November 2024 Client Letter

In the world of advertising, few campaigns have been as iconic as the 1975 ad created by David Ogilvy of Ogilvy & Mather for American Express, featuring the memorable tagline, “Don’t leave home without it.” This slogan resonated deeply, emphasizing the indispensability of the American Express card. Since that ad was created 50 years ago, the economic, financial, and technological landscape has transformed dramatically. Included in this change is the advent of mobile payments services such as Apple Pay. We can now leave home without our physical American Express cards, relying instead on the convenience of our smartphones.

This evolution in technology highlights a broader trend: Companies like Apple and Microsoft, categorized within the tech sector of the S&P 500, have become so integral to our daily lives that, in my view, they can be considered consumer staples. These tech giants and others like them are woven into the fabric of our economy and personal routines. Consider this: How many of us would willingly leave the house without our iPhones? Given the choice between going a week without toothpaste or without my iPhone and Microsoft Office 365, I would find it far more challenging to forgo the latter. These technology tools are essential to me in managing client investment accounts and personal tasks such as juggling the logistics of guiding children under the age of 22.

In today’s digital age, the iPhone has transcended its original purpose as a mere communication device. It has evolved into a necessary tool, integrating seamlessly into various aspects of daily life. Far from being just a phone, the iPhone serves as your boarding pass, allowing you to breeze through airport security with ease. Here in Southwest Florida, it’s our personal weather center, providing real-time updates on hurricanes and other weather conditions. Need to get somewhere? The iPhone is your gateway to hailing a ride. It’s your digital wallet, allowing contactless payment at the grocery store and for making online purchases without fumbling and possibly dropping a credit card. This indispensability illustrates why I believe these companies should hold enduring value in portfolios and remain critical drivers of economic growth.

Digital Wallets: A Growing Trend with Investment Potential

According to McKinsey & Company, over 90% of Americans used some form of digital payment in 2023, with 20% anticipating using three or more digital wallets. Justin Passalaqua, Country Director of Worldline, one of the world’s largest digital payment providers, describes digital wallets as “virtual storage systems” that securely store payment information and enable transactions without the need to provide physical cards or payment details.

Despite their benefits, digital wallets are not without risks. If users are careless with security measures—such as using weak passwords, neglecting updates, or conducting transactions over public networks—their information could be compromised. Additionally, losing a device without proper protection could expose stored data to hackers.

To mitigate these risks, users should follow the best practices of safety. This includes enabling multi-factor authentication, using strong and unique passwords, and ensuring devices and wallet apps are updated. Avoiding public networks for transactions, practicing email safety, and setting up alerts for wallet activity are also important steps.

While digital wallets present risks, they are generally safer than physical cards due to their layered security measures, such as facial recognition and encryption. Sean Salter, a finance professor, notes that, unlike physical cards, digital wallets cannot be skimmed, and their authentication requirements protect users from unauthorized access. Passalaqua highlights that with proper precautions, digital wallets are a secure and efficient payment method, empowering users to transact with confidence both online and offline. Digital wallets using services like Apple Pay demonstrate the shift toward cashless economies, a trend that could strengthen the revenue of tech leaders like Apple and show the growing role of secure payment technologies in our daily lives.

Of course, when using your iPhone, you are not just using Apple products. Texas Instruments, by example, also contributes to the iPhone’s functionality, primarily through its analog and embedded semiconductor products. These components help manage power; sense and transmit data; and provide core control- or processing-functions. While the specific parts manufactured by Texas Instruments used in iPhones are not always detailed, their broad portfolio includes products that support various electronic systems, including personal electronics like smartphones.

NVIDIA does not directly supply hardware components for iPhones. However, NVIDIA’s influence can be seen in the iPhone’s capabilities. For instance, the iPhone 15 Pro features advanced graphics capabilities like ray tracing and upscaling, which are technologies NVIDIA has pioneered in the PC gaming world. While these features are implemented through Apple’s own A17 Pro chip, they reflect NVIDIA’s impact on the broader tech landscape.

Additionally, NVIDIA’s GeForce NOW streaming service is available on iOS devices, allowing users to stream PC games directly to their iPhones via Safari. This service leverages NVIDIA’s powerful cloud gaming infrastructure, bringing high-quality gaming experiences to iPhone users without requiring NVIDIA hardware inside the device.

NVIDIA: A New Dow Jones Member and AI Powerhouse

NVIDIA was added to the Dow Jones Industrial Average (DJIA) on November 8, 2024. This decision reflects NVIDIA’s importance in the tech sector, particularly in artificial intelligence, the data-center markets, and shaping the future of the information highway. Like Apple and Microsoft, NVIDIA’s products are becoming essential to modern life, reinforcing its role in the economy and investment portfolios.

Broadcom and VMware: The Quiet Giant

While companies like Apple and NVIDIA dominate headlines, Broadcom quietly stands as the eighth-largest U.S. company by market capitalization. Best known as a semiconductor powerhouse, Broadcom’s influence extends far beyond chips. Its acquisition of VMware in 2023 solidified its leadership in cloud computing and enterprise software.

VMware helps businesses simplify and improve how they use computers and technology. Its main focus is virtualization, a process that allows a single physical computer or server to act like many individual machines. For example, instead of needing multiple physical servers for different tasks, businesses can use VMware’s software to run multiple “virtual machines” on a single server. This saves money, reduces hardware needs, and improves efficiency.

VMware allows businesses to store and access their data over the internet instead of relying solely on physical computers. This flexibility makes it easier for companies to scale up or down based on their needs. VMware’s tools also make sure this data is secure, which is especially important in today’s world, where cyberattacks are a growing concern.

For most of us, VMware’s technology is not something we interact with directly, but it powers many services we use, like banking, shopping online, or using apps that require secure and reliable data storage. It also supports remote work by enabling employees to access their work computers or files securely from anywhere.

Dividend investors will like the fact that Broadcom, along with Apple and Microsoft, have raised their dividends for at least ten consecutive years.

A Rapidly Evolving Trend

“Sovereign AI” refers to a nation’s capability to develop and control its own artificial intelligence infrastructure, data, workforce, and business networks. Countries recognize the strategic importance of AI in driving economic growth, enhancing national security, and maintaining technological independence.

The concept of sovereign AI has evolved rapidly over the past few years. Initially, it was driven by the need for countries to control their data and AI capabilities to safeguard against external dependencies and potential threats. Today, sovereign AI includes a broad range of goals, including the development of local AI infrastructure, the creation of AI factories, and the training of AI models on domestic data to reflect local dialects, cultures, and practices. This evolution is marked by significant investments in AI infrastructure and capabilities, with countries like Japan, Canada, and France leading the way.

NVIDIA has been a key player in the sovereign AI landscape, providing the necessary hardware and software to support these national initiatives. Nvidia is projecting $10 billion in revenue from governments’ sovereign AI investments in 2024, up from zero last year.

NVIDIA’s partnership with Oracle is a pivotal development in the sovereign AI space. Announced in March 2024, this collaboration aims to deliver sovereign AI solutions worldwide by combining Oracle’s distributed cloud and AI infrastructure with NVIDIA’s accelerated computing and generative AI software. This partnership enables governments and enterprises to deploy AI factories that can operate within secure premises, supporting their sovereign goals of economic growth and data protection.

For investors, the rise of sovereign AI should present opportunities. The increasing investments in AI infrastructure by governments worldwide indicate a strong and growing market for AI technologies. Companies like NVIDIA and Oracle, which are at the forefront of this trend, are positioned to benefit from these investments. The partnership between NVIDIA and Oracle shows the potential for collaborative efforts to drive innovation and meet the specific needs of different countries.

Presidential Terms

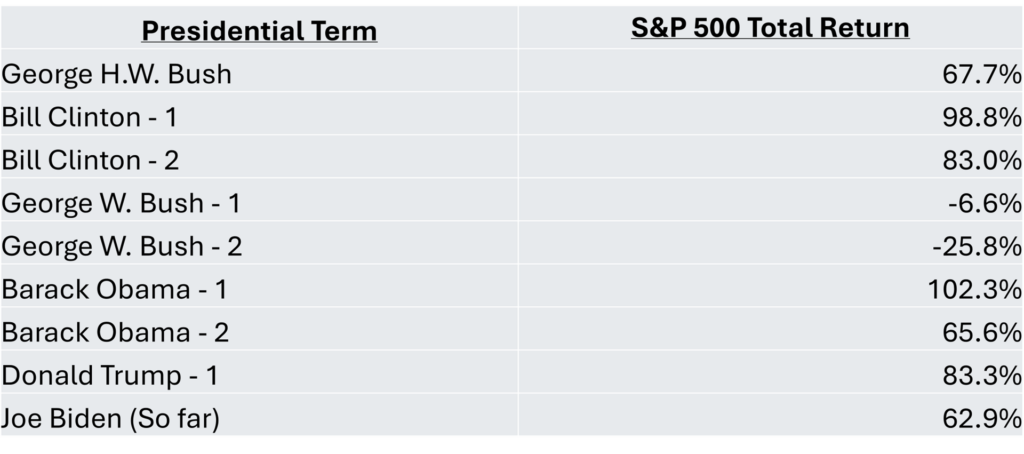

I started in the investment business when George H. W. Bush was president. That means when Donald Trump takes office, it will mark the 10th presidential term during which I have been working for investment clients. One thing I recall during many presidential terms is that, regardless of who is president, we can usually find analysts and economists predicting how the current or upcoming president will be terrible for the economy or the stock market.

However, looking back over the last nine terms, most have resulted in a positive outcome for stocks. There were only two down terms during this period, and one of them, George W. Bush’s first term, was a slight decline of -6.6%, or -1.7% on an annualized basis.

Historically, the stock market has shown resilience and growth across various administrations, regardless of the political party in power. I think the reason for this is because many factors affecting the stock market are outside of the president’s control. Global economic trends, geopolitical events, central bank policies, and technological advancements often have a more significant and immediate impact on the markets than domestic political outcomes.

Historically, the stock market has shown resilience and growth across various administrations, regardless of the political party in power. I think the reason for this is because many factors affecting the stock market are outside of the president’s control. Global economic trends, geopolitical events, central bank policies, and technological advancements often have a more significant and immediate impact on the markets than domestic political outcomes.

For the last several months we’ve been reading about the Trump trade versus the Harris trade and which person would be better for the market. I put these types of narratives in the noise category and do not spend much energy on the topic.

Instead, I look at various indicators which could provide clues as to what type of environment we could be facing in the future. These include GDP growth and, specifically, business investment components of GDP, corporate earnings growth, the rate of inflation, bank loan growth, and money supply growth.

While political headlines often create market noise, history shows that long-term investment strategies usually prevail regardless of the administration in power.

As we navigate these transformative times in technology, politics, and the markets, I remain committed to helping you achieve your long-term financial goals. If you found the insights in this letter valuable—particularly our discussion of technology’s evolution from growth engine to modern necessity—I welcome the opportunity to explore these themes in greater detail. Please don’t hesitate to call me at 888-456-5444 to discuss how these trends might affect your portfolio. Additionally, if you know someone who might benefit from this type of analysis and personalized investment approach, I’m always happy to offer them the same careful attention I provide to you. Thank you for your continued trust in managing your investments.

Warm regards,

Matt Young

President and Chief Executive Officer

Nuclear Power

Southern Company has made substantial investments in nuclear facilities, particularly with the Plant Vogtle project in Georgia. The total cost of the Vogtle Units 3 and 4 projects exceeded $30 billion, up from the expected cost of $14 billion.

Plant Vogtle is now the largest generator of clean energy in the United States, providing carbon-free electricity to over a million homes and businesses. According to the U.S. Energy Information Administration, the United States has the largest nuclear generating fleet of any country. Electricity generation from nuclear reactors doesn’t produce CO2 emissions and can provide baseload power that would otherwise largely come from coal- and natural gas-fired plants. Although a number of nuclear reactors have retired in recent years, interest in nuclear power as an energy resource to help reduce the carbon footprint of the U.S. is on the rise.

Mobility Checklist

Wendy, a seasoned Pilates instructor at our fitness center, focuses on pain management and mobility. Two of my favorite quotes of hers are these: “If you don’t have your feet, you don’t have the rest of your body.” (We do a lot of footwork.) Regarding the aging process, she says, “You can’t stop the tide from rising, but you can slow it down.”

My mom, who has practiced yoga for 40 years, recently sent me an article that aligns with Wendy’s classes. It highlights the importance of longevity fitness, which isn’t just about adding years to life, but about living well in those years. One key takeaway is the value of periodic mobility tests to assess and improve our ability to age gracefully.

For more insights, check out the article “15 Mobility Tests to Check If You’re Aging Gracefully” on InsideHook.

A Country of Geniuses in Data Centers

Dario Amodei’s October essay, “Machines of Loving Grace,” explains the transformative potential of artificial intelligence while acknowledging the associated risks. Amodei, CEO of AI safety research company Anthropic, outlines five key areas where AI could have a profound impact: biology and physical health, neuroscience and mental health, economic development and poverty, peace and governance, and work and meaning. AI could revolutionize healthcare, enhance our understanding of the brain, boost economic growth, contribute to effective governance, and enhance human capabilities.

Amodei also delves into the concept of superintelligence, where AI surpasses human intelligence, and the profound implications this could have. He envisions a future where superintelligent AI has access to whatever it needs, including robots, laboratories, and means of production, to solve complex problems. This superintelligence could control existing physical tools and even design new robots or equipment for itself. Amodei highlights the importance of ensuring that these superintelligent AI systems are aligned with human values and safety so as to prevent negative outcomes. This is crucial as we move towards a future where AI could potentially become a “country of geniuses in data centers,” vastly outperforming human cognitive abilities and transforming society in unprecedented ways.

Amodei predicts that many of these advancements could begin to materialize as early as 2026, while acknowledging it could take longer. However, he stresses the importance of addressing the risks associated with AI, such as ethical concerns, potential misuse, and the need for robust safety measures. By focusing on these risks, says Amodei, we can unlock the full potential of AI and create a future where technology serves humanity’s best interests.

Client Portal

Client Portal Secure Upload

Secure Upload Client Letter Sign Up

Client Letter Sign Up