November 2018 Client Letter

Here is something I’ve been reviewing with clients that is helping with their unsettledness over the past three months. Most of you have a balanced portfolio, which includes a mix of cash, bonds, precious metals, and stocks. When you hear and read about the market’s decline and the uncertain period ahead, it is wise to remember these nasty headlines are not affecting your entire portfolio. Most of you have approximately 50% invested in equities and the other 50% invested in securities which tend to hold their value or decline less compared to stocks.

As for the stocks in your portfolio, we look to invest in blue chip, industry-dominating, financially stable companies. Sure, the share price of these companies will have periods of decline. But we expect most of the companies we own to weather market corrections and continue to generate sales, market their products or services and pay you a dividend each year.

None of us likes to see our portfolio lose value, but that is the nature of investing. Markets go both ways over time. But the more time passes, the greater the odds of success—especially when owning a group of solid businesses.

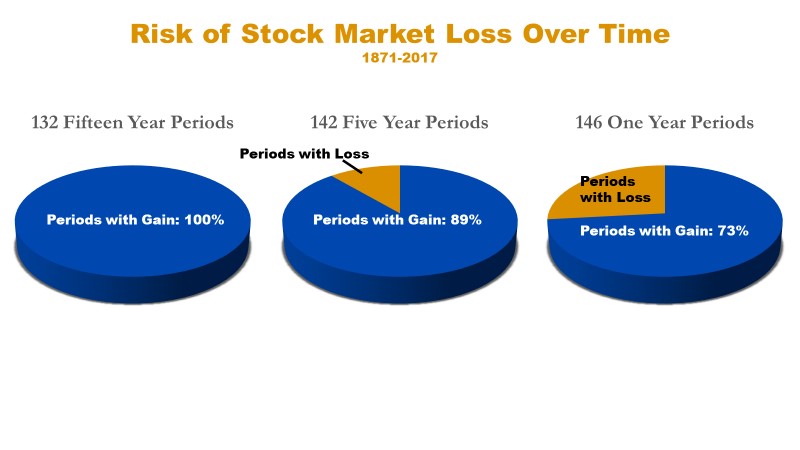

The following diagram shows that, over a one-year time horizon, investors should expect to lose money in stocks about 25% of the time, or once every four years. Extend the time horizon to five years and the risk of loss falls to 11%. For long-term investors, the news gets even better. Over the 132 fifteen-year periods since 1871, U.S. stocks have never lost money. That includes during the Great Depression and the more recent financial crisis. Successful investing has lots to do with quality and time. If we are invested in quality businesses and have time on our side, the chances of winning are pretty good.

Quality and time may not work for you when your time frame is short, you are not properly diversified, or you are over-concentrated in a limited number of securities. On occasion, even the bluest of blue-chip companies runs into trouble.

Blue-Chip Stocks That Ran into Trouble

The Dow Jones index is considered a blue-chip benchmark. In theory, one could buy stocks from the Dow and never need to sell. But the index changes because companies do not always last. At year-end 1999, the once-venerable General Electric, Hewlett Packard, General Motors, Eastman Kodak, Citigroup, and old AT&T were members of the Dow.

For decades, General Electric was considered the best-managed company in the world. GE’s management training program was second to none, with many former executives going on to lead large publicly traded companies. In 1998 Business Week ran a cover story on how well GE was managed, calling Jack Welch “America’s #1 Manager.” Today, General Electric is no longer a member of the Dow and appears to be struggling to survive.

Hewlett Packard was a pioneer in the technology industry and once considered one of the most innovative companies in America. It too was dumped from the Dow. HP has been sliced and diced and is now a shadow of its former self.

General Motors has long been America’s biggest car company, but that didn’t prevent GM from filing for bankruptcy following the 2008/2009 financial crisis.

Ditto for Eastman Kodak. Eastman was a former Dow member and the dominant provider of film in America, but the firm failed to adapt to the digital world and went bankrupt.

Citigroup, once the biggest banking enterprise in America, almost failed during the financial crisis, and AT&T, a longtime member of the Dow, was swallowed up by SBC Communications, one of the Baby Bells. SBC of course took AT&T’s name.

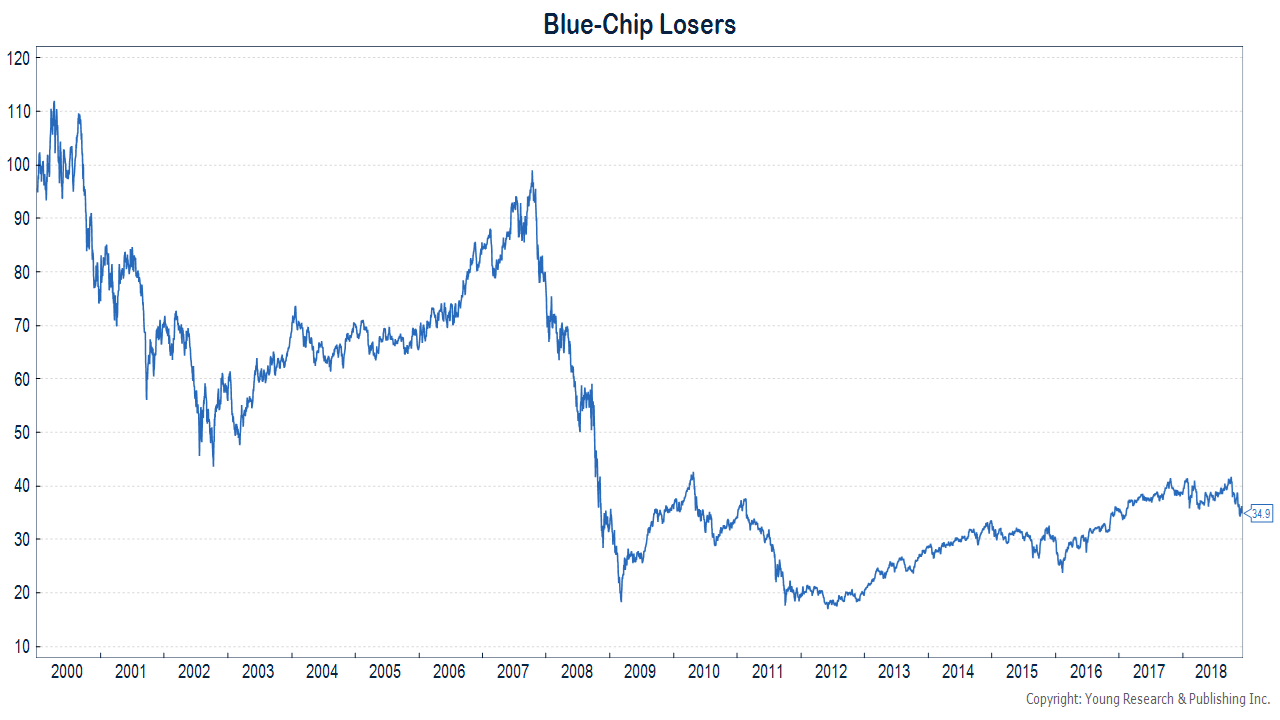

At year-end 1999, a portfolio invested in General Electric, General Motors, Citigroup, Hewlett Packard, the old-AT&T, and Eastman Kodak would have likely been considered a blue-chip portfolio. Admittedly, a poorly diversified portfolio with only six names, but blue-chip nonetheless.

How did this hypothetical blue-chip portfolio perform over the subsequent 19 years? The following chart tracks the performance of an equal investment in each of the above-named six stocks since year-end 1999. This portfolio would have lost about two-thirds of its value over a 19-year period.

I am of course cherry-picking a portfolio of blue-chip losers to illustrate a point, but even the blue-chip stocks that have survived and performed well can suffer from poor stock-market performance. Microsoft’s stock comes to mind in this category.

Microsoft

Microsoft is on the verge of becoming the world’s most valuable company, but at times its stock performance was not great. If you retired at the beginning of this century and owned a significant holding in Microsoft, you may have regretted your decision. Yes, things have worked out as of today; but, for the first 15 years of this century, the shares were underwater.

Today, we own Microsoft stock in some client portfolios. In addition to an impressive dividend-growth record, Microsoft’s position in the technology industry appears to be well entrenched. The Windows operating system and Office productivity suite still have the leading market share among consumers and businesses. Microsoft is also a strong number two in the public cloud, where growth has been robust. Unlike some technology businesses that have few barriers to entry and almost no competitive advantage, we believe Microsoft possesses both.

Pacific Gas & Electric

Investors who believe diversification doesn’t have to be one of their primary concerns because they invest in regulated utilities and other “widow and orphan” stocks should think again. The recent share price collapse of Pacific Gas & Electric is instructive. PG&E is a large California-based gas and electric utility. Because of potentially bankrupting liability related to fires this year and last, PG&E has eliminated its dividend, and its share price is down over 60% from September of 2017.

Diversification a Cornerstone Principal at Richard C. Young & Co., Ltd.

At Richard C. Young & Co., Ltd., diversification is a cornerstone principle of our strategy. We seek to own a group of names diversified geographically and across industries. We will inevitably hold a stock like PG&E at an inopportune time or be invested in a blue-chip firm that fails to adapt to the ever-changing economic landscape. That is the nature of investing. But because we craft diversified portfolios, the risk of such an event having a devastating and lasting impact on your portfolio is remote, in our view.

Unlike many of the market-cap-weighted index ETFs favored today, we favor what is essentially an equally weighted allocation strategy to common stocks. We believe a capitalization-weighted allocation strategy creates an overconcentration in the biggest firms. An ETF that tracks the S&P 500, by example, may own 500 names, but the top 10 account for an outsize share of the portfolio.

We own both Exxon Mobil and WEC Energy (a utility) in some client portfolios. Both stocks receive the same allocation in our clients’ portfolios, but if we pursued a market-cap-weighted approach, we would own about 14 times more Exxon than WEC Energy.

How Is the Economy Doing?

Third-quarter GDP growth came in at an impressive 3.5%, but some indicators now point to a potential slowing in economic momentum. The slowing is not yet broad-based enough to become overly concerning, but it is meaningful enough to make us perk up and pay attention.

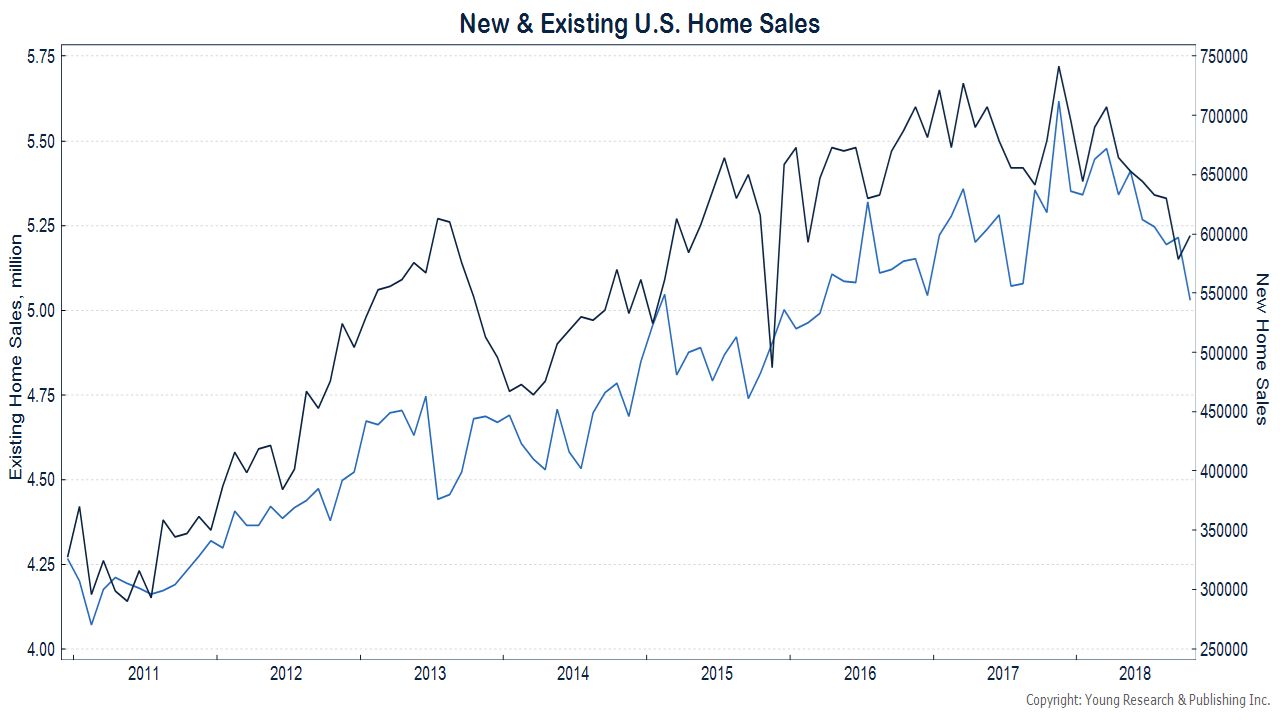

The interest rate-sensitive sectors appear to be the most impacted. Auto sales have plateaued over the last year or two, and now the housing sector is looking top-heavy.

My chart below on new and existing home sales shows signs of a slowdown in housing. The nearly one-percentage-point rise in mortgage rates since the start of the year has likely dampened demand. With consumers still in good shape, the question for investors is whether the slowdown in home sales is a temporary reaction to the “sticker shock” of higher interest rates or something more lasting.

In the coming months, we will look to the Conference Board’s Index of Leading Indicators to assess the prospects for the economy. Last month the leaders registered their lowest monthly rate of increase since May of this year.

The slowing in select sectors of the economy appears to have caught the attention of the Federal Reserve. Some members of the policy-setting FOMC committee have started to call for a pause in interest rate increases. We continue to anticipate one more interest rate hike in 2018, but the number of hikes in 2019 is now less certain.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. Last year at this time you would have been forgiven for thinking Bitcoin was taking over the financial universe. Today, things have changed dramatically. Prices for Bitcoin are down 79% in less than a year. There may be value in the innovative technologies that drive Bitcoin; but, as a currency, Bitcoin remains speculative and best avoided by retired and soon-to-be-retired investors.

P.P.S. The China Household Finance Survey run by Gan Li at Chengdu’s Southwestern University of Finance and Economics recently found that one fifth—that’s 20%—of Chinese homes do not have occupants. Instead, these homes are owned as investments in what could be one of the world’s most distorted markets ever.

Keeping in mind Chinese shares are already down over 20% (in yuan terms) in 2018, the country has had rocky trade relations with the U.S. That and the disturbing real estate statistics above makes it appear China has some problems. In 2012 my dad explained his bearish outlook on China:

I have long advised against direct investment in China. Among the many reasons I am bearish on China is the country’s vastly distorted economy. China is a command style economy run by an unelected political party—the Communist Party of China (CPC). The CPC’s policies have resulted in a grand misallocation of capital. A mercantilist currency policy, perverse incentives for provincial government officials, and crude monetary policy tools have helped inflate a fixed asset and real estate bubble that puts the U.S. real estate bubble to shame.

In our view, until and unless there is meaningful reform in China, direct investment in the country should be avoided.

P.P.P.S. According to the WSJ, some 15,000 financial advisors at Merrill have complained to management about a pay structure that encourages customers to take on more debt. This is possible because brokerages like Merrill are held to the low-bar “suitability” standard of client service. Boutique fee-only investment counsel firms like Richard C. Young & Co., Ltd. are held to the higher fiduciary standard. Fiduciaries must put clients first, and we always do.

Read this from Lisa Beilfuss in the WSJ about how Merrill advisers are pressured to push their clients to take on debt to maximize company profits:

Adding to tension within the Merrill ranks: Some brokers say they feel pressure to push Bank of America products, such as checking accounts, to wealthy investor clients. Merrill is the brokerage arm of Bank of America.

Advisers can make up lost compensation by acquiring new clients and doing more for existing clients. The catch, some brokers say, is that growing portfolios by pushing clients to take on debt can be easier than finding new assets.

Loans that are backed by a client’s investment portfolio are a particular favorite of brokerage firms, said Jeffrey Harte, a brokerage analyst at Sandler O’Neill + Partners. “It’s taking money that’s already there and making more money on it, versus the much harder job of going out and growing assets,” he added.

Client Portal

Client Portal Secure Upload

Secure Upload Client Letter Sign Up

Client Letter Sign Up