Volatility Returns

February 2018 Client Letter

There Are No Guarantees in Investing

It’s wise to remember that investing in the stock market is not a strategy guaranteed to make you wealthy. In fact, the stock market at times can decrease your wealth. Twice over the last 19 years, once between 2000 and 2002 and again from 2007 to 2009, the stock market declined by more than 50%.

At the start of this century, a freshly retired couple was likely feeling pretty good. The economy was humming along nicely, 9/11 had not yet occurred, and the stock market was delivering some of its best returns ever.

Since then, the stock market has crashed twice, the economy has gone through two recessions, with one accompanied by a financial crisis, and the Fed took risk-free interest-generating investments out of the game for nearly a decade. Such an environment has tested the nerves of even the most seasoned investors. The problem for many is that, once you retire, you no longer have the security blanket of a regular paycheck to get you through volatile periods. For many investors, the primary source of income in retirement is an investment portfolio. Watching the source of your livelihood rise and fall by 50% is not a calming tonic.

Volatility and steep stock market losses often lead to the type of emotionally charged investment decisions that sabotage portfolio performance. I have referenced Dalbar many times in these monthly letters because their data is stark. For the 30-year period ending in 2016, the average investor underperformed the stock market by a staggering 6.18%, and the bond market by an equally disturbing 5.77%. Investors buy at the wrong time and sell at the wrong time. Volatility and emotion are often contributors here.

While risk can never be eliminated entirely from an investment portfolio, proper diversification can help cushion the blow of big stock market declines, allowing retired investors and those approaching retirement to stay the course.

I often find that once investors have crafted a diversified and balanced portfolio, volatility is viewed in a different light.

Volatility Returns

The stock market started 2018 strong with a 5.7% return in January. That translates to an annualized return of 85%. A show of hands by those who expect an 85% stock market return in 2018? It was clear stocks would either correct significantly or go through a period of time with minimal price appreciation. The former is, of course, what happened, but that has recently been followed by another rally.

As my dad recently wrote on his Young’s World Money Forecast website, the first step toward achieving investment success is to define your goals and determine how much risk you can and want to take to achieve those goals.

For over four decades, I have offered strategies and insights to help individual investors like you. My primary goal, whether in my monthly strategy reports, at investment seminars, or for current clients of my money management firm, has been helping investors achieve long-term investment success.

What you buy, what you sell, what price you pay, and which strategies you pursue all matter for your investment success, but they aren’t the most important steps in the process. Focusing first on what the “good buys” are is putting the horse before the cart.

What’s your goal? First, define what investment success means to you and your family. Next, determine how much risk you can or want to take in your portfolio to achieve that goal.

Does investment success mean doubling your money in five years, even if that requires a portfolio with neck-snapping volatility and nights awake in a cold sweat? Or are you like me—a more patient investor who is more interested in preserving wealth and letting the power of compounding work its magic over time?

Ask yourself how much risk you can take or want to take.

The success I want you to embrace comes from compounding and patience. I invest guided by the principles embraced through the decades by Benjamin Graham, Walter Schloss, and David Dreman.

Dividends Are Our Focus

Our stock market investment strategy is focused on companies that pay dividends and raise those dividends. Dividends are cold hard cash. Earnings and revenues can be faked and manipulated. Even the cash flow statement, which many investors believe is more difficult to manipulate than the income statement, can provide a misleading picture of a company’s health.

Paying a dividend requires actual cash. Boards and management teams are reluctant to cut dividends, which makes dividend hikes a signal of management’s confidence in the business’s prospects. Dividends also create a scarcity of retained earnings so only the best growth opportunities get funded.

Two companies in our clients’ portfolios that pay healthy dividends and have a record of making regular annual dividend increases are Fortis and UPS.

Fortis Inc.

Fortis Inc. is a diversified utility company that owns and operates regulated and unregulated utility assets in Canada, the United States, and the Caribbean. Fortis serves nearly 2 million electric customers and 1.2 million natural gas customers across its portfolio of regulated utilities. The company’s non-regulated power generation portfolio has a generating capacity of 391MW. In 2016, at peak demand, Fortis’s electric systems delivered 33,021 megawatts of power, and its gas system delivered 1,586 terajoules. Fortis is one of North America’s 15 largest investor-owned utilities (based on enterprise value).

Fortis holds the record for the most consecutive years of dividend increases by a Canadian company, 44 in total. The company’s management and board aim to keep increasing dividends each year by 6%. In the fourth quarter of 2017, Fortis raised its dividend by 7% to an annual rate of $1.60 per share. The shares yield 4.1% today.

UPS

UPS is the world’s largest package delivery company—an impressive statement for a company founded by two teenagers. UPS got its start in 1907 in Seattle when Claude Ryan and Jim Casey hired other teens to run errands, make drug store deliveries, and carry notes on foot or by bicycle. Their operation wasn’t the only one in town; but a commitment to courtesy, neatness and high ethical standards made them stand out from the competition.

In 2016 UPS delivered an average of 19.1 million pieces per day—that’s 4.9 billion for the year. To keep up with the current explosion in e-commerce demanding an ever-larger volume of package delivery services, UPS is upgrading its 30 processing hubs and adding more. It is also adding trucks and another 14 Boeing 747-8s to its already sizeable fleet of 657 owned and leased aircraft.

UPS has paid a stock or cash dividend every year since 1955 and has raised its dividend each year for the last nine years. In early February, the board of directors at UPS announced an increase of the quarterly dividend to $0.91, a nearly 10% boost. Dividends are “a high priority at UPS,” according to CEO David Abney. Since going public in 1999, the package delivery service has more than quadrupled its dividend. UPS shares yield 3.4% today.

Did Rising Rates Cause the Correction?

There were likely many reasons for the sharp stock market correction in February, but one some pundits have pointed to is a rise in long-term interest rates.

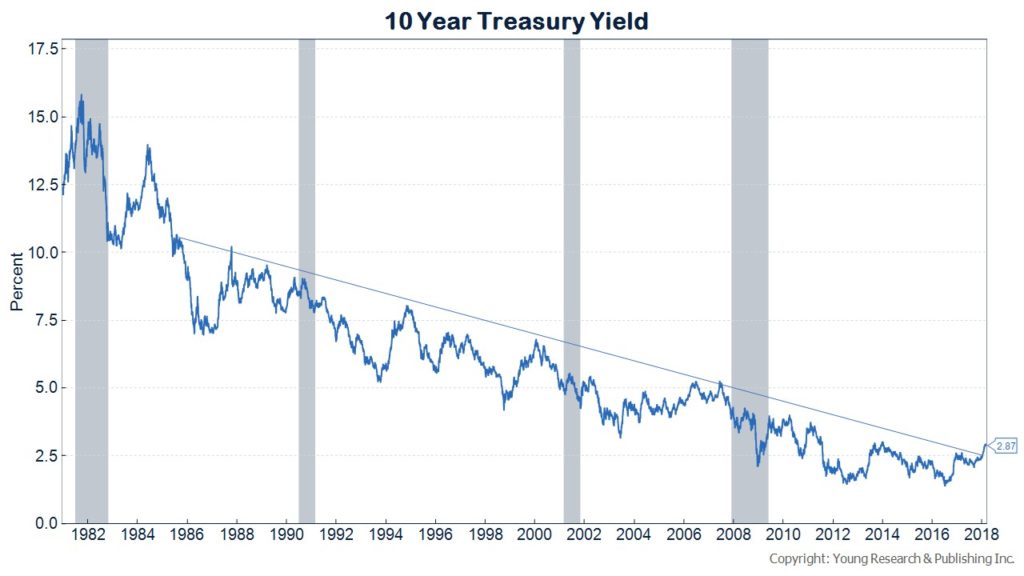

In September of 1981, 10-Year Treasury rates peaked at almost 16%. From that high, interest rates went on a three-and-a-half decade secular decline that colored every asset class in the world. Bond prices benefited from the decline in interest rates, but so did stocks, real estate, private equity, venture capital, and art, among other asset classes.

In July of 2016, the multi-decade bull market in bonds ended when the 10-year Treasury rate hit 1.31%. Rates moved up following the 2016 low, but only recently have they broken above their three-decade downward sloping trendline. The breakout may be one of the most consequential in your investing lifetime.

The end of the great bond bull-market signals the beginning of a new paradigm in financial markets. Bonds may be at the start of a bear market, but that isn’t the most important takeaway from the breakout in interest rates. The more important implication is that financial assets no longer have the tailwind of regularly falling long-term interest rates at their backs. Returns on a wide spectrum of assets are likely to be much lower looking forward than they have been looking backward.

Rates remain low by historical standards, but they have increased markedly over the last 18 months. In September of 2016 the three-month T-bill offered a yield of about 0.25%, the two-year Treasury note paid about 0.75%, and the 10-year Treasury rate was 1.6%. Today, you can buy a three-month T-bill with a yield of 1.64%, a two-year Treasury note with a yield of 2.25%, and a 10-year Treasury note with a yield of 2.92%.

Higher yields have caused investors to reassess the relative appeal of stocks and bonds. Holding interest rates at zero for nearly a decade, and pressuring long-term rates with quantitative easing, distorted financial asset prices of all kinds. Investors were pushed to reach for return. That has long been apparent in the high-yield bond market, where spreads are tight and yields are near historic lows.

The high-yield bond market, a sector that traditionally outperforms Treasuries when interest rates rise, has underperformed during the most recent leg-up in yields. Investors have started to bail out of the sector. High-yield is a sector of the market we have owned in the past and may own in the future, but at current yields, we don’t like the risk-reward trade-off.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. From its high of almost $20,000 in December, the price of bitcoin fell to $5,800 in early February—that’s a 70% loss over about eight weeks. The crypto-currency has bounced off of its low, but it remains at about half of its former high. How many mom and pop investors trying to strike it rich in bitcoin have been burned? Crypto-currencies and especially the shared ledger technology underlying them may be of interest, but in our view, they have no place in a prudently managed investment portfolio.

P.P.S. Ben Stein writing at the American Spectator recently opined on bitcoin and the recent bout of stock market volatility.

There is also a Godzilla monster lurking on the ocean floor, too. ‘Bitcoin.’ No one knows for sure what it is or why it has any value at all. It’s bound to go to close to zero, and when it does, it will take a lot of decent people with it. This will not help the national mood. I would feel differently about it if anyone had ever been able to explain to me what it is or why it had any value. No one has. Charlie Munger says it’s a fraud. I don’t think I want to bet against Charlie Munger. Neither should you.

So, my humble thought, which could be totally wrong: there is no general weakness in the economy. There is no 2009 financial system super catastrophe waiting to happen. The market just got way ahead of itself in an uncertain environment about inflation. The rout may continue for a while but it’s not the end of the world as we know it. At least that’s what I have to tell myself to sleep tonight.

P.P.P.S. Facebook is declining in popularity among U.S. teens. The platform has lost 10% of its users aged 12 to 17 according to eMarketer. Ben Rubin, a 30-year-old tech entrepreneur, has developed a group video chat app called Houseparty that is gaining in popularity with teens. Can Houseparty replace Facebook?

The FT recently reported on Rubin’s goals for his app:

Two years ago he landed on the idea for Houseparty, where groups of up to eight friends gather to chat, moving in and out of “rooms” and meeting friends of friends. It has already hosted half a billion chats. The average time spent on the app has gone from zero at launch in September 2016 to 51 minutes a day.

Many teenagers do their homework in there. It is, for the uninitiated, like a more casual version of a FaceTime call. Most users are in the US, with the UK in second place.

Mr. Rubin had been searching for “meaningful connection” for people online long before Mark Zuckerberg, Facebook founder, started talking about prioritizing “time well spent” early this year. It worries Mr. Rubin that teenagers are 40 percent less likely to hang out with their friends in person every day than the same age group just seven years ago, according to the book iGen, by psychologist Jean Twenge.

“Our kids are going to have the best emoji for conversation, but they won’t know how to wink,” he says. “And that’s not the world I want.”

P.P.P.P.S Traditionally emerging markets haven’t performed well in times of inflation in the United States. While most inflation predictions for the U.S. don’t put emerging markets in jeopardy, the latest inflation numbers and some predictions are raising red flags that all emerging market investors should be paying attention to. Steve Johnson reports in the FT:

Research by Daniel Salter, head of emerging market equity strategy at Renaissance Capital, an EM-focused investment bank, suggests that four of the five 30 percent-plus falls in the MSCI EM index since its inception in 1987 occurred within one month of US consumer price inflation hitting 3 percent.

While most forecasters are not penciling in such an eventuality in the foreseeable future, it should perhaps not be entirely ruled out in the wake of recent data showing year-on-year US wage growth of 2.9 percent in January, which seemingly provoked the current sell-off in global markets.