can’t afford to pursue their own opportunities. Guerzoni writes, “It is becoming clear that global capital markets are restricting their funding of new oil and gas projects. With higher costs of capital to fund new projects from a smaller capital base, it will be left to larger players to develop the still-needed resources necessary to manage the net-zero transition.”

Some of you own ExxonMobil in your accounts. Exxon, America’s largest energy company, made a major acquisition over the last year, announcing a merger with Pioneer Natural Resources last October. The purchase of Pioneer more than doubled Exxon’s footprint in the oil-rich Permian Basin to an estimated 16-billion barrels of oil equivalent resources. By 2027, Exxon plans to produce 2-million barrels of oil equivalent per day from the Permian. Exxon is a Mergent Dividend Achiever, and the board of directors has raised the dividend each year for the last 40 years. Today Exxon shares yield 3.31%.

Election Year Boost?

As America works its way through another election year, the stock market has once again been strong. Of the 24 election years since 1928, only four saw negative performance for the S&P 500 stock index.

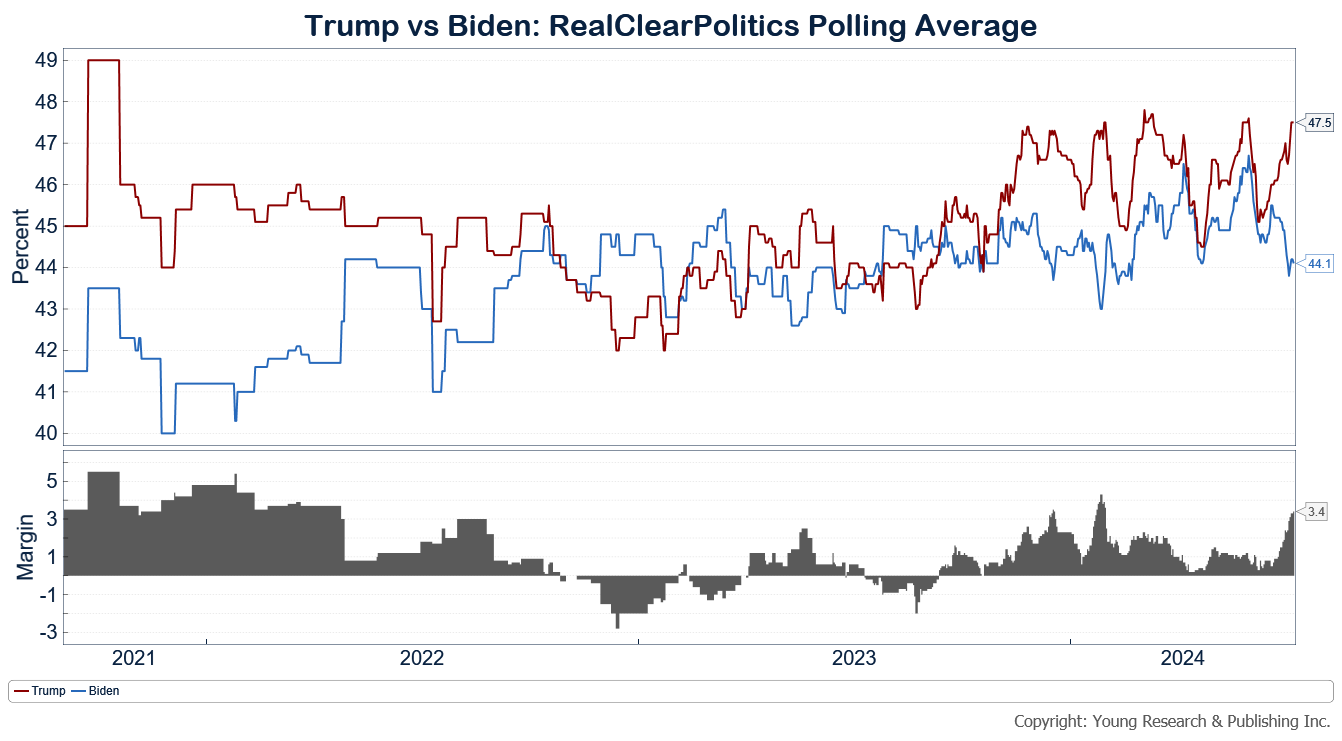

This year Americans will presumably be choosing between Republican Donald Trump and Democrat Joe Biden, with independent Robert F. Kennedy, Jr., on the ballot in many states as well. Polls suggest the race will be very close, with Trump maintaining a 1-point margin in the RealClearPolitics Polling Average.

The outcome of the election could have major impacts on investors and retirees. The tax plans proposed by the major party candidates are very different in their treatment of wealth, IRAs, capital gains, and income. We’ll be keeping an eye on these proposals as the election nears.

Have a good month. As always, please call us at (800) 843-7273 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

Client Portal

Client Portal Secure Upload

Secure Upload Client Letter Sign Up

Client Letter Sign Up