Three Decades of Helping Investors Like You

January 2020 Client Letter

Last year completed our 30th year providing investment counsel to investors like you who are retired or saving for retirement. As many of you are aware, the foundation of our investment strategy was formed by my dad during decades of researching and writing financial newsletters. His most widely circulated letter, The Intelligence Report, focused investors on the benefits of diversification, patience, and compound interest. He would often cite the knowledge he gained from Benjamin Graham, Wellington Management Company out of Boston, MA, and Jack Bogle.

The Intelligence Report encouraged readers to adopt an investment strategy focused on one’s own personal objectives and risk tolerance, not recent performance figures. IR also looked to simplify the investment process and concentrated on time-tested basics. Here are five of those strategies we use at Richard C. Young & Co., Ltd. to help investors achieve their long-term investment goals.

Your Money is Always Working

One of the easiest and most powerful investment strategies is harnessing the positive effects of compound interest. The compounding of money can significantly increase portfolio value. Compounding is done through the reinvestment of dividends. Our equity strategy emphasizes dividend-paying securities, allowing for the compounding process to take effect each year. Compounding can allow for portfolio growth even when stock market returns are modest.

You Receive Annual Pay Raises

We invest in blue-chip stocks with a history of paying dividends. A focus on quality companies paying out cold, hard cash each year is comforting for those relying on their portfolio for cash flow. But annual dividends are not the whole story. We also target companies that raise their dividend each year. Annual dividend increases are critical in helping offset the nasty effects of inflation—one of the most significant risks retired investors face.

Predictability in an Uncertain World

We all face the uncertainty of wondering whether markets will go up or down. A company with a long track record of annual dividend payments offers no guarantees. But these companies prefer to keep their streak intact. Many investors take comfort knowing it is likely they will receive dividend income year after year.

Lower Volatility Can Lower Anxiety

In most portfolios, we include a high-quality bond component, which helps reduce volatility. Yes, yields are low today. But many investors like to incorporate the concept of return of principal more than a return on principal. Bonds, falling under the category of return of principal, can lower volatility and help you sleep at night, knowing your entire portfolio is not linked to equity markets.

Comfort from 30 Years of Consistency

While our strategy has evolved, our basic investment tenets have remained constant—diversification, patience, and compound interest. It can be frustrating to invest in a fund, insurance product, or annuity that you do not understand. Most individuals intuitively understand the benefits of diversification, the need for patience, and how dividends provide the fuel for compound interest to work. Implementing these concepts can give you confidence that your hard-earned savings are positioned well for decades to come.

Today’s Economic Environment Looks Good

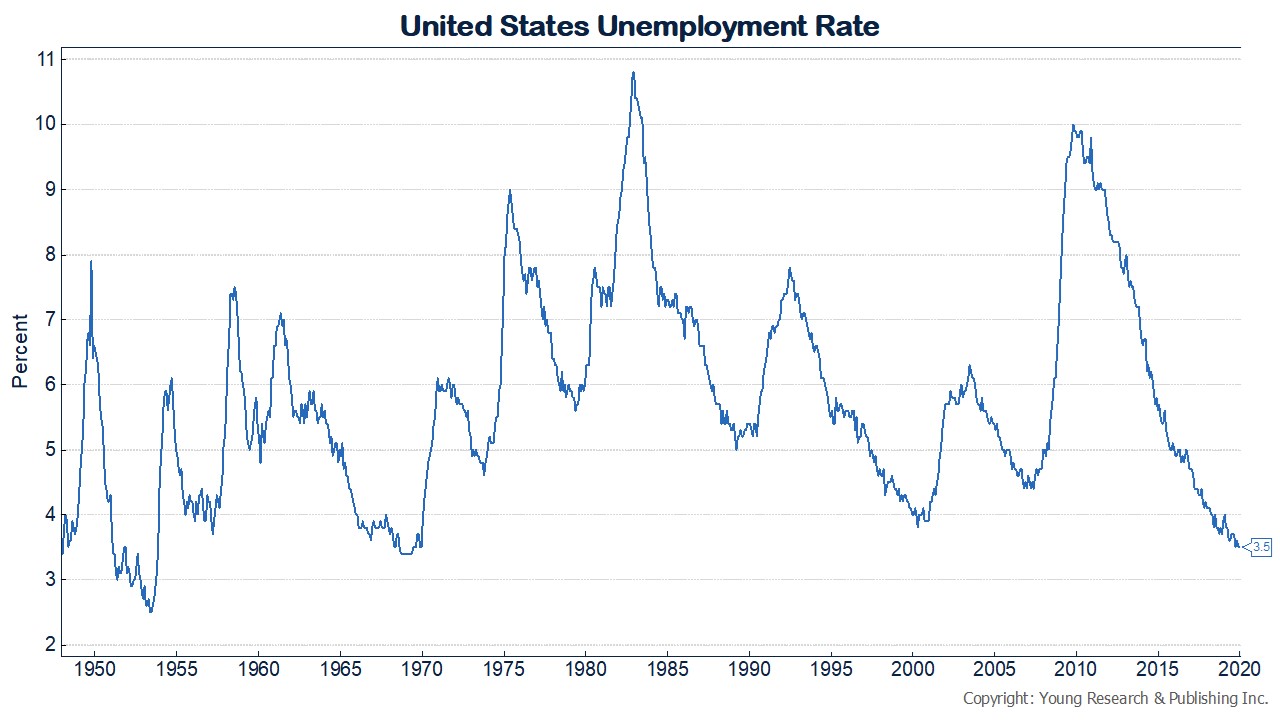

The U.S. economy has been humming along. The unemployment rate recently hit a 50-year low, and underemployment (considered a better measure of labor conditions by some economists) is the lowest on record. Anybody who wants a job in the U.S. should be able to find a job today.

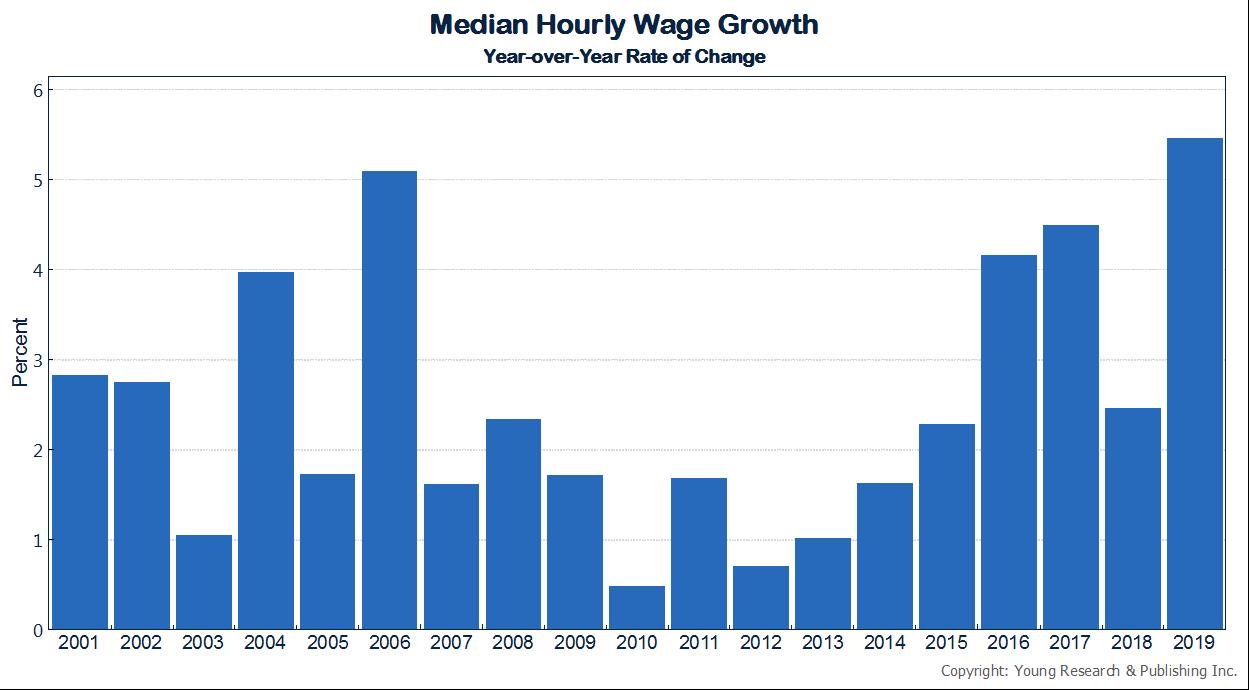

Alongside low unemployment, wages are increasing at the fastest rate this century. In 2019, median hourly wages increased by an impressive 5.5%.

With such a strong labor market, it’s no surprise that in December 2019 retail sales reached their highest value ever at $464.5 billion.

Services Sector Still Strong

The Institute of Supply Management’s (ISM) Non-Manufacturing Index has been holding steady above 50, indicating continued growth in the services sector of the economy. In the most recent survey of services companies by ISM, respondents reported shortages of workers for construction for the 45th month in a row and a shortage of temporary labor for the 6th consecutive month. The number of Americans working in construction is the highest it has been since October of 2007 and is only 175,000 workers away from its peak of April 2006.

The services side of the economy has become much more important over time. There are now over 108 million Americans working service jobs.

Trade Tensions Cooling

Investors have also taken comfort in what appears to be a cooling off in tensions between China and the United States. On January 15, President Trump and Chinese Vice-Premier Liu signed the first phase of a trade deal that aims to reduce tariffs and barriers created during the trade war and to address previous trade-related concerns.

Election Cycle Tailwind

In addition to a solid economic picture, stocks have the election cycle at their back. Historically, stocks do best in the third year of the election cycle, but election years also tend to be positive for the market. As I pointed out last month, during the previous 17 election years the stock market has only fallen twice.

The Good Environment Doesn’t Mean There Aren’t Risks

Despite all the good news, some areas could be troublesome. Corporate earnings growth for 2019 is likely to come in around 1% or less. Not exactly the standard of a roaring economy. Without a recovery in earnings, stock prices may come under pressure.

Another risk to the market is continued softness in the manufacturing sector. As best we can tell today, the weakness in the manufacturing sector has a lot to do with Boeing’s 737 Max problems and trade policy uncertainty, but it would be a mistake to ignore the weakness. The manufacturing sector has historically been a good barometer of broader economic conditions. If manufacturing conditions don’t improve, other sectors of the economy may start to weaken.

Fed Encouraging a Bubble-Bust Cycle

A weak manufacturing sector and trade policy uncertainty are two of the reasons the Federal Reserve has maintained a very accommodative monetary policy. While pumping liquidity into the financial system is often beneficial to stock market investors, it can distort markets and mislead investors.

Federal Reserve Bank of Dallas President Robert Kaplan recently commented on the market’s perception of the Fed’s liquidity purchases and the effects of that perception: “Many market participants believe that growth in the Fed balance sheet is supportive of higher valuations and risk assets.” He continued, “I’m sympathetic to that concern” and “I think it’s wise to acknowledge it and be cognizant of that concern as we think about our next actions.”

With the valuation on some stocks in the market at nose-bleed levels, merely turning off the money printing press could be all that is needed to cause a correction.

A Flash Point in the Middle East?

Another potential flash-point for financial markets is the Middle East. The recent exchange of hostility between the United States and Iran was taken in stride by investors; but a more severe outbreak of hostilities in the Persian Gulf region could impact the global price for oil, driving up costs for nearly all other activities.

ETFs Not as Diversified as Some Believe

The problem facing investors then is how to minimize their investment portfolio’s exposure to these risks. The first answer is diversification. For some, that might mean buying index funds; but, as we saw during the dot-com bust, index funds and ETFs tend to become concentrated in a limited number of pricier stocks.

Broad diversification simply doesn’t exist in most index funds. Among the eleven sector ETFs representing the S&P 500 sectors, three contain just two stocks that make up nearly 40% of the index’s market capitalization.

Even the broader-based S&P 500 ETFs lack the diversification we favor. Five holdings, Apple, Microsoft, Google, Amazon, and Facebook, represent 18% of every fund and ETF tracking the S&P. That’s higher than at any time on record, including during the tech bubble. Do you want almost 20% of your portfolio in a group of stocks offering an average dividend yield of only 0.44%?

How We Diversify for You

At Richard C. Young & Co., Ltd., we spread risk across industry sectors and individual holdings. Portfolios are built with a global view and a focus on dividends, dividend growth, stability, and staying power.

We also advise a healthy bond position for almost all investors. Bonds not only provide a steady stream of income, but they also tend to rise when stock prices fall. Our bond strategy eschews bond funds and ETFs where possible and instead favors individual bonds to mitigate the performance drag from spreads and fees.

Another component of the diversification efforts in most portfolios we manage is an investment in precious metals. We buy precious metals not with the idea that their value will soar, but to counterbalance risk. When precious metals, especially gold, rise in value, other types of securities are often losing value. Gold is an insurance plan for the unpredictable.

In fact, in response to the recent flare-up of tensions with Iran, gold rallied. Gold is now trading at over $1,550 an ounce. That’s around $100 an ounce more than just two months ago, and nearly $300 an ounce more than eight months ago. Gold tends to bounce during periods of unrest as investors move into safe-haven assets.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. On December 20, 2019, President Trump signed the Secure Act. Much of the new law’s focus was on retirement plans, including a mixture of good and bad provisions. One provision that may affect many of our clients is the change to rules regarding required minimum distributions. Morningstar explains the new rules:

For any individual born after June 30, 1949, the required beginning date [of required minimum distributions] is April 1 of the year after the year in which such individual reaches age 72 (or, in the case of certain plans, if he or she is still working, after the year in which he or she retires if later). Previously, the trigger age was 70½. As a result of this change, no IRA owner will have a required beginning date in 2021.

One of the unfavorable provisions in the law is the elimination of the stretch IRA, which could force heirs of IRAs to pay significant upfront tax bills on their inheritance, rather than stretch those obligations out over time.

P.P.S. Donald Trump may not be your favorite individual. But for many workers and investors, the Trump administration has not produced the terrible results some expected. Writing for the National Review, Victor Davis Hanson explains:

• Paul Krugman: The Nobel Prize winner insisted that Mr. Trump not only would crash the stock market but also suggested that stocks might never recover.

• Larry Summers: The former treasury secretary envisioned a recession within a year-and-a-half [sic], thanks to Mr. Trump’s being elected.

• Steven Rattner: The former head of the National Economic Council predicted a market crash of “historic proportions.”

Yet, three years later, in terms of the stock market, unemployment, energy production, and workers’ wages, the economy has done superbly.

P.P.P.S. As I mentioned earlier, the Federal Reserve has been injecting liquidity into the financial system by printing money to buy T-bills, thereby expanding the size of its balance sheet. Over the last three months, the Fed has undone more than half of the entire balance sheet unwinding that began in 2017. Powell & Co. insist the balance sheet expansion is not quantitative easing (QE) but is instead a remedy for problems in overnight lending markets.

By the time quantitative and non-quantitative easing ends, the Fed’s balance sheet is likely to be back near a record. What was once supposed to be an emergency measure to stem losses during the financial crisis has become standard operating procedure at the Fed.

Central bank intervention in markets has been going on for so long now, many have become numb to it, but there is nothing ordinary about regularly distorting markets on a massive scale.

The payback is likely to be ugly when it comes; the sharp correction in stocks in the 4th quarter of 2018—the first time global central-bank balance sheets shrank since the QE expansion began—may foreshadow what lies ahead. Trying to time such an event is never a useful exercise, but adequately preparing your portfolio to weather a bust is indeed useful.